Even after recent gains, Amazon (AMZN) stock is still down by 25% on a year-to-date basis. Yet despite the issues faced by the ecommerce sector this year, Amazon e-commerce demand has not waned to an alarming extent. In fact, Deutsche Bank’s Lee Horowitz believes it has “held up relatively well.”

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

That said, with recessionary concerns to the fore, Horowitz does not consider Amazon immune to the macro whims and heading into next week’s Q2 report (July 28), he has tempered the revenue outlook beyond the second quarter and into 2023.

As for 2Q22, Horowitz expects revenue of $120 billion, a figure which suggests sequential revenue growth of ~2% (non-AWS), which is “in line with normal seasonality and consistent” with the firm’s proprietary geolocation data across Amazon’s North America footprint.

Going by the warehouse geolocation data, Horowitz is of the mind the Q2 North America revenue forecast of ~$70 billion is “generally safe.” Considering the recent remarks from BoFA that suggested solid credit and debit card spending, as well as Horowitz’ expectation that Amazon’s retail business could “prove stickier” than rivals against a backdrop of tighter spending, the analyst feels that the Q2 sales figures should hold up quite well.

“That said,” the 5-star analyst went on to add, “with macro conditions still generally unstable, we believe that all eyes will be on the 3Q guide and expectations for how consumer spending evolves for the rest of the year.”

Although Q3’s OI (operating income) stands to gain from abating inflationary headwinds related to labor, fuel, and “excess capacity,” Horowitz thinks gross margins will be affected by “incremental discounting associated with ballooning inventory growth.” As such, the analyst expects Amazon’s Q3 OI guide to fall short of Street expectations.

In fact, factoring in “accelerating growth headwinds across both e-commerce and cloud,” Horowitz has reduced his 2023 OI figures by ~14%, which in turn results in a new price target – lowered from $174 to $155. There’s still upside from 24% from current levels. (To watch Horowitz’s track record, click here)

That said, Horowitz’s rating stays a Buy as he is still fully behind Amazon and signs off on a positive note, saying, “as we inch towards what could be seen as the last cut for e-commerce, we would expect sentiment for Amazon to shift more positively and for shares to outperform.”

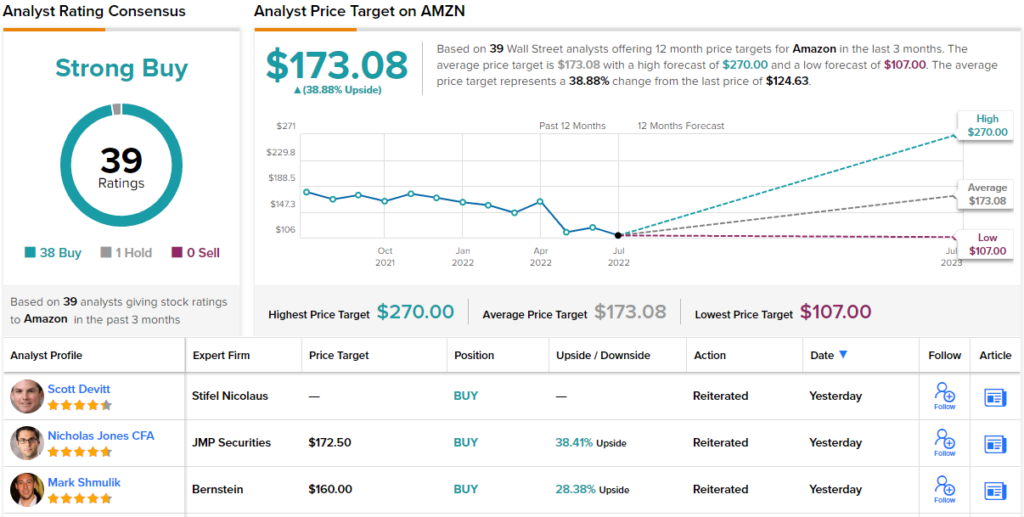

Turning now to the rest of the Street, where barring one skeptic, the remaining 38 Buys all add up to a Strong Buy consensus rating. Moreover, the average price target is more bullish than Horowitz will allow; at $173.08, the figure makes room for 12-month gains of 39%. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.