High inflation and macro challenges have been weighing on Amazon’s (NASDAQ:AMZN) business over recent quarters. Nonetheless, Wall Street continues to express its confidence in the e-commerce and cloud computing giant’s ability to navigate through short-term pressures and emerge stronger in the long term. AMZN shares have advanced over 27% in the past three months and have risen 55% year-to-date

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Analysts Remain Bullish on AMZN Stock

Amazon reported market-beating first-quarter results, even as macro pressures continue to impact consumers’ spending on high-ticket discretionary items. Moreover, the slowdown in the higher-margin cloud-computing Amazon Web Services (AWS) unit has also been a matter of concern. Enterprises are optimizing spending due to macro uncertainties, which is impacting AWS’s growth.

Nonetheless, most analysts remain bullish on Amazon, ignoring short-term noise.

On Monday, DBS Bank analyst Sachin Mittal initiated coverage of AMZN with a Buy rating and a price target of $150. The analyst expects the company’s retail segment to become a major growth driver. Mittal noted that while Amazon is the leading e-commerce player holding a 39% share of the U.S. e-commerce market, there is still a “significant portion of untapped market” that the company can capture.

Mittal thinks that the focus will shift toward profitability and expects the retail segment’s operating income to be a key driver of share price from 2023 onwards, “dethroning” AWS’s operating income.

Meanwhile, Roth MKM analyst Rohit Kulkarni opines that Wall Street continues to underestimate potential leverage arising from the company’s cost-cutting efforts, workforce reductions, and logistics efficiency initiatives. He expects Amazon to deliver annualized cost savings in the range of $9 billion to $13 billion in 2024, which would benefit margins.

Kulkarni is also optimistic about Amazon positively surprising the market with AWS’s rate of expansion. He highlighted that Wall Street’s consensus estimates indicate 9% to 10% revenue growth for Q2 and Q3 and low-teens growth in Q4 2023. The analyst raised his price target for Amazon to $155 from $130 and reiterated a Buy rating, calling AMZN a “top pick.”

Ahead of Amazon’s Prime Day event, JPMorgan analyst Doug Anmuth reiterated a Buy rating on AMZN stock with a price target of $145, saying that the stock remains the best stock idea in his coverage. Anmuth expects the Prime Day event to generate $7 billion in revenue, up 12% compared to the last year.

Is Amazon a Buy or Sell?

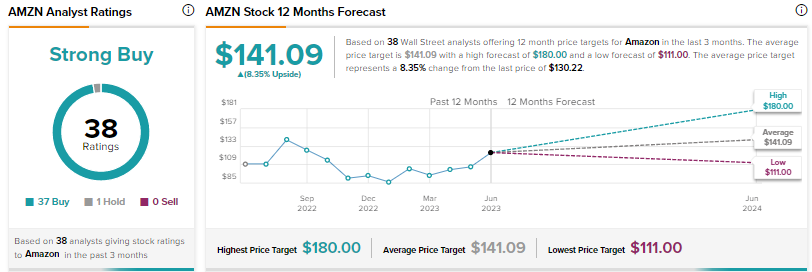

Wall Street’s Strong Buy consensus rating on Amazon is based on 37 Buys and one Hold. The average price target of $141.09 implies about 8.4% upside potential from current levels.

Conclusion

Despite ongoing macro uncertainty, Wall Street is upbeat about Amazon’s growth potential in the times ahead. Analysts continue to be bullish on AMZN due to its leadership position in the e-commerce space, dominance in the cloud computing market, the growing ad business, and focus on cost controls.