Small-cap stocks, which have a market valuation between $300 million and $2 billion, are often in the early stages of their growth cycles. By investing in these companies, investors gain access to significant long-term returns that larger, established players may not provide. However, these stocks are more susceptible to market fluctuations, which results in higher price volatility compared to their larger counterparts.

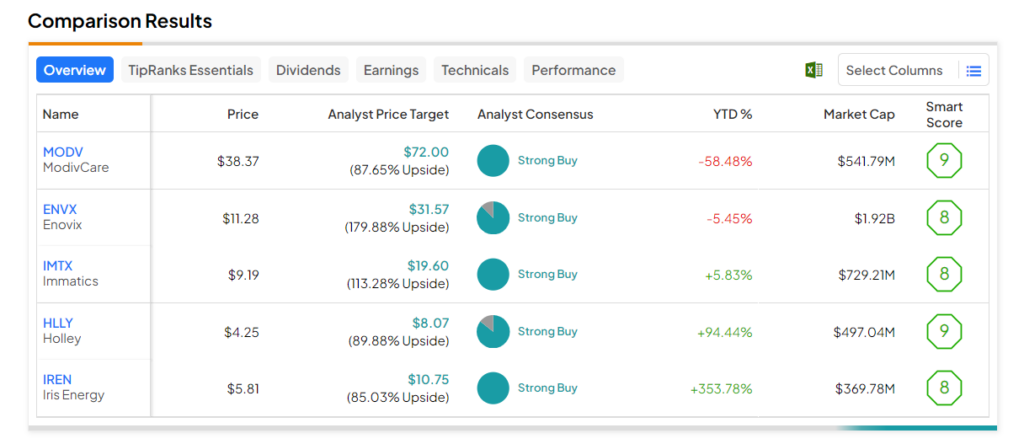

Thus, to support investors’ search for the best small-cap stocks, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 60%.

Here are the five best small-cap stocks for investors to consider.

- Enovix (NASDAQ:ENVX) – ENVX is focused on developing advanced lithium-ion battery technology for various applications. Its price forecast of $31.57 implies a 179.9% upside. Also, the stock has a Smart Score of eight.

- Immatics (NASDAQ:IMTX) – Immatics is a biotechnology company dedicated to developing innovative cancer immunotherapies. The stock’s average price target of $19.60 implies a consensus upside of 113.3% and carries a Smart Score of eight.

- Holley (NYSE:HLLY) – The company manufactures high-performance automotive aftermarket products. The stock has an analyst consensus upside of 89.9% based on the average price target of $8.07. On TipRanks, HLLY earns a Smart Score of nine.

- Iris Energy (NASDAQ:IREN) – The company owns and operates bitcoin mining data centers. IREN stock’s price forecast of $10.75 implies an 85% upside. It has a Smart Score of eight.

- ModivCare (NASDAQ:MODV) – ModivCare is a technology-enabled healthcare services company. The stock’s average price target of $72 implies an 87.7% upside potential. Also, its Smart Score of nine is encouraging.