Value investing is one of the numerous methods employed in stock market investing. It involves considering a stock undervalued when it trades at a lower price relative to its fundamentals, including dividends, earnings, or sales. This makes it appealing to value investors seeking stocks with the potential for long-term gains. Moreover, value stocks are perceived as a prudent investment choice amid the current market uncertainty.

Don't Miss out on Research Tools:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

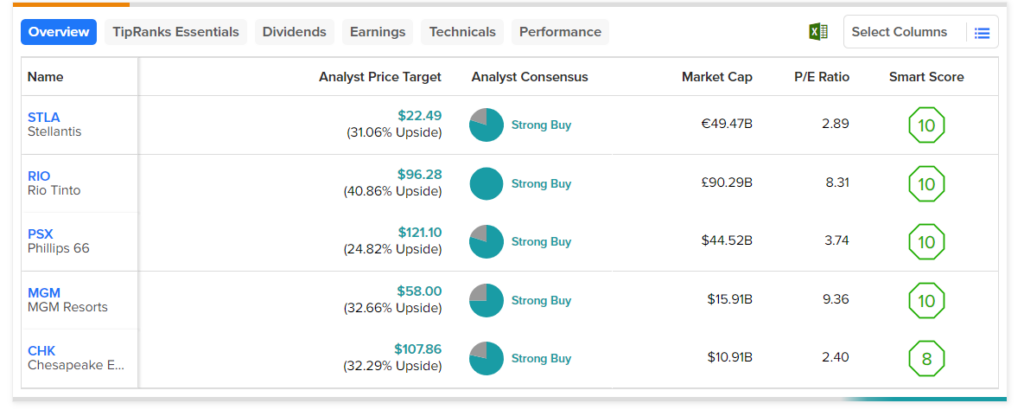

Using the TipRanks stock screener tool, we zeroed in on stocks with a Strong Buy rating from the top Wall Street analysts, and their price targets reflect an upside potential of more than 20%. Also, they carry an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks. Furthermore, these stocks seem to be undervalued, as they are currently trading at a considerable discount from their respective sector averages.

According to these screeners, the following stocks are reasonably valued and are analysts’ favorites.

- MGM Resorts (NYSE:MGM) – Top analysts currently see an upside potential of 37.5% in the global casino operator’s stock. Also, the stock is trading at 9.4 times earnings, which reflects a discount of about 47% from the sector’s average.

- Rio Tinto (NYSE:RIO) – Rio Tinto is a mining group that processes mineral resources like iron ore, copper, lithium, and diamonds. Based on the ratings of the three top analysts, the stock has an average price target of $96.28, which implies a 40.9% upside potential from current levels. RIO shares trade at 8.8x earnings, which is below its sector average of 13.67x.

- Phillips 66 (NYSE:PSX) – The downstream energy giant’s average price target, assigned by top analysts, implies a consensus upside of 24.8%. Its price-to-earnings (P/E) ratio is 3.7x, which is below the sector average of 7.16x.

- Stellantis (NYSE:STLA) – Stellantis is one of the largest automakers in the world. The stock has a top analyst consensus upside of 30.9%. The stock trades at 3 times trailing earnings, reflecting an 82.1% discount from the sector average.

- Chesapeake Energy (NASDAQ:CHK) – Chesapeake is an independent exploration and production company. The top analysts have set a 12-month price target of $111.89 for CHK stock, which implies a nearly 37% upside. It’s trading at 1.7 times earnings, 75.4% lower than its sector average of 7.16.