High inflation and fears of a looming recession have caused a slowdown in digital ad spending. The revenue growth of Google’s parent company, Alphabet (NASDAQ:GOOGL) (GOOG), decelerated in the third quarter, while Meta Platforms (NASDAQ:META) reported a decline in its revenue for the second consecutive quarter. This duopoly is not only getting impacted by weak ad spending but also by growing competition from tech, retail, and streaming companies that are gradually eating into their market share.

Meta and Google Facing Intense Competition

As per Axios, which cited Insider Intelligence data, Google and Meta are estimated to capture 28.8% and 19.6% share of the U.S. digital ad revenue market this year. Their combined market share of 48.4% marks a decline compared to 54.7% in 2017. Furthermore, their market share is expected to drop to 43.9% by 2024.

Apple’s iOS privacy changes, the rising popularity of ByteDance’s TikTok, the Russia-Ukraine war, and macro pressures have hurt the ad revenues of Meta, which owns Facebook, Messenger, Instagram, and WhatsApp. Insider Intelligence projects that the U.S. digital ad revenue of Amazon (AMZN), Apple (AAPL), Instacart, Microsoft (MSFT), Netflix (NFLX), TikTok, and Walmart (WMT) will grow at a faster rate than Meta and Google in 2023.

Google and Meta’s domestic ad revenue is expected to increase by 3% and 5%, respectively, in 2023. In comparison, U.S. ad revenue growth of Walmart, Instacart, TikTok, Spotify, Apple, Amazon, Walt Disney’s (DIS) Hulu, and Microsoft is projected to be 42%, 41%, 36%, 30%, 26%, 19%, 13%, and 10%, respectively. While the ad revenue generated by some of these players dwarfs that of Meta and Google, the pace of their growth is strong enough to impact the two ad giants in the years ahead.

It’s worth noting that Amazon defied the weakness in the digital ad market, with its ad revenue growing 25.4% to $9.5 billion in Q3, reflecting an acceleration compared to the 17.5% growth in Q2. In comparison, Meta Platform’s advertising revenue declined 3.7% to $27.2 billion while Alphabet’s revenue from Google advertising (includes Google Search, YouTube ads, and Google Network) grew 2.5% to $54.5 billion.

Is Alphabet Stock a Buy, Sell, or Hold?

Wall Street is bullish about Alphabet, with a Strong Buy consensus rating based on 29 unanimous Buys. The average GOOGL stock price target of $125.76 implies 42.5% upside potential. Shares have declined 39.1% in 2022.

Is Meta a Buy?

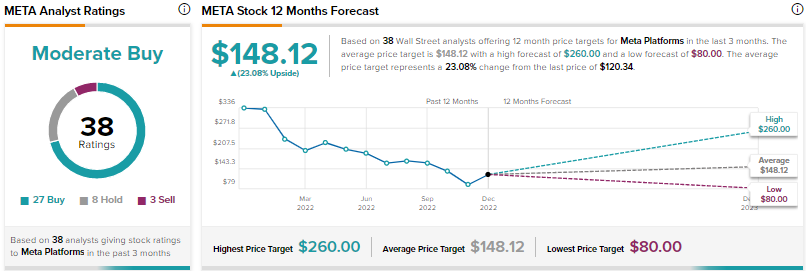

The Street’s Moderate Buy consensus rating for Meta Platforms stock is based on 27 Buys, eight Holds, and three Sells. The average META stock price target of $148.12 suggests 23.1% upside potential. Shares fell 64.2% in 2022.

Conclusion

Alphabet’s Google and Meta Platforms have dominated the U.S. digital ad market for several years. However, they are now losing market share to companies in the tech, e-commerce, and streaming services markets. Nonetheless, Wall Street still seems bullish about the long-term prospects of the two digital ad giants, especially that of Alphabet.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.