As the world increasingly finds itself on the other end of the COVID-19 pandemic, financial growth is all around us. We’re currently riding a four-week winning streak in the market, where the S&P 500 index has gained about 7%.

The U.S. economy is firing on all cylinders, as vaccine distribution is expanding and COVID-19-related business and travel restrictions are being lifted. U.S. GDP is expected to post better than 6% GDP growth in the first quarter and corporate earnings are on track to be up more than 30% from the previous year.

This bullish environment is being supported by government stimulus for individuals and small businesses, in addition to accommodative monetary policy from the Federal Reserve. The Fed has repeatedly said that it will keep short-term interest rates at or near zero, in order to support a full post-pandemic recovery of the U.S. labor market.

On the other hand, there are signs that inflationary pressures are rising. The core producer price index increased by 3.1% in March and businesses are looking to passing along higher input costs to customers. While consumer prices grew just 1.6% excluding food and energy last month, we believe that inflation is the one bogey that can put the brakes on the recent market rally.

That’s because it’s also the Federal Reserve’s job to ensure that inflation does not run rampant. If prices continue to rise, Chair Jerome Powell & Co. could be pressured to increase short-term interest rates sooner, rather than later.

However, investors should not fear the potential for any temporary pullback. A decline in the stock market can lead to excellent opportunities in finding the best growth stocks, and above-average growth is the best antidote for keeping up with inflation.

We’ve found three such stocks to watch today, which we highlight below:

The Best Stocks to Watch Today

Best Technology Stock

Par Technology (PAR)

The company provides technology solutions for two distinct sets of customers: government contracts and the hospitality industry.

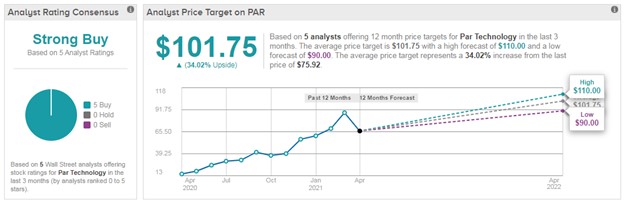

The stock recently changed hands around $75.92 and sports a market capitalization of about $1.9 billion. It is a component of the Russell 2000 index, a key proxy for small-cap investors.

While many operators in the hospitality industry have struggled in the past year, Par Technology is still delivering impressive growth. The company increased revenue more than 10% in the fourth quarter of 2020 and also posted 67% bookings growth for its point-of-sale software.

That kind of top-line growth potential has Par on the path toward future profitability. Both empirical data and anecdotal evidence have shown that buying a company on the cusp of generating sustainable profits can boost investment performance.

Par is also looking to augment its growth through acquisitions. Earlier this month, management said that it bought privately-held Punchh, for $500 million of cash and stock. The new business has industry-leading growth in supporting customer loyalty programs and expands the company’s presence in the restaurant industry.

Back in March, Sidoti upgraded the stock from Neutral to Buy. All five active analysts tracked by TipRanks rate Par a Buy and the average price target of $101.75 represents 34% upside potential.

In addition, the company carries a Smart Score of 10/10 on TipRanks. This proprietary score utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

On top of the positive aspects mentioned already, the Smart Score indicates that shares have seen insider buying, in addition to improving sentiment from investors and financial bloggers.

Best Biotech Stock

ImmunityBio (IBRX)

The company develops immunotherapies to combat cancer and infectious diseases. ImmunityBio recently merged with NantKwest and a lead product of the combined company looks to treat bladder cancer.

The stock recently traded around $18.09 and has a market capitalization of about $6.7 billion. It is a component of the S&P Biotech sector SPDR and the Russell 2000 index.

In February, management said that Phase 2/3 clinical trials for its treatment Anktiva showed a complete response. ImmunityBio has received Breakthrough and Fast Track status for the product in this indication. The company is also running a Phase 2 study for lung cancer with Anktiva, in addition to testing its efficacy against pancreatic cancer.

What makes ImmunityBio a top biotech stock is that it has many irons in the fire, offering multiple potential avenues of future growth. The company is currently running more than 20 Phase 2 or Phase 3 trials.

In addition, management said earlier this month that initial Phase 1 data from its COVID-19 vaccine candidate showed a 10-fold increase in T-cell response from a single injection. The next step is a clinical trial with 80 participants that is expected to be fully enrolled in the second quarter.

ImmunityBio is also running early-stage trials for prostate cancer. In March, management said that its developmental vaccine developed T-cell responses for more than one targeted antigen in 94% of patients.

The stock is currently flying under the market’s radar and has just one activist analyst tracked by TipRanks. Joseph Catanzaro has a Buy rating and $25 price target, reflecting 38.2% upside potential.

Even though ImmunityBio currently has limited analyst coverage, Catanzaro is considered one of the top names on Wall Street, which adds weight to the call. TipRanks rates him in the top-4% of the more than 7,400 analysts tracked.

Best Electric Vehicle Stock

Workhorse (WKHS)

The company serves the commercial transportation market and is looking to change the future of vehicle delivery. Workhorse has developed an electric truck that it distributes through Ryder System (R) and even a delivery drone that’s dubbed HorseFly.

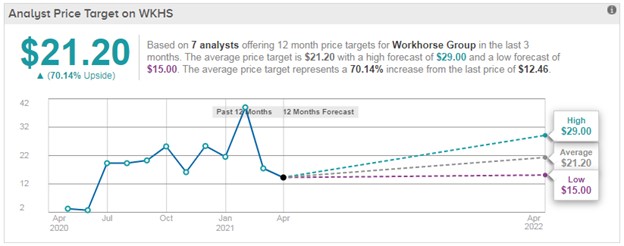

The stock recently changed hands around $12.46 and sports a market capitalization of about $1.7 billion. It is a component of the Russell 2000 index.

The company reportedly missed out on a contract with the U.S. Postal Service to deliver electric deliver trucks back in February, although the validity of the deal that was awarded to its competitor is currently under question. Because it’s temporarily down on its luck, Workhorse may well be the best EV stock to buy now.

That’s because the company has a backlog of over 8,000 vehicles. Management has guided that it will deliver 1,800 of those trucks in this year, which is a growth trajectory leading to a consensus analyst estimate that Workhorse can generate over $300 million of revenue in 2022.

The company also has a hidden asset in that it’s the second largest investor in electric pickup truck manufacturer, Lordstown Motors (RIDE). Workhorse owns 9.3% of Lordstown, a stake that’s currently worth about $160 million.

In addition, Wall Street sees value in the stock. Earlier this month, B. Riley initiated coverage of the company with a Buy rating, stating:

“We believe Workhorse has the potential to gain early footing with key customers as it ramps up production and sales this year. The company will be beating to market most of the electric competition focused on the delivery space by quarters or years with its C-Series ramp expected this year, and we believe the larger size cargo offers differentiation in the space relative to the smaller-volume vans coming from the large auto OEMs and upstarts.”

Of the seven active analysts tracked by TipRanks, the average price target of $21.20 represents 70.1% upside potential.

Like Par Technology, Workhorse also has a Smart Score of 10/10. On top of the positive aspects mentioned already, the Smart Score indicates that Workhorse has seen improving sentiment from hedge funds and financial bloggers.

Focus on Growth

Investors are always looking for growth; but it’s more important than ever, when stocks are near record highs and inflationary pressures are rising. With U.S. GDP approaching double-digit growth in 2021 and the Federal Reserve likely to keep short-term interest rates low for the next several quarters, these three names are among the best stocks to watch today.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.