With numerous headwinds implying that the economy could be headed for a hard landing, the fear trade naturally bolstered gold. However, daring investors may want to consider silver miners such as Endeavour Silver (NYSE:EXK). Riding coattails on gold’s upward trajectory, silver also benefits from a critical supply shortage. Therefore, I am bullish on EXK stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

EXK Stock Hitches a Golden Ride

Arguably, the biggest factor bolstering gold and the broader precious metals complex centers on the fear trade. Basically, investors shifted their focus from outright capital gains to wealth protection. For that, gold benefits from an attribute that very few other assets can claim — divine endorsement. From various religious doctrines to the earliest records of human history, gold (and silver) represent measures of wealth.

That’s hardly an insignificant point when assessing the headwinds of the day. Most notably, the recent failures of two U.S. regional banks highlighted the precarious nature of the post-COVID-19 economic recovery effort. With both individual and corporate depositors quickly realizing that American banks can’t be trusted, gold – which clearly stood the test of time – offers an attractive alternative investment.

Still, for the intrepid market participant, silver offers an even more enticing opportunity. Sharing similar properties to gold – rarity, provenance, and industrial demand, among others – silver can likely hitch a ride with the yellow metal and offer greater upside potential. Notably, in the trailing month, EXK stock gained over 50%.

Even better, the performance might just be the beginning of Endeavour’s northbound journey.

Silver Prices May Surge on a Shortage

To understand one of the key drivers for EXK stock, it’s important to realize a distinction between gold and silver. While industries use both metals for various applications, the latter sees significant demand. According to The Silver Institute, global silver demand has been soaring to fresh heights due to increased industrial consumption. From the 5G rollout to the integration of electric vehicles, silver undergirds multiple innovative markets.

Fundamentally, then, the upside journey for EXK stock may only be in its early innings. In an interview with CNBC, Nicky Shiels, head of metals strategy at precious metals company MKS PAMP, stated, “Silver is in a shortage… and there is a notable drawdown in the available physical stocks held in New York and London’s physical hubs, more so than seen in gold.”

According to Shiels, there may be a deficit of over 100 million ounces of silver in the next five years, with industrial demand accounting for nearly 50% of the total demand. Shiels predicts a base case scenario in which silver prices could rise to $28, while a bullish case scenario could push prices to $30 or higher.

To back up the point, TipRanks reporter Shrilekha Pethe noted in early March that aside from crude oil prices, many other commodities experienced price surges. Of course, the post-pandemic environment has been plagued with geopolitical flashpoints. As Western nations draw ideological lines in the sand, resource acquisition from “questionable” jurisdictions may become limited. This, too, may cynically lift EXK stock.

The Financials Will Require Patience

Although EXK stock might seem like a no-brainer, prospective buyers should also consider the financial backdrop. Here, Endeavour offers some decent metrics to mull over. However, it may be significantly overvalued right now, thus requiring high conviction in the upside narrative.

On the positive front, Endeavour offers a profile of competency. Most notably, it features solid strengths in its balance sheet. Its debt-to-equity ratio pings at 0.05 times, favorably below the sector median value of 0.15 times. Also, its Altman Z-Score (a solvency metric) hits 5.54, indicating high fiscal stability and a low risk of bankruptcy over the next two years.

Operationally, Endeavour’s three-year revenue-per-share growth rate stands at 9.4%, above 56.62% of its peers. As well, its operating margin comes in at 11.26%, outpacing 68.75% of rivals in the metals and mining industry.

However, the market also prices EXK stock at a forward multiple of 138.89. This stat ranks unfavorably above 98.94% of the competition, and herein lies the rub. Investors must believe that EXK still has more gas in the tank than the print shows. Covering analysts believe it, but ultimately, it’s your call.

Is EXK Stock a Buy, According to Analysts?

Turning to Wall Street, EXK stock has a Moderate Buy consensus rating based on two Buys, three Holds, and zero Sell ratings. The average EXK stock price target is $4.68, implying 11.96% upside potential.

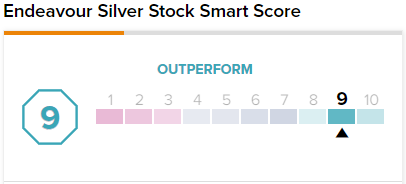

Supporting the bull case, on TipRanks, EXK stock has a 9 out of 10 Smart Score rating. This indicates high potential for the stock to outperform the broader market.

If You Believe in Gold/Silver, You Should Believe in EXK Stock

As precious metals, both gold and silver responded positively to broader economic concerns. However, silver, which is enjoying significant industrial demand, suffers from a critical shortage. And that makes EXK stock particularly enticing. Essentially, if you believe that gold and silver will swing higher based on the fear trade, it may be worth throwing a bone at Endeavour Silver.