Align Technology (ALGN) is a medical device company that offers products and services to orthodontists and dentists.

We believe it is a good company that sports a competitive advantage. Nonetheless, we are neutral on the stock.

Competitive Advantage

There are a couple of ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating the earnings power value (EPV).

Earnings power value is measured as adjusted EBIT after tax, divided by the weighted average cost of capital, and reproduction value can be measured using total asset value. If earnings power value is higher than reproduction value, then a company is considered to have a competitive advantage.

The calculation is as follows:

EPV = EPV adjusted earnings / WACC

$16.04 billion = $1.123 billion / 0.07

Since Align Technology has a total asset value of $5.9 billion, we can say that it does indeed have a competitive advantage. In other words, assuming no growth for Align Technology, it would require $5.9 billion of assets to generate $16.04 billion in value over time.

The second method is by looking at a company’s gross margins because it represents the premium that consumers are willing to pay over the cost of a product or service.

An expanding gross margin indicates that a sustainable competitive advantage is present. If an existing company has no edge, then new entrants would gradually take away market share, leading to decreasing gross margins as pricing wars ensue to remain competitive.

Align Technology’s gross margins have contracted slightly over the past several years but improved in 2021 to 74.3%, bringing its margins close to its peak of 75.9% in 2014. As a result, we would say that it likely has the ability to fend off competition and a slight competitive advantage in this regard.

Profitability

In 2021, Align Technology recorded $827 million in free cash flow. This indicates that the company doesn’t have to rely on equity raises to continue funding its growth.

More importantly, its free cash flow has been trending up in recent years. To us, this means that the company’s free cash flows are reasonably predictable.

Risks

To measure Align Technology’s risk, we will first check to see if financial leverage is an issue. We do this by comparing its debt-to-free cash flow. Currently, this number stands at 0.12. Overall, debt is currently not a risk for the company.

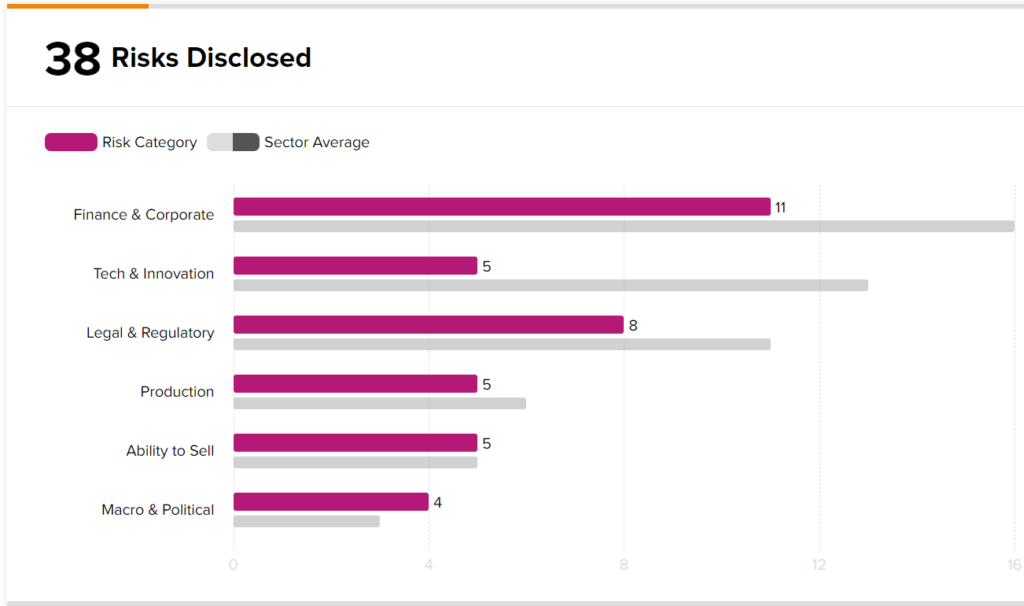

However, there are other risks associated with Align Technology. According to TipRanks’ Risk Analysis, the company disclosed 38 risks in its most recent earnings report. The highest amount of risk came from the Finance & Corporate category.

As we can see from the picture above, in total, ALGN has disclosed less risks than its sector’s average.

Wall Street’s Take

Turning to Wall Street, Align Technology has a Moderate Buy consensus rating based on six Buys, zero Holds, and one Sell assigned in the past three months.

The average Align Technology price target of $633.14 implies 25.9% upside potential.

Final Thoughts

Align Technology is a great company with a quantifiable competitive advantage. Analysts currently believe that the stock is undervalued and estimate approximately 30% upside potential.

Despite this, we remain neutral in the short term due to the overall market volatility.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Questions or Comments about the article? Write to editor@tipranks.com