Amid persistent inflation, an uncertain macro backdrop, and volatility in shares, investors have lost confidence in the stock market. What they need now is to safeguard their returns. Hence, dividend stocks that give a regular return on their investments have become popular. Let’s take a closer look at tobacco giant Altria Group (NYSE:MO), which offers a huge dividend yield of 8.64%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

MO: Strong Track Record of Dividend Growth

Based in Virginia, U.S., Altria Group, Inc. is a tobacco company that manufactures and sells cigarettes, smokeless products, and wine in the United States.

Though the world is moving away from smoking cigarettes, Altria enjoys significant loyalty from its customers and continues to have strong pricing power. It has also made strategic efforts to diversify its portfolio by adding smoke-free products. The company forecast high-growth potential in its oral tobacco, e-vapor, and heated tobacco categories.

With a current market capitalization of $75 billion, the company has outperformed the benchmark index. Altria Group shares have lost 14.9% in the past year compared to the S&P, which was down 17.7%.

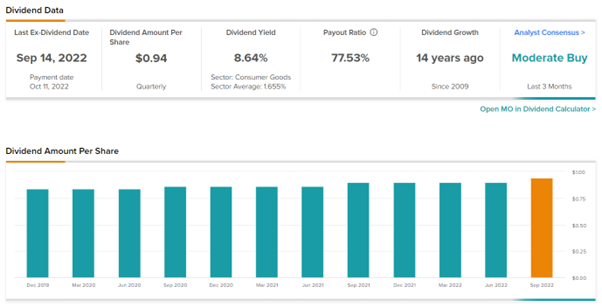

However, the regular stream of quarterly dividends that implies an 8.64% annualized return provides investors with some relief.

Notably, the company has consistently grown its dividends with an average annual dividend growth rate of more than 8% in the past 10 years. Last month, the company increased its quarterly dividend by 4.4% to $0.94 per share (from $0.90).

Further, its payout ratio of 77.53% implies that the dividends are well covered by its earnings.

Is Altria a Buy, Sell or Hold?

As per TipRanks, analysts are cautiously optimistic about the stock and have a Moderate Buy consensus rating, which is based on three Buys, three Holds and one Sell. Altria Group’ average price forecast of $46.57 implies 12.30% upside potential.

Notably, MO stock has a top-notch Smart Score of a “Perfect 10” on TipRanks. Further, the stock has a very positive signal from hedge fund managers, who added 1.0 million shares during the last quarter.

Following the footsteps of the top hedge fund managers, retail investors are also bullish on MO stock. TipRanks’ Stock Investors tool shows that investors currently have a Positive stance on Altria Group, with 2.3% of investors on TipRanks increasing their exposure to MO stock over the past 30 days.

Concluding thoughts

Altria shares are trading at attractive levels and present a good buying opportunity. It is trading much lower than the 52-week highs of $57.05 seen only a few months back.

What’s reassuring is that its high dividend yield is backed by stable and regular free cash flows as well as a healthy balance sheet.

Read full Disclosure