The AI (Artificial Intelligence) boom has propelled Nvidia’s (NASDAQ:NVDA) stock skyward (see image below). NVIDIA AI has emerged as the operating system for all AI systems. It runs on every cloud and supports all frameworks and models. This implies that Nvidia is poised to deliver massive growth due to the rapid adoption of this next-gen tech, leading its stock to new highs.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Strengthening this view is the company’s solid Q3 outlook. The company delivered exceptional second-quarter financials and expects revenue of about $16 billion in Q3, representing a year-over-year growth of nearly 170%. Nvidia’s Q3 sales outlook handily surpassed the Street’s expectations of $12.5 billion.

The tremendous demand for its accelerated computing and AI platforms will drive Data Center revenues in Q3 and beyond. NVDA’s HGX platform, known as the engine of generative AI and large language models, is witnessing enormous demand from cloud service providers and large consumer Internet companies. Thanks to the secular tailwinds, the company is well-positioned to deliver record revenues and earnings and enhance shareholders’ returns through share buybacks.

With Nvidia stock riding high on the AI wave, Mizuho Securities analyst Vijay Rakesh sees significant upside potential from current levels.

Analyst Rakesh Sees Over 25% Upside in NVDA Stock

Rakesh raised Nvidia’s price target following its solid Q2 performance and strong outlook. The analyst increased his price target to $590 from $530, implying an upside potential of over 25% from current levels.

The analyst expects spending on AI to increase by 10 times in the next five years. With its leadership position in the AI space, Nvidia will benefit significantly from higher investments in this space.

He further added that the large addressable market for generative AI could remain a key growth driver for NVDA. With AI spending projected to increase, Rakesh expects Nvidia to “drive 75-90% market share.”

Are Nvidia Shares a Buy?

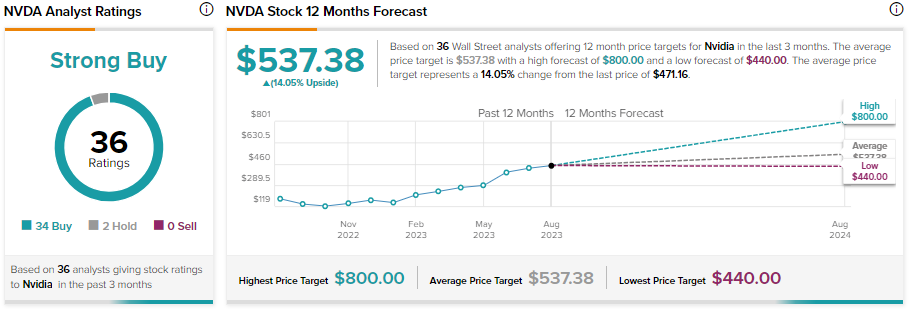

Nvidia stock has appreciated quite a lot, but it hasn’t peaked. Analysts maintain a bullish outlook on the stock and see further upside potential. With 34 out of 36 analysts covering the stock recommending a Buy, NVDA stock commands a Strong Buy consensus rating on TipRanks.

The average analysts’ price target of $537.38 implies 14.05% upside potential from current levels. Additionally, the highest 12-month price target on NVDA is $800, indicating an impressive 69.79% upside potential. This was given by Rosenblatt Securities analyst Hans Mosesmann on August 16, 2023.

Investors should note that the average price target is expected to increase as analysts may revise their price targets upward following the company’s massive Q2 beat and solid outlook.

The Final Takeaway

Thanks to the incredible demand for accelerated computing and AI platforms, Nvidia is poised to deliver massive growth, driving its stock higher to new highs. In addition, the company announced an additional $25 billion stock repurchase plan, highlighting its ability to generate significant cash flows and enhance its shareholders’ value.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue