No pressure, Tesla (NASDAQ:TSLA), but today’s 4Q22 results are “one of the most important moments in the history of Tesla and for Elon Musk himself.” At least that is the opinion of Wedbush analyst Daniel Ives, who’s also quick to point out why.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

“After experiencing unprecedented hyper growth over the past few years in the EV market which was essentially created by Musk, now Tesla faces a darker macro in 2023 with fierce competition coming from all angles,” the 5-star analyst explained. “Adding to that backdrop is Musk who has essentially gone from a superhero with a red cape to a villain in the eyes of many investors after the ongoing Twitter fiasco has cast a dark shadow over Tesla’s stock.”

Ives thinks three big topics are on the agenda for this quarterly update.

For one, while the recent price cuts were greeted positively by the Street and should result in bigger volumes, the question is what sort of impact they will have on margins going forward.

Ives says that for 2023, the “line in the sand for Auto GM (ex credits)” is ~23%. The price cuts add further pressure, then, although the analyst points to Tesla’s global scale as a way to offset the concern. He anticipates this issue will be a “key dynamic on the call.”

The second topic revolves around volumes. While beforehand Tesla was targeting longer term growth of ~50%, that might be a stretch in the current economic climate with Ives expecting a more realistic target. “We view 35%-40% delivery growth for 2023 as the line in the sand based on whisper numbers with 1.8 million units the general bogey for the year,” Ives said on the matter.

Lastly, it’s unavoidable but there’s a guy called Elon Musk involved here who likes to stir things up a bit. Ives says this is a “key moment of truth for Musk” with TSLA investors looking for a refocused Musk to offer a “strategic vision despite a near-term dark macro.”

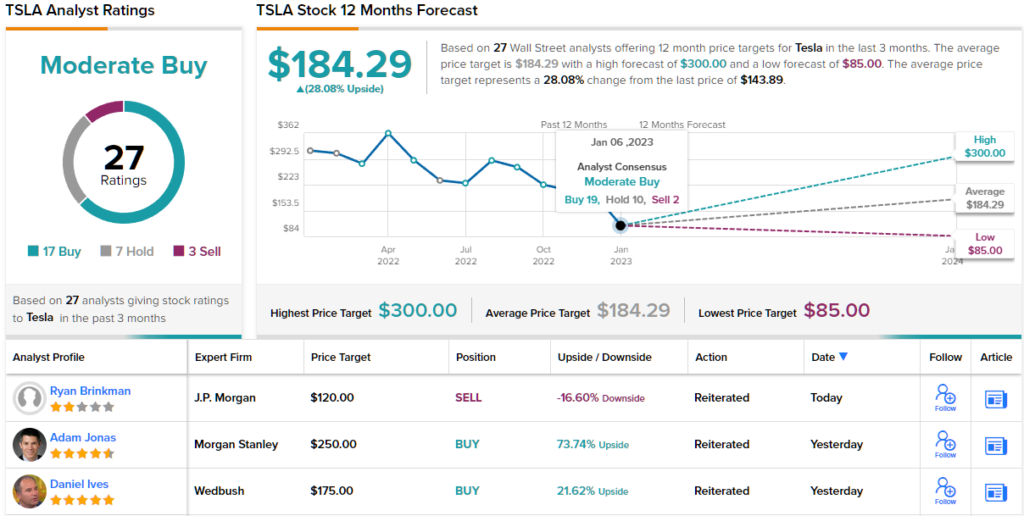

All told, for now, Ives maintains an Outperform (i.e., Buy) rating backed by a $175 price target, suggesting gains of ~22% are in the cards for the coming year. (To watch Ives’ track record, click here)

Overall, Tesla stock has received 27 reviews over the past 3 months and these breakdown into 17 Buys, 7 Holds and 3 Sells, all culminating in a Moderate Buy consensus rating. The shares are expected to change hands for a 28% premium in 12 months’ time, considering the average target stands at $184.29. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.