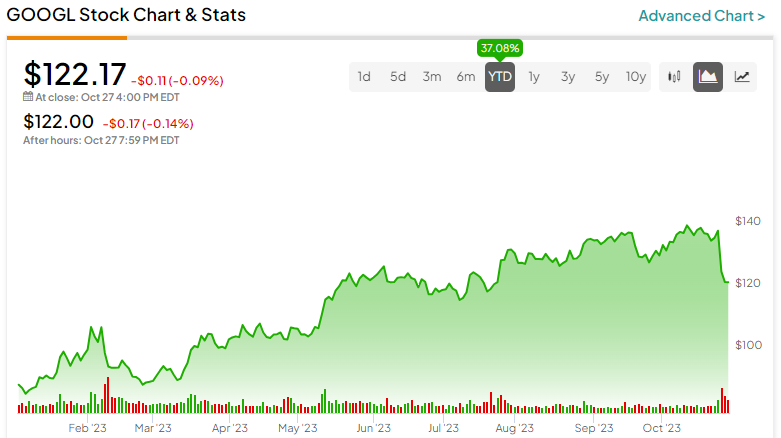

Media and AI tech giant Alphabet (NASDAQ:GOOGL) reported its Q3 earnings on Tuesday. However, the market was unimpressed, and the stock of Google’s parent company is now down 13.5% from its 52-week high. Analysts believe the market may have exaggerated the miss in estimates for Google Cloud revenue. Plus, Alphabet still has strong fundamentals, brand value, and the potential to continue boosting revenue and profits from AI integration. Hence, I am bullish on GOOGL stock now.

Google Cloud Revenue Missed Estimates but Grew 22.5% in Q3

Alphabet’s total revenue in the quarter grew 11% year-over-year to $76.7 billion, beating the consensus estimate of $75.9 billion. Meanwhile, earnings per share jumped to $1.55 versus $1.06 in the prior-year quarter. EPS also beat analysts’ estimate of $1.46.

Google Cloud revenue in the quarter grew by an impressive 22.5% year-over-year to $8.41 billion. However, according to Reuters, it missed analysts’ estimate of $8.62 billion.

Google is still trying to catch up to Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) in the cloud market. Notably, Amazon’s AWS (Amazon Web Services) and Microsoft Azure together account for 54% of the market share in the cloud market.

This, however, does not justify the market’s overreaction to Alphabet’s Q3 results. Google Cloud accounted for 11% of Alphabet’s total revenue in Q3.

Wedbush analyst Scott Devitt believes investors are overvaluing Alphabet’s Cloud segment, which accounts for only a small portion of the company’s overall revenue. Wedbush thinks share prices dipped after earnings primarily because of these two reasons — “uncertainty related to the trajectory of Cloud revenue growth following lackluster Q3 results, and incrementally lower expectations for future margin expansion as Q3 operating margin was 60bps below consensus.”

The five-star analyst added, “Owning Alphabet for its Cloud business is like rooting for Michael Jordan to play baseball.” The reiterated a Buy rating for GOOGL after its earnings report, giving it a $160 price target.

Sharing the same optimism, Bank of America (NYSE:BAC) analyst Justin Post stated, “More important for 2024 EPS, strong Search, and YouTube growth suggest the ad recovery remains strong, while product and advertiser initiatives suggest Alphabet will be an ongoing beneficiary of AI.” After earnings, Post rated the stock a Buy while raising the target price to $149 from $146.

For context, Google Advertising, which includes Google Search and others, YouTube ads, and Google Network, made up 78% of total revenue in Q3. This segment increased by 9.5% year-over-year to $59.6 billion.

Long-Term AI Prospects Still Look Good

During the Q3 earnings call, CEO Sundar Pichai stated how the company is making significant investments to incorporate AI into all its products. Management highlighted spending $8 billion on capital expenditures in the quarter, led by investments in technical infrastructure and servers, followed by AI-computing investments in data centers.

Management also discussed that the responses to the integration of generative AI into Google Search have been positive. Google Search, its flagship product, controls approximately 91.6% of the global search engine market. Its dominance and market position have been repeatedly called into question, as evidenced by the ongoing anti-trust trial. AI integration into Search could help Alphabet maintain its market share.

Earlier this year, Alphabet introduced Google Bard, a generative AI-powered personal assistant. It has now expanded Bard’s capabilities into its other products, such as Workspace, Maps, YouTube, and Gmail.

Management also emphasized that the company is experiencing continued growth across Cloud and that over “60% of the world’s thousand-largest companies are Google Cloud customers.”

Financially, Alphabet is capable of introducing more AI-powered products to its customers in the near future. It had $120 billion in cash, cash equivalents, and marketable securities, with long-term debt of $13.8 billion at the end of Q3.

Keeping the AI-led opportunities in mind, analysts foresee Q4 revenue to be around $85.3 billion, along with EPS of $1.61.

Alphabet’s revenue for 2023 is expected to grow by 8.0% year-over-year to $305.5 billion, further increasing to $340.2 billion in 2024. Analysts also predict EPS to rise by 25.9% to $5.74 this year and come in at $6.71 in 2024.

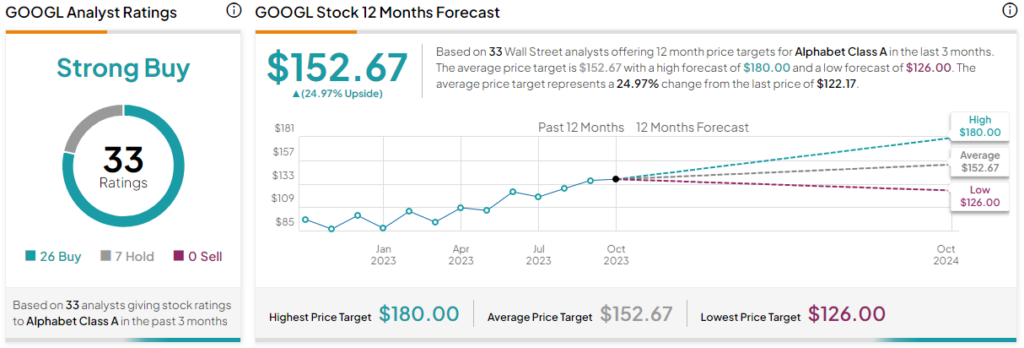

Is GOOGL Stock a Buy, According to Analysts?

Wall Street maintains its overall Strong Buy rating for GOOGL stock. Analysts at Needham, Piper Sandler, and a few others raised the target price for GOOGL. Out of the 33 analysts covering GOOGL stock, 26 recommend a Buy, and seven recommend a Hold. The average Alphabet stock price target is $152.67, which is 25% above current prices. The stock trades at 18.2 times forward 2024 earnings, which seems reasonable based on its long-term AI-related prospects.

The Final Takeaway

Summing up, although Alphabet may take some time to challenge Amazon and Microsoft in the cloud business, it will be difficult to shake its dominant position in the search engine market. Its strong fundamentals, brand name, reasonable valuation, drive for innovation, and commitment to adapt to the rapidly evolving AI niche make it a compelling tech choice now.