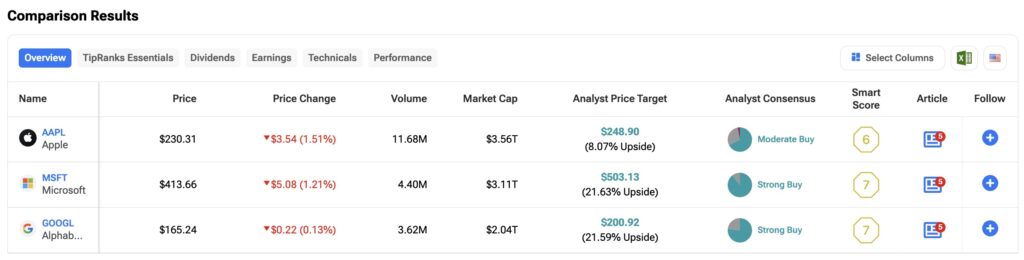

As earnings season approaches for big technology companies, I will compare Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL) using the TipRanks Stock Comparison Tool to determine which stock is the best buy. While I hold a neutral outlook on Apple and a bullish outlook on both Microsoft and Alphabet, a closer analysis suggests that Microsoft may be the best choice heading into earnings.

Apple (AAPL)

I hold a neutral stance on Apple ahead of its earnings report on Oct. 31. My skepticism is due to what I view as overly optimistic revisions from Wall Street analysts, with 21 out of 25 raising earnings per share (EPS) estimates and 21 out of 24 boosting revenue projections over the past three months. The consensus expects EPS of $1.55 (up 6% year-over-year) and revenues of $94.23 billion (up 5.3%).

While the iPhone 16 and 16 Plus, both capable of running artificial intelligence (AI), are key to Apple’s growth, initial sales of 37 million units fell 12.7% below the iPhone 15’s launch figures. The full potential of these devices, however, may not be realized until more AI features become available, delaying any AI-driven super cycle.

Apple’s performance in China will also be important this earnings season. Over the last nine months, Apple’s sales in China have dropped by 9.6%, with a 6.5% decline in Fiscal Q3 compared to last year, reflecting a downward trend. While there was an expectation of demand recovery in Fiscal Q4 due to the iPhone 16 launch, the full impact is likely to materialize over the coming year when AI-driven updates become available.

Additionally, Apple’s Services segment should continue to post record revenues, benefiting from Apple’s ecosystem of 2.2 billion active iOS devices.

Is Apple Stock a Buy, Hold or Sell?

I rate Apple as a Hold ahead of its earnings, though I expect near-term growth to sustain the stock’s momentum, which is trading near all-time highs. Despite this, I see few catalysts that will enable the company to surpass the upwardly revised expectations.

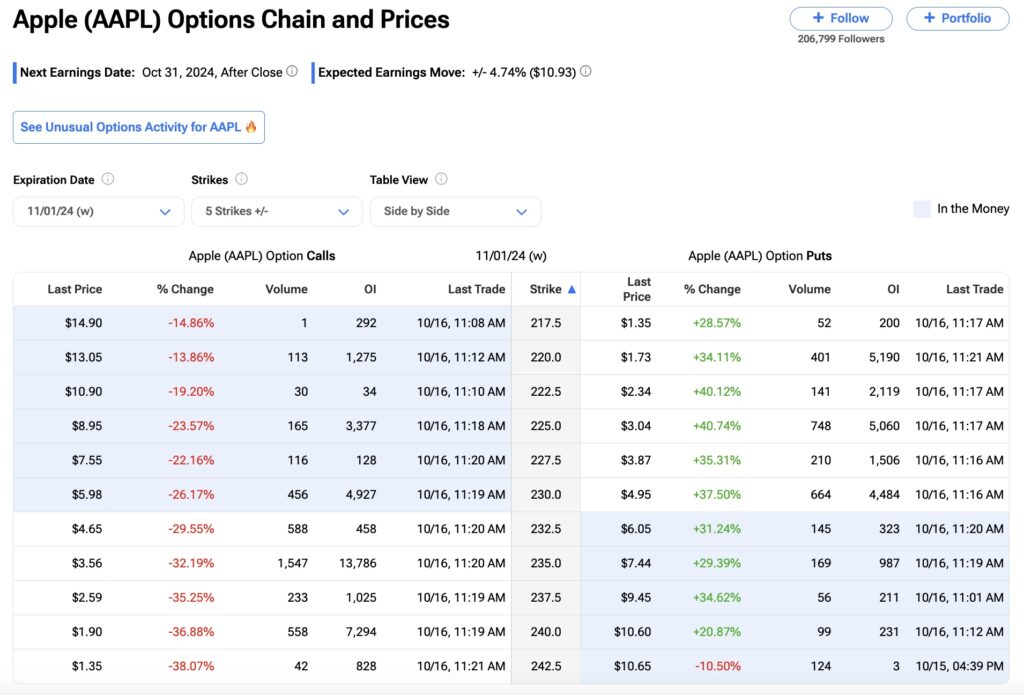

Moreover, Apple’s options chains reflects some volatility, with an expected price swing ahead of earnings of 4.7% in either direction based on an at-the-money $230 strike price for options expiring on Nov. 1. The chart below illustrates the options chain.

At TipRanks, Apple’s Wall Street consensus is a Moderate Buy, with 23 out of 34 analysts recommending investors Buy the stock. The average price target is $248.90, suggesting potential upside of 7.99%.

Microsoft (MSFT)

I am bullish on Microsoft leading into earnings scheduled for Oct. 30. Despite beating expectations across the board with its previous financial results, that print did not positively impact MSFT stock. And, analysts have revised their projections downward for the upcoming Fiscal Q1 2025 earnings.

In the past three months, 15 of 21 analysts have lowered their EPS estimates, and all 26 have revised revenue projections for Fiscal Q1. Current expectations are for EPS of $3.10 (a 3.7% year-over-year increase) and revenues of $64.54 billion (up 14.2%).

Last quarter, a major concern that hurt Microsoft was the announcement of increased infrastructure spending to meet growing demand. This spending is expected to pressure margins in the current Fiscal year. Additionally, the performance of the Intelligent Cloud segment, led by Azure, showed some moderation, with Azure growing by 22% year-over-year in the previous quarter. These revised estimates present a more tempered view, giving Microsoft an opportunity to meet or exceed expectations with its upcoming results.

Is MSFT Stock a Buy?

I rate Microsoft a Buy ahead of its earnings, believing that with lower expectations and more patient investors, the company’s strong cloud performance and sustained gross margins near 70% should be better appreciated. This could help the stock return to its all-time high of $468 per share reached in July of this year.

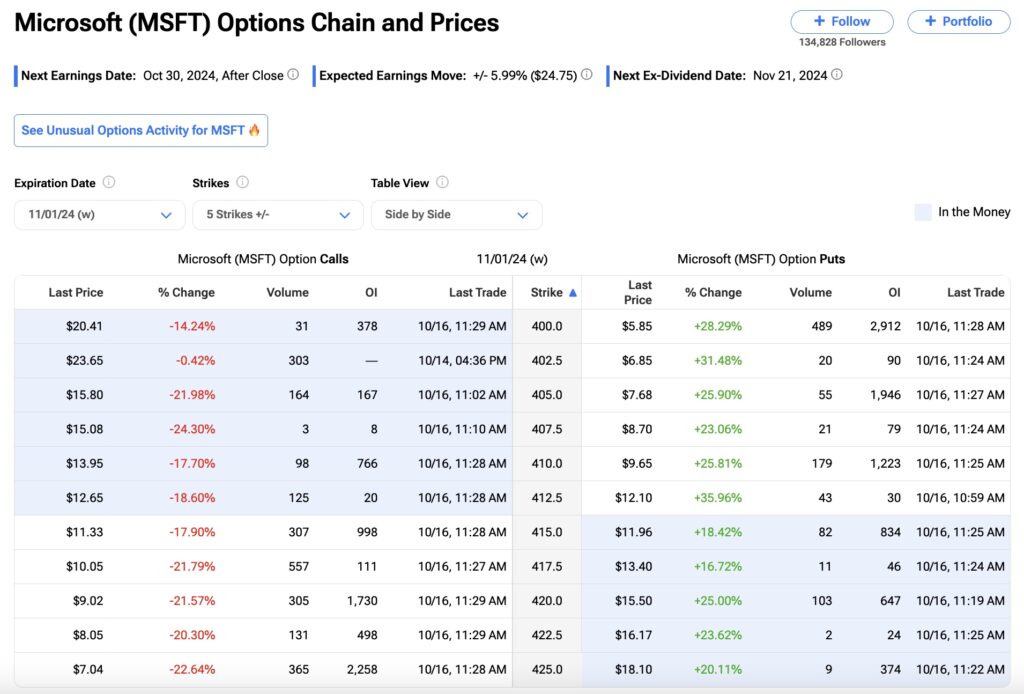

However, the options chain below indicates significant volatility, with an expected price swing of 5.9% ahead of earnings, based on the at-the-money straddle for options expiring on Nov. 1, at a strike price of $412.50.

At TipRanks, Microsoft has a Strong Buy rating from Wall Street, with 26 of 29 analysts rating it a Buy and an average price target of $503.13, suggesting potential upside of 21.84%.

Alphabet (GOOGL)

I have a positive outlook for Alphabet ahead of its Q3 earnings report on Oct. 29, as Wall Street expectations seem balanced and the company may exceed conservative guidance. Analysts have made 17 upward and 18 downward EPS revisions, along with 16 upward and 13 downward revenue revisions in the past three months. The target to beat is an EPS of $1.84 (up 19% year-over-year) and revenues of $86.23 billion (up 12.4% year-over-year).

While Alphabet’s Q2 results beat expectations, YouTube’s ad revenue of $8.66 billion fell short of the $8.93 billion consensus, contributing to the mixed revisions. Management also cautioned that operating margins could be impacted by increased depreciation, higher infrastructure costs, and the pull-forward of hardware launches.

Despite concerns about losing market share in Search due to rising AI competition, Google Search showed steady growth in this year’s second quarter, with double-digit growth expected to continue. Any potential weaknesses in YouTube or Search can be offset by Google Cloud, which experienced a 29% revenue increase in Q2, marking its sixth consecutive quarter of growth.

Is GOOGL A Buy, Hold or Sell?

I rate Alphabet as a Buy ahead of its earnings, as the stock has fallen nearly 13% since its Q2 report, which I believe to be somewhat of an overreaction. Alphabet appears well-positioned to deliver strong performance for the third quarter, supported by a more balanced market outlook.

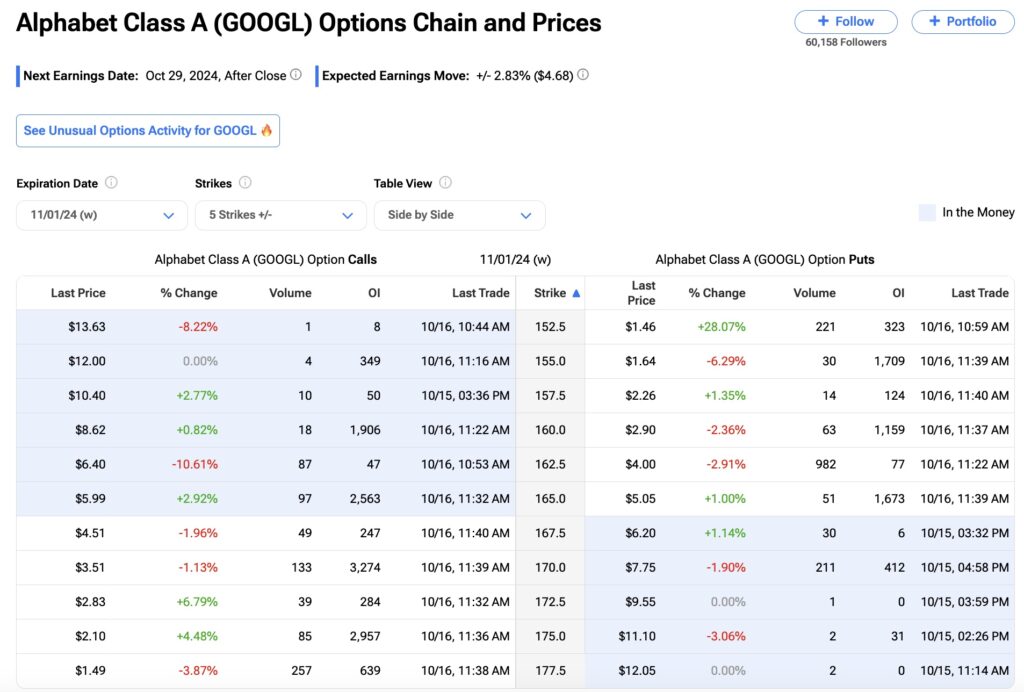

Compared to Apple and Microsoft, Alphabet’s options chains below shows the lowest volatility ahead of earnings. The expected price swing is 2.8% in either direction, based on the at-the-money straddle for options expiring on Nov. 1, calculated using a $165 strike price.

According to TipRanks, Alphabet is rated a Strong Buy, with 39 analysts recommending Buy and nine recommending Hold. The average price target is $200.92, indicating potential upside of 21.48%.

Conclusion

While analysts are revising estimates upward for Apple, making it harder to beat expectations in a transitional quarter, softer expectations for Microsoft and Alphabet create a better outlook for earnings beats. Though I consider both MSFT and GOOGL to be Buys, I believe Microsoft is the stronger choice as its stock likely has more room to run and it could easily beat modest earnings expectations.

Questions or Comments about the article? Write to editor@tipranks.com