At the start of 2023, the oil industry experienced imbalances between supply and demand, resulting in a decrease in crude oil prices. However, despite this decline, oil companies have substantial cash reserves, which they are actively deploying to improve their capabilities and overall operations. Additionally, data from the Energy Information Administration (EIA) and the American Petroleum Institute (API) suggests that oil demand in the recent week surpassed initial expectations, indicating a stronger demand for oil than anticipated.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

While the oil and gas sector continues to be volatile due to constantly changing prices, there are some of the best-performing oil stocks that investors can consider. To assist investors in selecting those stocks, TipRanks offers a Stock Screener tool.

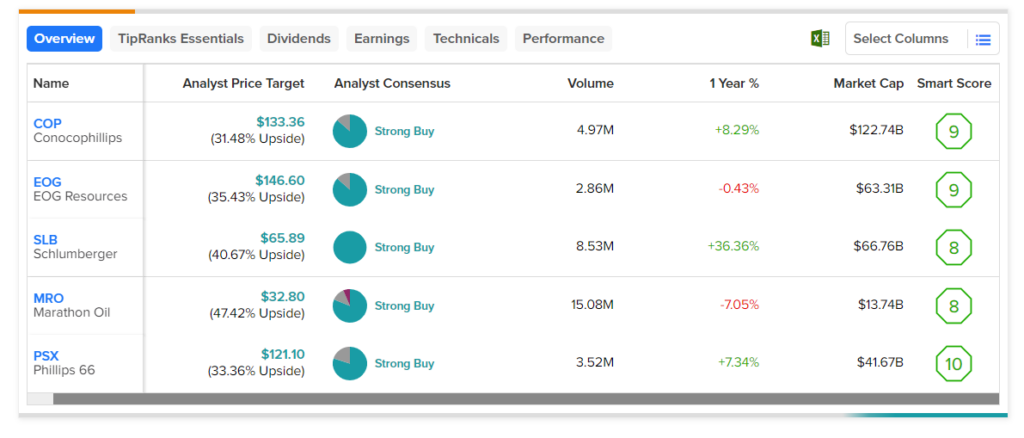

Using this tool, we shortlisted stocks that have a Strong Buy rating from analysts and an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, indicating a chance to outperform the broader market. Also, analysts’ price targets reflect an upside potential of more than 20%.

Here are the five key stocks from the oil sector that investors can consider.

- ConocoPhillips (NYSE:COP) – Analysts currently see an upside potential of 31.5% in COP stock. Also, it has a Smart Score of eight.

- EOG Resources (NYSE:EOG) – The stock’s price forecast of $146.60 implies a nearly 35% upside. EOG stock has a Smart Score of eight.

- Marathon Oil (NYSE:MRO) – MRO stock has an analyst consensus upside of 47.4% and a Smart Score of nine.

- Phillips 66 (NYSE:PSX) – PSX stock’s average price target implies a consensus upside of 33.4%. Moreover, it has an outperforming Smart Score of ten.

- Schlumberger (NYSE:SLB) – The stock has an average price target of $65.89, which implies a 40.7% upside potential from current levels. Also, its Smart Score of eight is encouraging.