2023 is the year of efficiency for Amazon (NASDAQ:AMZN), as the company is looking to enhance its profitability through cost discipline. In addition, the Internet commerce and cloud company is prioritizing its AI (artificial intelligence) strategy to integrate this transformative technology into its AWS’ (Amazon Web Services) suite of services to maintain its leadership in the cloud space. These initiatives keep analysts, who see substantial upside potential in AMZN stock, optimistic about its prospects.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Therefore, let’s delve into AMZN’s initiatives aimed at driving profitability and strengthening its position in the AI space.

Amazon Shuttering Businesses

As part of its broader cost restructuring strategy, Amazon is closing down several of its businesses, as they weren’t producing the returns the company hoped for. Amazon is winding down its live radio app Amp, which enabled users to take on the role of DJs, offering commentary while playing music tracks, as reported by Bloomberg.

Besides Amp, the company shuttered its health-focused Halo division. Further, several media outlets reported that Amazon had closed the tests of its home delivery robot Scout as growth slowed amid macro challenges.

Along with shuttering businesses and scaling down experiments, the company eliminated 27,000 corporate roles. These moves are intended to drive revenue, operating income, and free cash flows in the long term and enhance AMZN’s return on invested capital.

While Amazon focuses on driving efficiency, it has invested heavily in AI to accelerate its growth. Let’s look at the company’s AI initiatives.

Amazon’s AI Push

During its Q2 conference call, Amazon said it is leveraging Nvidia’s H100 graphics processing units to develop generative AI applications. Further, the company announced a strategic collaboration with Anthropic to boost its AI initiatives.

Regarding its partnership with Anthropic, Wedbush analyst Scott Devitt expressed that this arrangement holds the potential to accelerate the uptake and integration of generative AI capabilities for AWS customers. Further, the analyst added that this “should ease investor concerns that Amazon has been less proactive than its peers in its approach to generative AI.” Devitt reiterated a Buy recommendation on AMZN stock on September 25.

With this backdrop, let’s look at what other Wall Street analysts are saying about AMZN stock.

What is the Future Outlook for Amazon Stock?

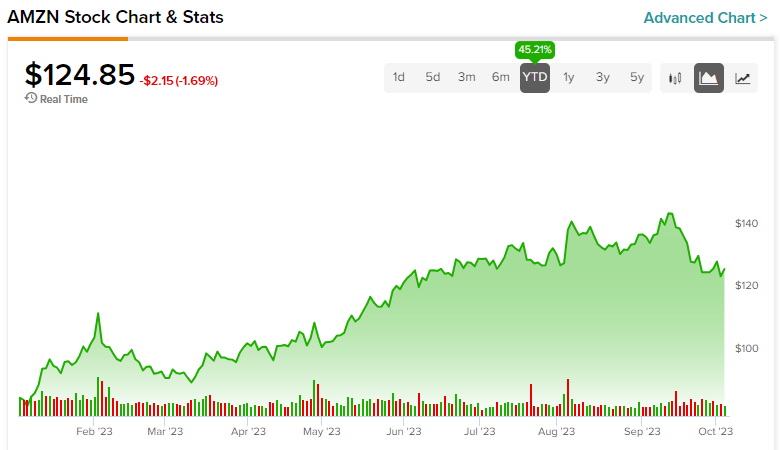

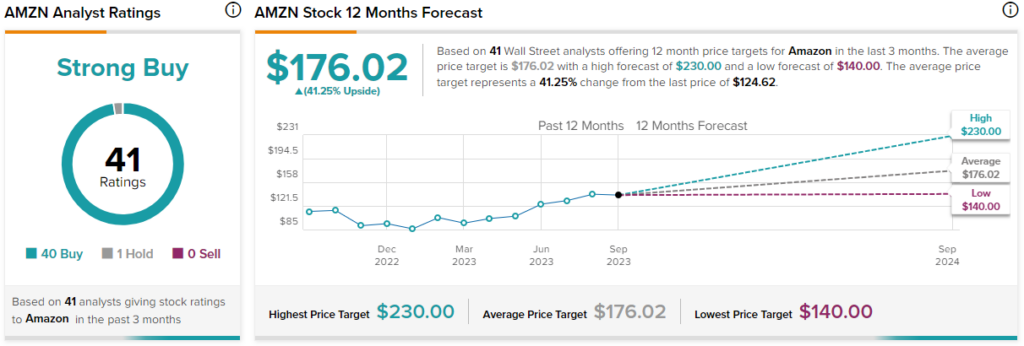

Amazon stock has gained 45% year-to-date. Despite the significant appreciation in value, Wall Street analysts are bullish about its prospects. With 40 Buys and one Hold recommendation given in the past three months, Amazon stock has a Strong Buy consensus rating. Further, the average AMZN stock price target of $176.02 implies 41.3% upside potential from current levels.

The Takeaway

Amazon’s focus on cutting costs and driving efficiency should cushion its bottom line. Further, the signs of stabilization in the cloud business and its focus on AI initiatives bode well for future growth, as reflected through its Strong Buy consensus rating on TipRanks.