The market’s giants grab all the headlines, with their huge market caps and 4-figure share prices, making it easy to overlook that there are plenty of other opportunities in the stock market for investors willing to take a deeper look into the background.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

So let’s come up with a profile for lesser-known stocks with high potential. To start with, we should look for stocks with a Strong Buy from the analyst consensus – these are the equities that have broad agreement from Wall Street on the quality of their forward prospects. Along with that, we should look for a strong upside forecast in the coming year. While this is an estimate, it’s a good representation of just how strong that Strong Buy consensus actually is.

To make sure that we’re really looking into the ‘under the radar’ category, we’ll limit our search to stocks in the ‘small-cap’ category, with market valuations less than $400 million, and with a share price under $10. These are indications of small size and lack of exposure, rather than fundamental unsoundness, and they also permit high-percentage returns even on a small gain in absolute value.

That’s what we’ve run through the TipRanks sorting tool. The results have brought up three interesting stocks with triple-digit upside potential. Let’s take a closer look.

Reneo Pharmaceuticals (RPHM)

We’ll start in the biotech industry. Reneo is a clinical-stage biopharmaceutical company with a single leading drug candidate, REN001, taking multiple development paths. The company describes this as ‘one approach, multiple diseases,’ and the basic idea, to give a single flexible drug candidate multiple shots on goal, promises efficiencies in the research program.

Reneo’s therapeutic approach focuses on the treatment of genetic mitochondrial diseases. These conditions are associated with serious deficits in both cellular metabolism and energy production; the mitochondria, the affected organelle of the cells, are essential for life, as they are the basic metabolic ‘energy factory’ for all of us. REN001 is a peroxisome proliferator-activated receptor delta agonist (PPAR) with a known capacity to increase transcription of genes involved in the function of mitochondria and in the increase of fatty acid oxidation (FOD). In addition, it may also aid in production of new mitochondria.

The company uses REN001 to target critical genes in mitochondrial metabolism and in the generation of ATP, the main energy source in basic cellular processes. The company believes the drug candidate can offer substantial benefits to patients suffering from genetic mitochondrial myopathies and consequent symptoms of weakness, fatigue, cramping, and loss of muscle mass.

REN001 is currently the subject the three different develop tracks and no fewer than five early-stage clinical trials. The targeted diseases are primary mitochondrial myopathies (PMM), long-chain fatty acid disorders (LC-FAOD), and McArdle’s disease (MD).

In late July, the company initiated enrollment in STRIDE, a Phase 2b global, double-blind, randomized, placebo-controlled study in the treatment of PMM. Data is expected later in 2023. Also in 2023, the company expects to release data on a related open-label safety trial in the treatment of PMM.

Furthermore, the company completed enrollment in REN001-102, the open-label Phase 1 trial for patients suffering from LC-FOAD. Data on this study, and on the related natural history study, are expected in 1H22.

The first catalyst to hit, however, will be the 1Q22 readout from the Phase 1b trial of REN001 as a treatment for McArdle’s disease. This condition, also called glycogen storage disorder, causes pain, fatigue, and cramping, and may lead to muscle loss later in life. The current trial of REN001 on this indication is an open-label safety and tolerability trial that is also exploring multiple clinical outcomes. Investors should look for signs of mitochondrial improvement in the topline results, as well as patient tolerability for increased exercise.

In a development that bodes well for the company’s intellectual property, Reneo announced that it had received a patent allowance from the US Patent Office, for application number 17/381,005. This patent is expected to be issued by early 2022 at the latest, and will protect intellectual property on REN001 for twenty years.

Based on multiple potentially significant clinical catalysts as well as its $6.84 share price, Piper Sandler analyst Yasmeen Rahimi rates RPHM an Overweight (i.e. Buy). Not to mention her $45 price target puts the upside potential at a whooping 553%. (To watch Rahimi’s track record, click here)

Backing her bullish stance, Rahimi writes: “We believe RPHM shares remain undervalued considering the number of near-term stock-moving catalysts including the Phase 1b McArdle readout in 1Q22, topline data from the LC-FAOD Phase 1b in 1H22 and natural history study in 2H22, as well as topline data from the Phase 2b STRIDE study in PMM and open-label safety data in 2023.”

“We maintain our conviction in RPHM mgmt’s ability to execute, with the team completing Phase 1b (LC-FAOD) enrollment and remaining on track for topline data. Lastly, REN001 received a patent allowance for a composition of matter that is expected to issue in 2022 and protect until 2041 in the US,” the analyst added.

Overall, with only bullish calls issued in the last three months, the word on the Street is that RPHM is a Strong Buy. Adding to the good news, its $35.75 average price target indicates ~419% upside potential from current levels. (See RPHM stock analysis on TipRanks)

Redbox Entertainment (RDBX)

From biotech we’ll move over to video rentals and digital streaming. Physical video rental is an older mode of entertainment that has survived even in this age of online streaming, and Redbox has a foot in both camps. The company is a market leader in the physical rental niche for DVDs, and operates thousands of kiosks in retail locations across the US. On the streaming side, the company has entered the ad-supported video on demand niche (AVOD), and has partnerships with Hollywood studio, content providers, and over 100 streaming TV channels.

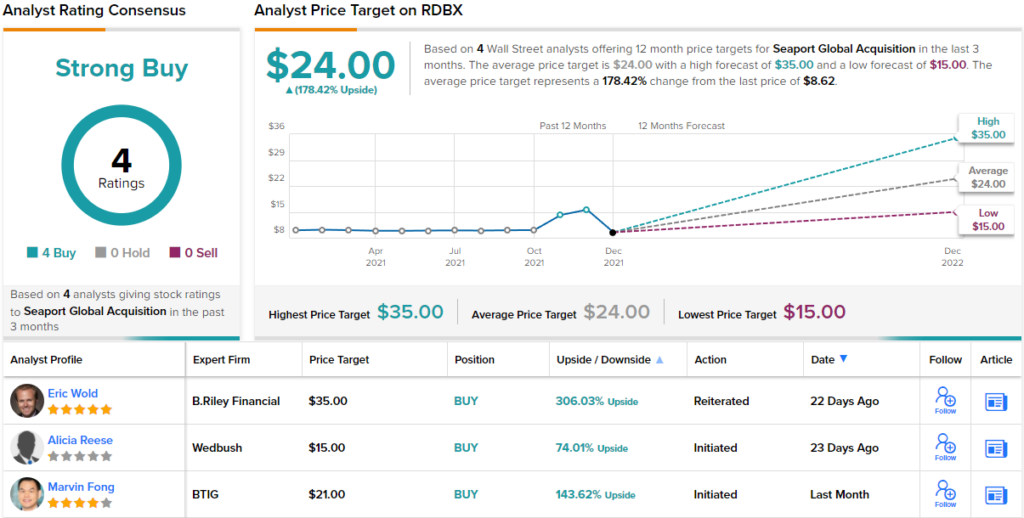

In October of this year, Redbox went public through a SPAC transaction with Seaport Global Acquisition. The business combination was completed in late October and the RDBX ticker started trading on the NASDAQ on October 25. Redbox realized approximately $88 million in new capital, and now has a market cap of $390 million.

In the weeks since the SPAC closed, Redbox has been continuing its moves to expand its operations. The company in November signed a new AVOD deal with Warner Media, and added additional AVOD titles to its offerings from Sony Pictures Television. Both moves sped up the company’s streaming expansion. And in December, Redbox partnered with Velocity MSC to add video signage on 2,000 kiosks. This is part of a 4,000 kiosk ad partnership, allowing video campaigns to be seen by millions of Redbox’s kiosk customers.

Redbox released its first quarterly results as a public company just after the SPAC transaction finished, and the results did not impress investors. Revenues at $552 million missed the expectation of $562 million, while the net income of $17.9 million was down 78% yoy. The company saw rental volume drop significantly, and a weak offering from the Hollywood studios negatively impacted the streaming segment.

Nevertheless, Eric Wold, 5-star analyst from B. Riley, remains optimistic on Redbox. He writes, “With a relatively robust theatrical release schedule into year-end that dovetails into a robust 2022 film slate that currently includes three Marvel Universe films, four DC Universe films, along with sequels to “Jurassic World,” “Transformers,” “Mission: Impossible,” “Top Gun,” and “Avatar,” we remain optimistic that rental patterns (both physical and TVOD/PVOD) will begin to return to more normalized patterns during 2022 and heading into 2023. And with RDBX providing the most robust choice of rental options and low-priced physical options, we would expect share gains to take hold with that film slate.”

To this end, Wold rates RDBX a Buy, while his $35 price target implies a powerful one-year upside of 306%. (To watch Wold’s track record, click here.)

Overall, this relatively new stock has a unanimous Strong Buy rating from the Street, with 4 recent positive reviews on record. The shares are priced at $8.62 each and their $24 average price target is indicative of ~178% upside for the next 12 months. (See RDBX stock analysis on TipRanks)

Viant Technology (DSP)

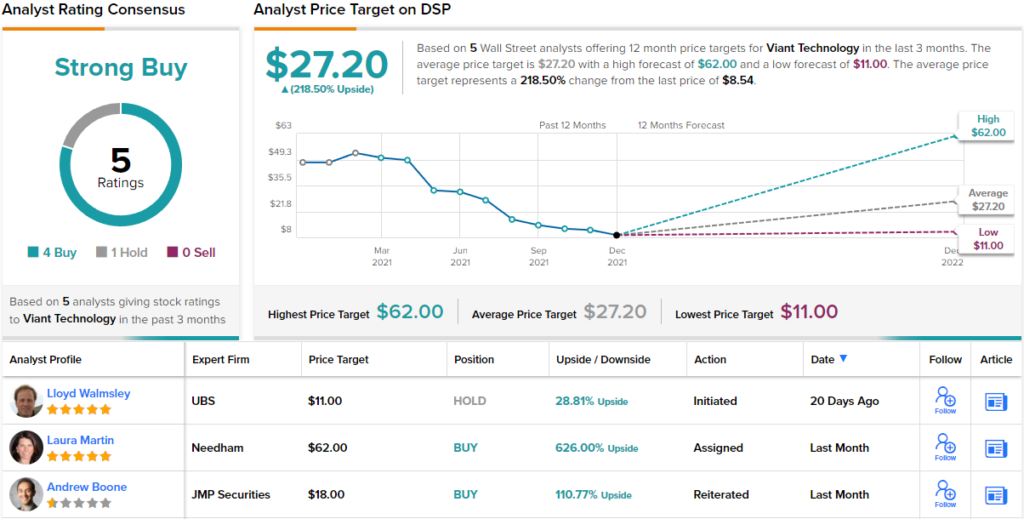

Wrapping up our list, we’ll move over to the digital advertising market. Viant is a software company, specializing in what it describes as ‘people-based advertising.’ The company’s Adelphic platform is an omnichannel demand-side system for agencies, brands, and media buyers, allowing efficient execution on ad campaigns through digital audio, desktop and mobile devices, and both connected and linear TV. Perhaps the company’s greatest asset is its high level of customer satisfaction; Viant reports customer approval of its ad tech platform at 95%.

This is not a new company, but it is relatively new to the public markets. In February of this year, after nearly 20 years in business, Viant took advantage of rising market tides to go public. The IPO raised $213 million in new capital. Since then, things have gotten complicated.

The share price has fallen by a whopping 82% this year, reducing the market cap to $115 million. Earnings turned negative in 1Q21, although the loss per share has moderated from 27 cents in Q1 to 20 cents in Q3. At the same time, 2021 quarterly revenues have been rising, from $40 million in the first quarter to $50.8 million in the third.

These headwinds came after Apple, early this year, introduced privacy changes that blocked competitors ads from appearing on iPhone devices. Apple has nearly one billion installed users, so this made a major impact on advertisers. Companies like Viant, and their customers, have been working to adapt to the new environment.

In one major example, Viant introduced the WWC (world without cookies) update to its Adelphic platform. The new update exited beta testing in October, and customers have seen quick results: over 200% average conversions, and a 40% increase in reach. WWC is one of several updates Viant is making to Adelphic, to help its customers cope with Apple’s policy change.

Viant has also introduced Household ID on the Adelphic platform. This is a powerful new tool that allows marketers to bypass third-party cookies altogether, to build sustainable relationships directly with consumers. The Household ID solutions ‘cuts through the noise of more than 1.5 billion IP addresses,’ to find 115 million tangible households that can be targeted for direct advertising.

The success of Viant’s efforts forms the core of the upbeat view from Canaccord’s 5-star analyst Maria Ripps.

“Viant added 17 new customers during Q3, well ahead of expectations, with the recent sales & marketing headcount growth and heightened awareness of its privacy-compliant solutions amid Apple’s platform changes both contributing to the continued client acquisition momentum, particularly for mid-market agencies,” Ripps noted.

“It is very encouraging that broader privacy headwinds within the digital advertising ecosystem are leading advertisers to explore privacy-compliant solutions like Viant’s people-based household ID, and we see potential for upward estimate revisions as recently added customer cohorts mature and ramp their spend on the platform and new marketers are onboarded,” the analyst added.

In line with her upbeat outlook, Ripps rates DSP shares a Buy, and her $25 price target suggests the stock has an impressive 193% upside ahead of it in 2022. (To watch Ripps’ track record, click here)

Wall Street’s attitude toward this stock can be seen from the 4 to 1 breakdown of Buys versus Holds in the recent reviews. This supports the Strong Buy consensus view, and the average price target of $27.20 implies a one-year upside even more bullish Ripps would allow, at ~218%. (See DSP stock analysis)

To find good ideas for small-cap stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.