Once the market action comes to a halt today, EV giant Tesla (NASDAQ:TSLA) will grab the earnings wheel and deliver its Q2 report.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

One big metric that is of interest to investors is already in the public domain. Tesla already announced the delivery numbers for the quarter, and they were much better than expected. The question ahead of the print, though, says Morgan Stanley analyst Adam Jonas, is “at what margin do they come in?”

Tesla stimulated demand by enacting a series of price cuts on its models, but the Street is curious to know how that has affected the margin profile. Jonas says he has heard estimates as low as 16% and as high as 20%. He reckons the “confluence of factors at play include: the exit rate for 1Q margins (full Q was 19.0% but many believe the exit rate was 100bps+ below that), increased utilization of the Berlin and Austin facilities, the easing of commodity costs, and TSLA’s regular cost elimination efforts, to name a few.”

Although the Street sees GMs as the major yardstick, Tesla believes that on account of its top-of-the-pile operating leverage, the operating margin is a better marker. With 1Q R&D and SG&A as a percentage of sales hitting 3.3% and 4.6%, respectively, the question here, according to Jonas, is “can TSLA exhibit operating leverage beyond this point?”

Elsewhere, with the first Cybertruck having finally rolled off the production line in Texas, investors will also be keen to get more info about the plans for the vehicle.

With the report about to land, Jonas says he is “relatively cautious on the earnings revision outlook” and to keep investors’ chins up and prolong the shares’ rally, he thinks Tesla might go heavy on the AI opportunity. What does Jonas expect to find out on the “TSLA AI story” during earnings? “Likely not much,” he says. “But that doesn’t mean people won’t be asking about it, especially with Dojo potentially having started production earlier this month.”

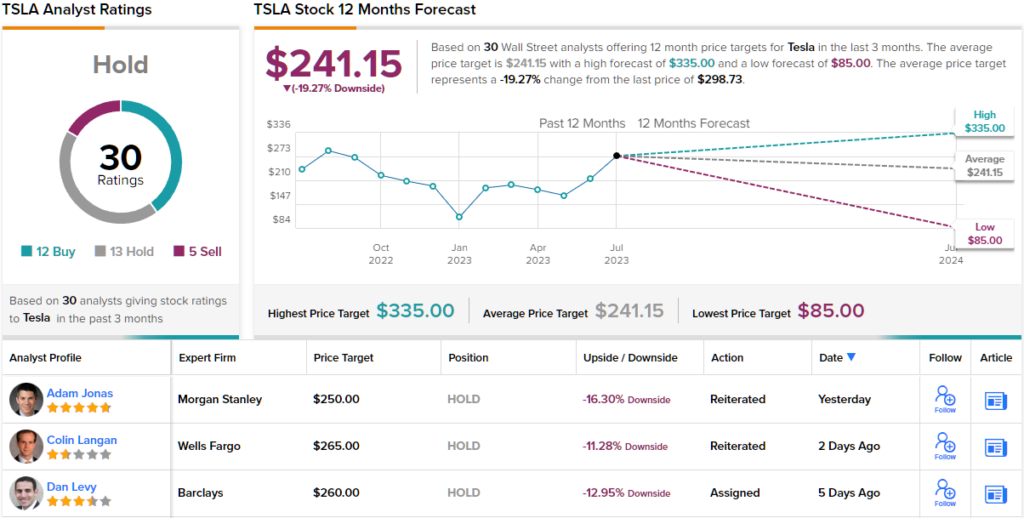

All told, Jonas sticks with an Equalweight (i.e., Neutral) rating alongside a $250 price target, suggesting the shares are currently overvalued by 16%. (To watch Jonas’ track record, click here)

It’s a similar story amongst Jonas’ colleagues. The stock garners a Hold consensus rating, based on 12 Buys, 13 Holds and 5 Sells. According to the $241.15 average target, a year from now, shares will be changing hands for a 19% discount. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.