For struggling cineplex operator AMC Entertainment (NYSE:AMC), its strong showing for the second quarter would appear to be exactly what the firm needed. In addition, Hollywood is starting to find its footing, releasing a slew of compelling films. Nevertheless, both investors and options traders aren’t having it, showing bearish sentiment, likely based on underlying financial vulnerabilities. Despite personally holding a small stake, I am neutral on AMC stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AMC Stock Briefly Popped on Its Earnings Disclosure

On paper, the Cineplex giant delivered better-than-expected results on Tuesday against a favorable backdrop as movie studios began churning out films that resonated with audiences. In so doing, AMC stock popped higher during the session. Unfortunately, it was a rather brief blip.

Sure, the print looked impressive. As TipRanks reporter Kailas Salunkhe stated, the company rang up revenue of $1.35 billion, representing a 15.6% year-over-year lift. Even better, this tally outflanked analysts’ consensus target by a sizable margin of $60 million.

On the bottom line, the box office operator posted earnings per share of 1 cent. This, too, conspicuously beat Wall Street’s estimate of a net loss per share of 4 cents.

Impressively, Salunkhe wrote that “during the quarter, AMC saw a 12% growth in attendance. Additionally, adjusted EBITDA at $182.5 million clocked the highest mark since the last quarter of 2019. The company also generated $7.36 in food and beverage revenue per patron during this period.”

If that wasn’t enough, AMC also appears poised for a solid start to Q3, thanks to hit titles including Barbie, Oppenheimer, Sound of Freedom, and Mission Impossible: Dead Reckoning Part One.

However, as TipRanks reporter Sheryl Sheth mentioned, “The company has consistently urged the need to raise additional cash or else risk the possibility of going bankrupt, similar to the recent bankruptcy of Cineworld cinema.”

Few Beyond Speculators Want a Piece of the Action

Fundamentally, a case can be made that the box office provides significant bang for the buck. This year, the average price of a movie ticket stands at $10.53, about 15% higher than the $9.16 average posted in 2019. That’s not bad, considering that cheap streaming services have also raised their prices by similar percentages. Still, beyond the speculating crowd, few folks want a piece of AMC stock.

True, shares have gained noticeably in recent sessions. Over the past month, they moved up by almost 18%. However, in the trailing one-year period, they fell by around 79%, a staggering figure. What’s more, the options market seems to signal exhaustion with the bullish narrative that refuses to convincingly pan out.

To be fair, the options chain for the Wednesday session revealed several optimistic trades. For instance, in terms of the volume-to-open-interest ratio, the most unusual activity for AMC stock centered on its $4.50 strike price call with an expiration date of October 20, 2023. Here, volume clocked in at 1,214 contracts against an open interest of 40 contracts.

However, the bears also piled into AMC stock to more than balance out the speculative long-side transactions. Notably, the $2 puts with an expiration date of October 20, 2023, saw volume hit 11,012 contracts against open interest of 2,259. Overall, volume levels for puts outpaced that of calls by a wide margin.

Fundamental Catalysts Might Drag AMC Along

Taken as a whole, the picture for AMC stock isn’t very encouraging, whether as a speculative investment or swing trade. However, it’s impossible to dismiss the loyal fans that support the underlying enterprise. Further, they wouldn’t be acting completely irrationally.

First, the phenomenon of revenge travel continues to be robust this year. One major takeaway is that consumers still have money to spend on discretionary purchases. However, with inflation being stubborn, many, if not most, consumers would appreciate a discount. AMC provides that relative to other entertainment alternatives.

Second, when circumstances get rough, Americans historically found solace and escapism through films. Therefore, a recession materializing on the horizon wouldn’t necessarily be the worst outcome for AMC stock.

Is AMC Stock a Buy, According to Analysts?

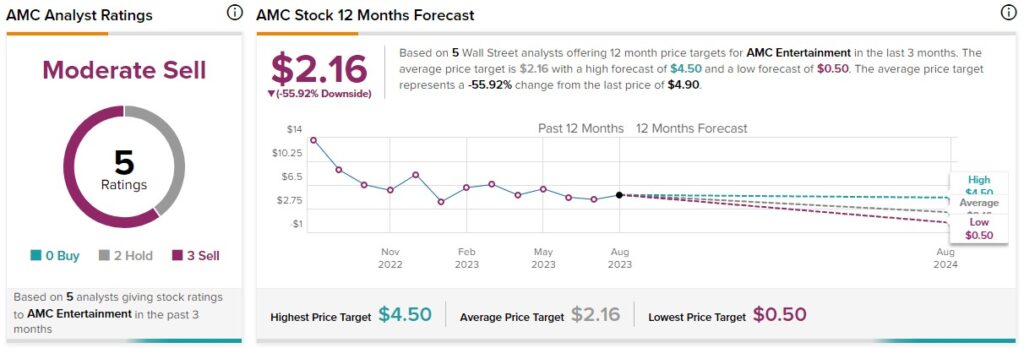

Turning to Wall Street, AMC stock has a Moderate Sell consensus rating based on zero Buys, two Holds, and three Sell ratings. The average AMC stock price target is $2.16, implying 55.9% downside risk.

The Takeaway: Speculators Clash with the Smart Money

Ultimately, good news or bad, those who ardently support AMC stock may do so to the bitter end. In fairness, the Cineplex operator does enjoy certain potentially positive catalysts that shouldn’t be ignored. However, it’s also reasonably clear that the smart money has legitimate credibility concerns about AMC’s viability. Therefore, if you’re going to gamble, do so with utmost caution.