Like other previous beaten-down stocks, Alibaba (NYSE:BABA) has generally benefitted from a shift in sentiment in 2023’s opening period. In BABA’s case that pertains not only to the market’s renewed appetite for tech stocks, but to expectations of a recovery for the Chinese economy.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This has already been evident in the December National Bureau of Statistics (NBS) data, which continues to show improving metrics. For example, there has been an improvement in the year-over-year displays for growth of online physical goods sales of +7.2%, +6.4%, and +6.2% in October, November, and December, respectively.

However, ahead of Alibaba’s FQ3 earnings later this month, Truist’s Youssef Squali forecasts the company’s China Commerce growth slowing by 2% year-over-year. This is mainly down to the fact that it “over-indexes to verticals, which are more negatively impacted by the current macro environment” such as Retail and Apparel, thus likely causing some share losses over the near-term. Squali also thinks the e-commerce giant is losing some share to faster growing, smaller ecommerce rivals although his call for a 2% y/y drop in China Commerce “already captures such a trend.” Nevertheless, despite these issues, the analyst expects the company to show “slightly positive YoY growth” in F3Q23.

Additionally, as the end to China’s zero-Covid policies starts to “drive more normalization,” Squali anticipates growth will re-accelerate throughout 4Q23 and FY24.

Elsewhere, Squali also sees other headwinds abating, such as the risk of de-listing for US-listed Chinese stocks while the analyst also notes that regulatory pressures in China appear to be easing somewhat.

Summing up, the 5-star analyst offered a confident outlook, saying, “We continue to view China as critical to global economic growth and Baba’s scale at 1B+ users with high engagement as a key beneficiary of China’s normalization.”

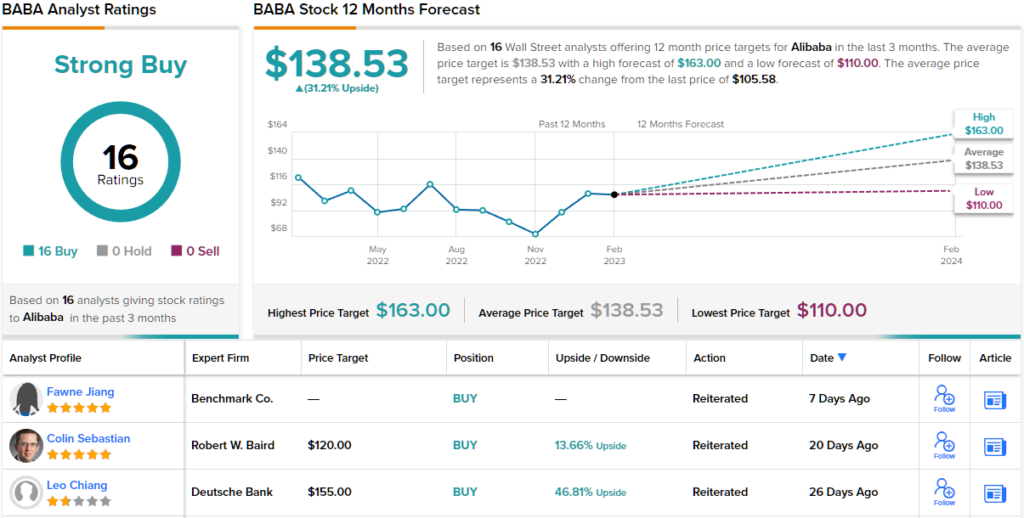

So, what does this ultimately mean for investors? Squali reiterated a Buy rating backed by a $120 price target. There’s potential upside of 14% from current levels. (To watch Squali’s track record, click here)

It appears Squali’s assessment chimes well with the rest of Wall Street. BABA stock currently boasts a Strong Buy consensus rating based on Buys only – 16, in total. Considering the average target comes in at $138.53, the shares are expected to appreciate by 31% over the coming year. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.