Amazon’s (AMZN) Prime services just got a new addition. On Wednesday, the company announced a commercial deal with Grubhub, a subsidiary of Netherlands-based Just Eat Takeaway.com. U.S. Prime members will be eligible for a free, one-year Grubhub+ membership with no food delivery-fees on permitted orders while Grubhub+ members will also be eligible for member-only perks and rewards.

The agreement stipulates Amazon will take a 2% equity stake in the food delivery service which could potentially rise to 15% according to performance terms. Unless terminated by either side, each year, the agreement will automatically renew. Of note, a partial or full sale of Grubhub remains one of the strategic alternatives Just Eat Takeaway is actively looking at.

While drawing on Amazon’s Prime service will expand the food-delivery company’s reach, Baird’s Colin Sebastian thinks it’s a good deal for the e-commerce giant.

“We view Amazon’s announcement with Just Eat Takeaway as a capital efficient way for the company to re-enter the local restaurant delivery market,” the 5-star analyst said. “With limited risk to Amazon, the company can offer Prime members free (one year) membership to GrubHub+, which could help retain/attract new Prime members.”

Sebastian also believes the announcement further demonstrates Amazon’s dedication to meeting the requirements of Prime subscribers in a strategic, cost-effective manner while continuing to prioritize its flagship Prime offering and fulfillment “advantage.”

The analyst also anticipates Amazon’s “category expansion” into groceries will continue, with the focus on physical and online food delivery, micro-fulfillment, and retail outlets (such as Amazon Fresh, Whole Foods, etc.), enabling the company to keep on taking market share and further penetrate a “significant” TAM (total addressable market).

All in all, Sebastian sticks with an Outperform (i.e., Buy) rating, while the $145 price target stays put too. Should the figure be met, investors will be sitting on gains of 25% a year from now. (To watch Sebastian’s track record, click here)

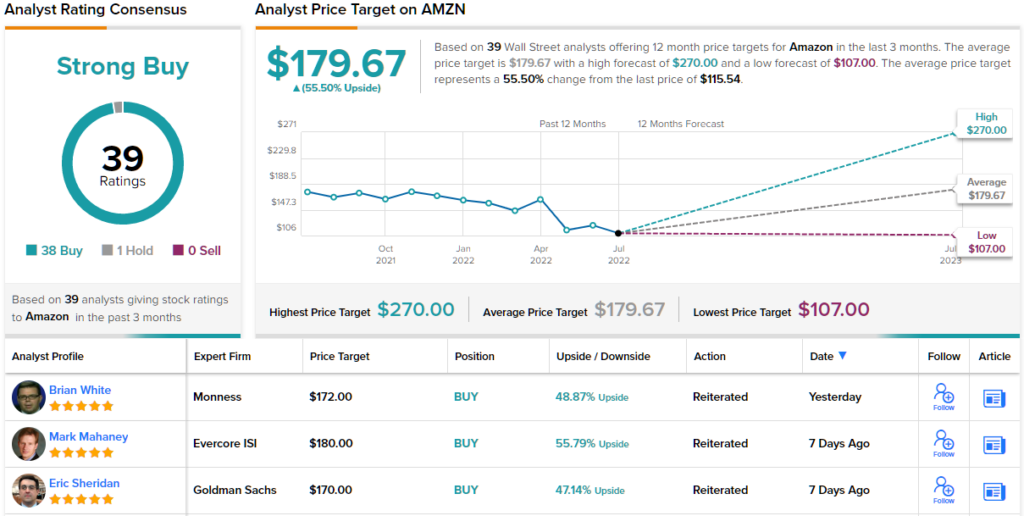

Turning now to the rest of the Street, where the average target is rather more upbeat; the forecast calls for 12-month returns of 55.5%, considering the figure clocks in at $179.67. While one analyst remains on the sidelines, all 38 other recent reviews are positive, naturally culminating in a Strong Buy consensus rating. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.