Investors in oil and gas stocks enjoyed significant returns in 2022, when the price of oil reached a 14-year high of $120 due to Russia’s invasion of Ukraine. However, oil prices have gradually declined to below $80 per barrel as a result of the enormous price swings brought on by supply and demand imbalances. Going forward, oil demand is expected to be high as a result of China’s reopening.

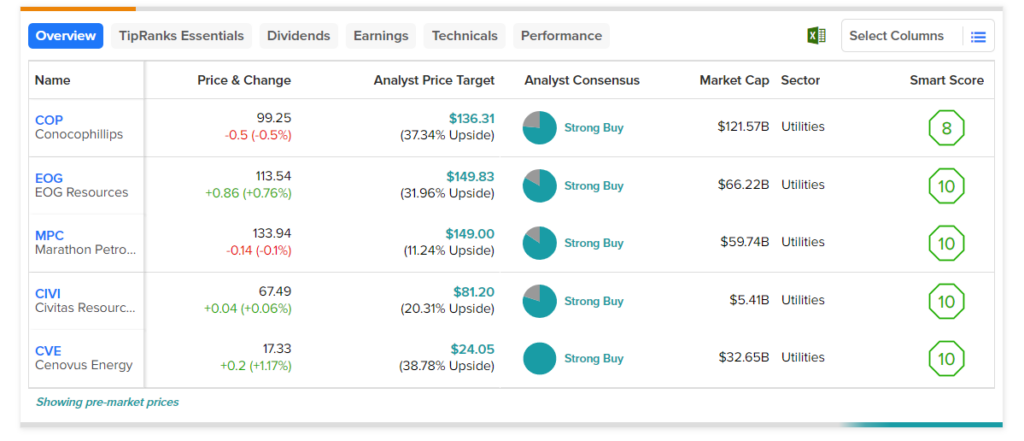

To help identify the best oil stocks for your portfolio, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 10%.

Here are the five key stocks from the oil sector that investors can consider.

- ConocoPhillips (NYSE:COP) – Analysts currently see an upside potential of 37.3% in COP stock. Also, it has a Smart Score of eight.

- EOG Resources (NYSE:EOG) – The stock’s price forecast of $149.83 implies a nearly 32% upside. EOG stock has a top-notch Smart Score of ten.

- Cenovus Energy (NYSE:CVE) – CVE stock has an analyst consensus upside of 38.8% and a Smart Score of “Perfect 10.”

- Civitas Resources (NYSE:CIVI) – CIVI stock’s average price target implies a consensus upside of 20.3%. Moreover, it has an outperforming Smart Score of ten.

- Marathon Petroleum (NYSE:MPC) – The stock has an average price target of $149, which implies a 11.2% upside potential from current levels. Also, its Smart Score of ten is encouraging.