Investors may decide to stay away from the banking industry after two U.S. banks failed this year. However, the sector’s robust performance in the most recent quarter is somewhat encouraging. According to the Financial Times, banks’ quarterly earnings reached an all-time high of $80 billion, up 33% year-over-year.

Furthermore, it is anticipated that high interest rates will continue to expand the top-line numbers for the banks. Last, the significant sell-off in the banking industry might be seen as an excellent opportunity for investors to buy bank stocks with long-term growth potential.

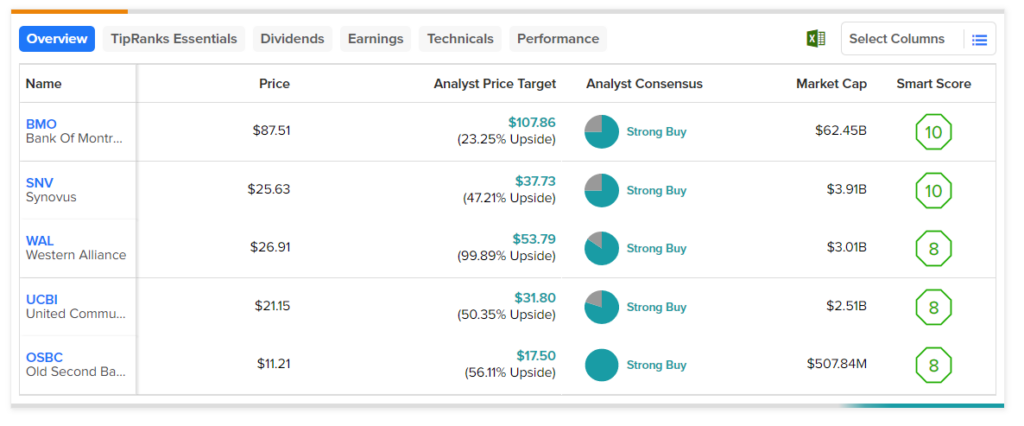

To help identify the best bank stocks for your portfolio, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 20%.

According to the screener, the following stocks have the potential to grow and are analysts’ favorites.

- Bank of Montreal (NYSE:BMO) – Analysts currently see an upside potential of 23.3% in the stock. Also, it has the highest Smart Score of ten.

- Synovus Financial (NYSE:SNV) – The stock’s price forecast of $37.73 implies a nearly 47.2% upside. SNV stock has a top-notch Smart Score of ten.

- Western Alliance (NYSE:WAL) – WAL stock has an impressive analyst consensus upside of 99.8% and a Smart Score of eight.

- United Community Banks (NASDAQ:UCBI) – UCBI stock’s average price target implies a consensus upside of 50.4%. Moreover, it has an outperforming Smart Score of eight.

- Old Second Bancorp (NASDAQ:OSBC) – The stock has an average price target of $17.50, which implies a 56.1% upside potential from current levels. Also, its Smart Score of eight is encouraging.

Questions or Comments about the article? Write to editor@tipranks.com