Tesla (TSLA) released Q2 earnings and revenues last week that beat analysts’ expectations. The EV pioneer reported a record $1.1 billion in net income on $12 billion revenues.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Still, Wall Street wasn’t that impressed, with the company’s shares rising slightly following the release of the report. (See Tesla stock charts on TipRanks)

Apparently, investors are concerned with several factors that may slow Tesla’s feverish share price growth soon, such as a high valuation, competition from “colonizers,” a large China and bitcoin exposure, as well as rising material costs.

High Valuation

Wall Street is an efficient market, discounting good news and bad news on listed companies. As a result, shares are run-up ahead of good news and sold-off ahead of bad news. Sometimes, Mr. Market—to use Benjamin Graham’s terminology—is too optimistic, sending the shares of listed companies well above their fundamental or intrinsic value. Other times, Mr. Market is too pessimistic, sending shares of listed companies well below their intrinsic value.

Tesla’s shares are overvalued by many standards. TipRanks, for instance, estimates Tesla’s 12-month-trailing return on equity to be a modest 12.41%, while estimates put Tesla’s intrinsic value at $160.11, well below its current price level.

Competition from Colonizers

Once, Tesla had little competition, as the electric vehicle (EV) market it pioneered had little competition from traditional automakers. However, that’s no longer the case, as General Motors (GM), Ford (F), Volkswagen (VWAGY), and Toyota (TM) are invading the electric market. (See Electric Vehicle Stock Comparison on TipRanks)

These “colonizers” of the EV market have the manufacturing experience, expertise, and distribution networks to scale up EV production and cross the “tipping point” of bringing EVs to the masses. Meanwhile, the entry of new competitors into the EV market could unleash price competition that will erode Tesla’s revenue growth and profit margins. That’s something Wall Street is watching closely in quarterly financial statements.

China Exposure

Tesla vehicles are trendy in China, given the country’s pollution problem. That’s why the EV pioneer derives close to one-quarter of the company’s revenues.

At the same time, such a significant exposure on the Chinese market has its challenges, such as competition from Chinese colonizers like Nio (NIO), Li Automotive (LI), and Xpeng (XPEV), all of which have strong government backing. There is also the potential of China’s crackdown on high-tech companies in order to catch up with Tesla.

Bitcoin Exposure

Tesla’s CEO Elon Musk has an affinity for bitcoin. That’s why he has been investing some of the company’s cash in digital currency. As of the end of March, Tesla’s $1.5 billion investment was worth $2.48 billion, based on the surge in bitcoin in the first quarter. However, that has its risks, too, given bitcoin’s volatility.

Adding to bitcoin’s volatility are accounting rules that treat the digital currency as an indefinite-lived intangible asset. Thus, it is subject to impairment losses if its fair value decreases below the carrying value during the assessed reporting period. Companies cannot recover impairment losses for any subsequent increase in fair value until the asset’s sale. Tesla reported bitcoin-related impairments of $23 million in Q2 as the price of digital currency dived. (See Bitcoin Stock Comparison on TipRanks)

Rising Material Costs

Together with traditional automobile makers, Tesla faces a severe material shortage due to supply chain disruptions during the COVID-19 pandemic, which is expected to slow down the pace of its feverish growth.

“While we’re making cars at full speed, the global chip shortage situation remains quite serious,” Musk told investors. “For the rest of this year, our growth rates will be determined by the slowest part in our supply chain,” adding that there are a wide range of chips that will serve as that brake on growth.

Wall Street’s Take

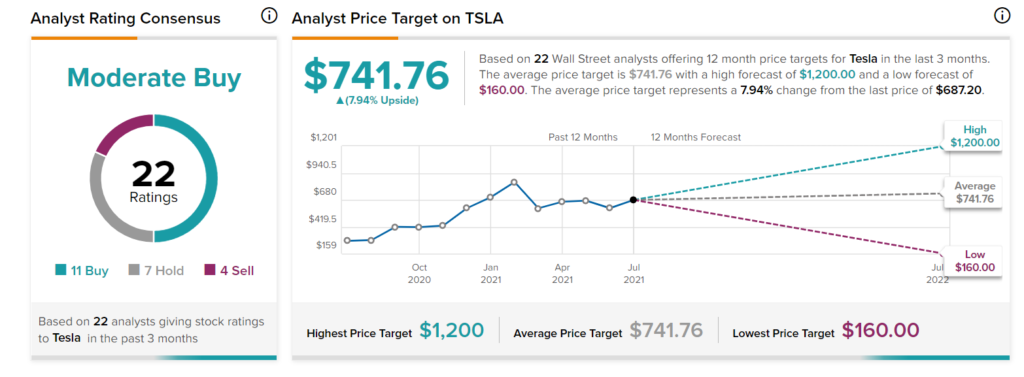

According to the analyst rating consensus, Tesla is a Moderate Buy, with 11 Buy, 7 Hold, and 4 Sell ratings.

The average Tesla price target is $741.76, which implies a 7.9% upside.

Summary and Conclusions

Tesla’s recent earnings report provides plenty of support for the company’s bulls. Yet the good news is already factored in the market value of the company’s shares and then some. Meanwhile, the EV pioneer will be facing many other challenges from now on: a significant exposure to China and cryptocurrencies, competition from colonizers, and rising material costs.

Therefore, value investors might want to wait for a better price-entry point.

Disclosure: The author doesn’t own shares of Tesla.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.