I am neutral on Airbnb (ABNB) as the company’s strong backing from Wall Street, growth momentum, and competitive strengths are offset by its elevated valuation.

Airbnb is an online marketplace for lodging, vacation rentals, homestays, and tourism-related activities. The company is based in San Francisco and was founded by Brian Chesky, Nathan Blencharczyk, and Joe Gebbia in 2008. (See Analysts’ Top Stocks on TipRanks)

Strengths

Airbnb is synonymous with the vacation rental industry. The company has transcended traditional hotels and vacation homestays, where guests look for the best deal, the most consistent services, and the best experience.

The company has a different payment model from hotels and does not require full payment upfront. Instead, booking fees are paid on reservations while the rest of the fees are paid once your stay is complete. This offers a more appealing and convenient arrangement for guests.

Recent Results

Airbnb reported a strong growth in the third quarter of 2021 and saw revenues of $2.24 billion, up 67% from the previous year, beating estimates of $2.05 billion. Earnings were $1.22 per share. Net income also improved 280%, to $834 million, from the third quarter of 2020.

The company is well on its journey to recover from the impact of COVID-19 as vaccination efforts ramp up across the globe.

Airbnb reported 79.7 million nights and experiences in the third quarter of 2021, which shows a slight decrease from 2021, and analysts estimated 80.8 million nights. The number was still up 29% year-over-year when the travel industry bore the full brunt of COVID-19.

However, the company posted its highest-ever revenue and net income in the third quarter of 2021, even though cross-border and urban travel has still not returned to pre-pandemic levels. Airbnb also said that it is “uniquely positioned” for recovery and reported that in North America alone, nights and experience booking saw a growth of 10% from the third quarter in 2019.

For the fourth quarter, Airbnb posted revenue guidance between $1.39 billion and $1.48 billion. It also expects nights and experience bookings to significantly outperform the fourth quarter of 2020.

Valuation Metrics

Airbnb’s stock looks richly valued right now as the EV/EBITDA multiple of 62.5x and the P/E ratio of 307.4x are both quite high.

That said, the company has a very strong growth outlook with EBITDA expected to grow by 713.6% in 2021 and 19.7% in 2022. Additionally, normalized EPS is expected to grow by 97% in 2021 and 254.3% in 2022.

Wall Street’s Take

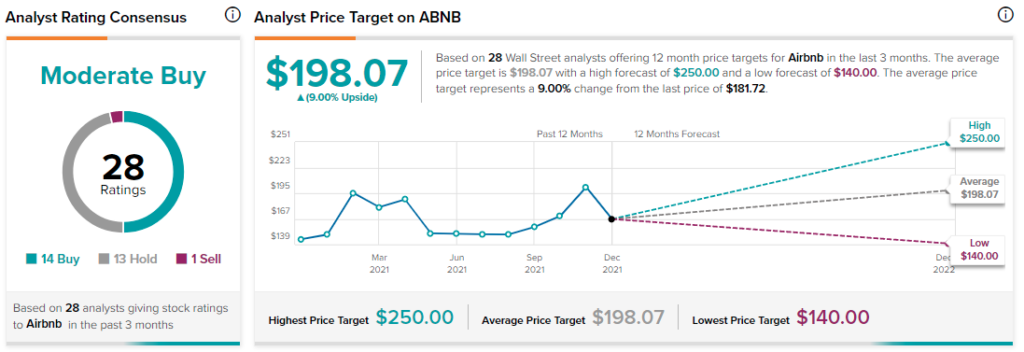

From Wall Street analysts, Airbnb earns a Moderate Buy analyst consensus based on 14 Buy ratings, 13 Hold ratings, and one Sell rating in the past three months. Additionally, the average Airbnb price target of $198.07 puts the upside potential at 9%.

Summary and Conclusions

Airbnb is a leading hospitality network company with a presence across the globe and a massive user base of both consumers and providers. As a result, it enjoys a strong competitive advantage and should continue to grow for years to come. Furthermore, Wall Street analysts are generally bullish on the stock at the current price.

That said, investors should keep in mind that the valuation multiples remain very elevated and require significant further growth to justify them.

Disclosure: At the time of publication, Samuel Smith did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >