Alibaba (NYSE:BABA), the Chinese tech giant, disappointed investors in 2023 while many of its American counterparts delivered strong returns. Alibaba stock has declined almost 40% in the last 12 months, but new catalysts have emerged to drive the stock higher in 2024. Although regulatory risks need to be monitored carefully, I am bullish on Alibaba stock.

SoftBank Finally Completes Divesting Alibaba

SoftBank (OTC:SFTBF), the Japanese investment firm led by billionaire Masayoshi Son, was one of the first institutional investors to believe in Alibaba. The investment firm invested $20 million in Alibaba in 2000. In late 2021, SoftBank entered into a forward contract with its subsidiary Skybridge to divest its Alibaba stake. This contract allowed SoftBank to repurchase Alibaba shares from Skybridge if needed.

On January 25, SoftBank announced the settlement of these prepaid forward contracts with Skybridge, reportedly booking a profit of around $8.5 billion from its investment in Alibaba. The investment firm has decided not to purchase or sell any new Alibaba shares in the foreseeable future. The firm currently owns a minor stake in Alibaba of approximately 0.5%, in contrast to an ownership stake of 32% back in 2021.

From a technical perspective, the massive selling pressure created by SoftBank over the last couple of years acted as a barrier for Alibaba stock to trend higher despite the company spending massive amounts on share buybacks. For reference, the company spent $10.2 billion on stock repurchases in the last 12 months.

Going forward, it seems reasonable to assume that buybacks will finally create a positive impact, assuming the company continues to perform well financially.

The Founder and President Are Betting on Alibaba

On January 23, SEC filings revealed that Alibaba founder Jack Ma and current Chairman Joe Tsai both purchased company shares, indicating their improving sentiment toward the company’s prospects at a time when SoftBank is exiting its investment. Mr. Ma purchased Alibaba shares worth $50 million, while Mr. Tsai invested $151 million in the company through his family investment fund.

Following these transactions, Jack Ma and Joe Tsai became the two largest shareholders of the company, ending SoftBank’s reign that spanned several years. The founding members’ return as largest shareholders is likely to boost investor sentiment in the coming months, which was evident from the initial market reaction on January 23, when Alibaba stock jumped more than 7% following the release of SEC filings highlighting these transactions.

Alibaba Enjoys a Long Runway to Grow

Alibaba’s investment appeal stems from two factors: the long growth runway enjoyed by the company and its cheap valuation.

Alibaba has emerged as a leader in the cloud computing space in China, which is a market that is expected to grow exponentially in the next few years, with companies of all scales and sizes moving to the cloud. According to Canalys data, Alibaba Cloud accounted for 34% of the cloud market in China at the end of Q1 2023, with Huawei Cloud in second place with a market share of 20%.

According to Statista, revenue in the Chinese public cloud sector will grow at a CAGR of 18.7% through 2028, resulting in a market value of $137 billion at the end of the forecast period. The ongoing integration of AI capabilities in the cloud market will be one of the key growth drivers in the next five years.

Alibaba enjoys quantifiable pricing power in this market segment, and the company has reported consistently higher renewal rates compared to many of its peers. These observations suggest that Alibaba is well-positioned to make the most of the expected growth in the cloud market.

The company is integrating AI into its digital retail technologies, including the development of unified core technology and solving language translation challenges. In the digital media entertainment segment, the company is using AI to create next-generation content and to achieve process-based digitalized film and TV show production capabilities.

Although a full business separation may not be in the cards anymore, Alibaba continues to find ways to manage its business units independently, which should enable the company to unlock hidden value in the coming years. This will be another growth driver.

At a more granular level, the company has come up with ambitious visions for each of its key business segments. Examples include 1688 aiming to leverage products manufactured in China with business customers in mind, Xianyu seeking to become a lifestyle platform without limiting itself to secondhand goods, DingTalk aiming to become the best AI smart assistant system in China, Quark targeting students to sell its knowledge products, and Youku committing to prioritize self-produced content to compete in the video content niche.

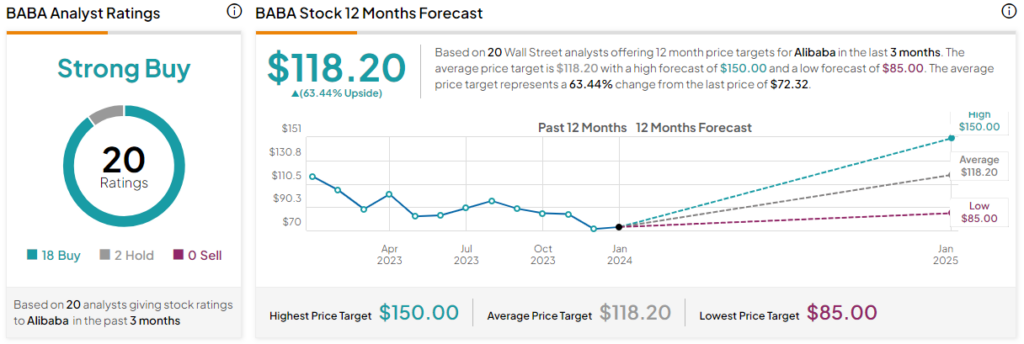

Is Alibaba Stock a Buy, According to Wall Street Analysts?

Based on the ratings of 20 Wall Street analysts, BABA stock comes in as a Strong Buy. The average Alibaba stock price target is $118.20, which implies upside potential of 63.4% from the current market price.

Alibaba is trading at a meaningful discount to its historical valuation multiples and also compared to its American counterparts. The company is valued at a forward P/E of 8.2 compared to its five-year average forward P/E of 18.15. To add more context, Amazon (NASDAQ:AMZN) is trading at a forward P/E of 59.4.

Alibaba’s cheap valuation has attracted many Wall Street bulls in recent months, but its stock has not performed up to expectations due to investor worries about Chinese regulators and other macroeconomic factors.

The Takeaway: Alibaba Stock Is Closer to Turning a Corner

Alibaba has remained cheaply valued for about two years. Today, new catalysts have emerged to drive the stock higher in the form of SoftBank completing its planned divestment of Alibaba shares and the improving regulatory improvement. The company seems attractively valued for long-term-oriented investors at a time when tables are turning in favor of the company both from a regulatory and financial performance perspective.