Joining peers Netflix, Disney+ and Max, Amazon (NASDAQ:AMZN) Prime Video is set to become the latest streamer to introduce ads to its service.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Starting early next year, ads will be incorporated into shows and movies on Prime Video in the U.S., U.K., Germany, and Canada. Later in the year, ads will also be integrated into the service in France, Italy, Spain, Mexico, and Australia.

For those after an ad-free experience, for an additional $2.99/month, U.S. Amazon Prime members will be able to subscribe to an ad-free tier.

The ad-free product amounts to a ~20% increase to the price of the monthly Amazon Prime subscription in the U.S. ($14.99), or a ~26% hike on the yearly fee ($139).

Wedbush analyst Scott Devitt anticipates that eventually in other international markets there will be similar 20% to 26% hikes implemented for the local ad-free tiers.

So, what sort of impact will the ads have? Amazon delivered $9.84 billion in Subscription revenue in 2Q23, which on an annualized basis, translates to $39.6 billion. Assuming approximately 80% is related to Amazon Prime and standalone subscriptions of Amazon Prime Video, subscription revenue of around $31.6 billion is set to rise ~23% (based on the assumption of a 50/50 split between annual and monthly subs), suggesting that if all members were to opt-in, Amazon would see ~$7.2 billion of incremental revenue.

While it’s expected that not everyone will opt in, Devitt’s analysis suggests that Amazon has set the price for its ad-free subscription tier in the United States at a level that aligns closely with the potential advertising income the company could generate per member. In other words, in a typical scenario, the result remains relatively balanced, irrespective of the percentage of users who choose to opt in.

In any case, the 5-star analyst applauds the move and sees the opportunity as a “material operating margin driver in 2024-2025 as the company directly monetizes its content investments and offsets a greater share of streaming costs.”

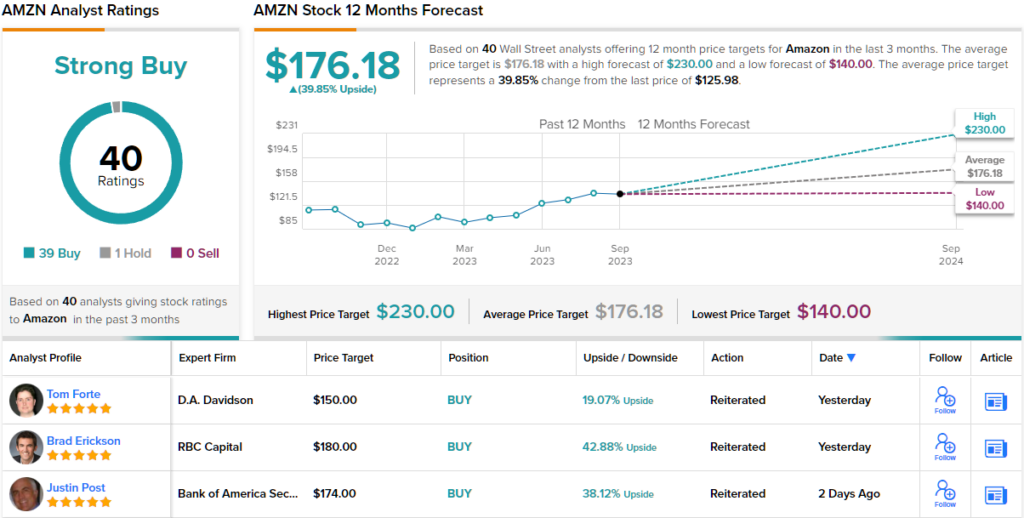

Down to business, what does this ultimately mean for investors? Devitt maintained an Outperform (i.e., Buy) rating on Amazon shares while his $180 price target implies the stock will climb ~43% higher over the one-year timeframe. (To watch Devitt’s track record, click here)

Overall, barring one skeptic, all 39 other recent analyst reviews are positive, naturally resulting in a Strong Buy consensus rating. The analysts see shares gaining ~40% over the coming months, considering the average target stands at $176.18. (See Amazon stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.