Allena Pharmaceuticals (ALNA), a late-stage biopharmaceutical company, announced its Q2 results on Tuesday. The company develops oral enzyme therapeutics for the treatment of metabolic diseases and kidney disorders.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company did not earn any revenues in Q2, and its net loss almost doubled from the same quarter of last year to $14 million. The increase in net loss was driven by the rise in Allena’s operating expenses, including research and development, and general and administrative expenses.

Last month, the company completed a $28-million direct public offering, resulting in net proceeds of $25.4 million. At the end of Q2, ALNA had a cash and cash equivalents balance of $26.7 million. (See Allena Pharmaceuticals stock chart on TipRanks)

According to H.C. Wainwright analyst Edward White, the capital raise of $25.4 million would give Allena a “cash runway of about 12 months.”

Following the Q2 results, White reiterated a Buy rating and raised the price target from $10 to $11 (1,028.2% upside) on the stock.

Let’s look at some of the key updates for the company’s lead drug candidates.

Phase 2a Program of ALLN-346

Last month, the company declared that it had completed a Phase 1b multiple-increasing dose study of ALLN-346. ALLN-346 is a first-in-class, orally administered enzyme, currently under development for the treatment of high levels of uric acid (hyperuricemia) and gout in advanced chronic kidney disease.

Allena has also initiated dosage for the ALLN-346 201 trial, the first of two planned Phase 2a trials. The results of this trial are expected during Q4 of this year.

White noted that Allena “plans to request to meet with the FDA to discuss whether to go with monotherapy or combination therapy for a Phase 3 trial.” The analyst expects ALLN-346 to be launched in 2027 for treatment of gout with anticipated sales of $88 million that year.

Plan for Interim Analysis of URIROX-2

In July, Allena updated its plan and timing regarding the first interim analysis of the URIROX-2 Phase 3 trial investigating reloxaliase, an orally administered enzyme in development for enteric hyperoxaluria.

The company had earlier planned to conduct the interim analysis only after 130 subjects had been treated for at least six months but “now expects to conduct the first interim analysis, which will include all patients who are enrolled in the trial by the end of November 2021 (currently expected to be approximately 80 patients), during the first quarter of 2022.”

White stated, “Allena does not expect any changes to the planned second interim analysis (200 patients treated for 24 weeks). The second interim analysis is intended to support a potential filing for accelerated approval for reloxaliase on the basis of UOx levels. We forecast a late 2023 launch and estimate reloxaliase sales of $18M in 2023 and $420M in 2029.”

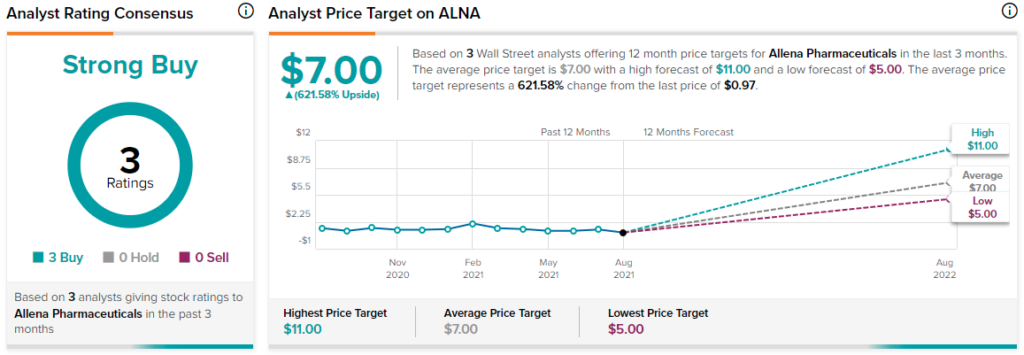

Street Consensus

Turning to the rest of the Street, consensus is that ALNA is a Strong Buy based on three Buys. The average Allena Pharmaceuticals price target of $7 implies 621.6% upside potential to current levels.

Disclosure: Shrilekha Pethe held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.