Buy cheap? Even in the stock market, buyers like to find a bargain. Defining a bargain, however, can be tricky. There’s a stigma that gets attached to low stock prices, based on the reality that most stocks don’t fall without a reason. And those reasons are usually rooted in some facet of poor company performance.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

But not always, and that’s why finding stock bargains can be tricky. There are plenty of low-priced equities out there with sound fundamentals and solid future prospects, and these options make it possible for investors to ‘buy low and sell high.’ These are the stocks that Warren Buffett had in mind when he said, “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

Using TipRanks’ database, we identified three stocks that feature both low prices now – and powerful upside potential for the coming year. Not to mention each one gets a “Strong Buy” consensus rating from the analyst community. Let’s dive in and find out what’s driving that prospect.

MYT Netherlands (MYTE)

We’ll start with a European holding company, MYT Netherlands, whose subsidiary Mytheresa is a leading e-commerce retailer based in Germany. The online store offers a wide range of products in ready-to-wear clothing, for women, men, and children, along with shoes and accessories. Mytheresa has a focus on luxury goods, and buyers can find high-brands like Gucci, Veneta, Burberry, Dolce & Gabbana… it’s a long list. MYTE went public in New York in January of last year, and in its first fiscal year as a public company, 2021, saw more than €612 million (US$694 million) in total net sales.

In its first four publicly reported quarters, Mytheresa’s revenues stayed in a narrow range, between $186 million and $198 million. Earnings have been more volatile, ranging from 6 cents to 24 cents per share. The most recent bottom line number, 11 cents per share in Q1 of fiscal year 2022, was up 10% sequentially, and a sharp turnaround from the year-ago quarter’s net loss of 10 cents.

Despite these gains, MYTE shares are down 54% in the last 12 months. In coverage for Societe Generale, analyst Abhinav Sinha explains why he sees this drop as an opportunity for investors: “We view the recent share price drop as overdone given Mytheresa’s unchanged underlying strengths: high growth prospects, sustained margins and sound balance sheet. In this context, we believe that the current stock price is attractive.”

The analyst sees the company in a position to maintain ‘decent and sustained profitability,’ writing, “We expect a stable medium-term EBITDA margin at c.9% (2022-24e) supported by the following: 1) MYT’s curation-driven proposition, with its strong track record on pricing discipline reducing downside risks on gross margin (the key indicator to judge a 1P business); 2) Mytheresa’s relative immunity to current supply chain disruptions, as stand-alone shipping/freight costs account for only 5-6% of sales, thus protecting the EBIT margin from current freight cost escalation, and the majority of MYT’s supply is sourced from Europe (close to its logistics hub in Germany).”

In line with his optimistic approach, Sinha gives MYTE shares a Buy rating and his $15 price target suggests an impressive 75% upside potential for the coming year.

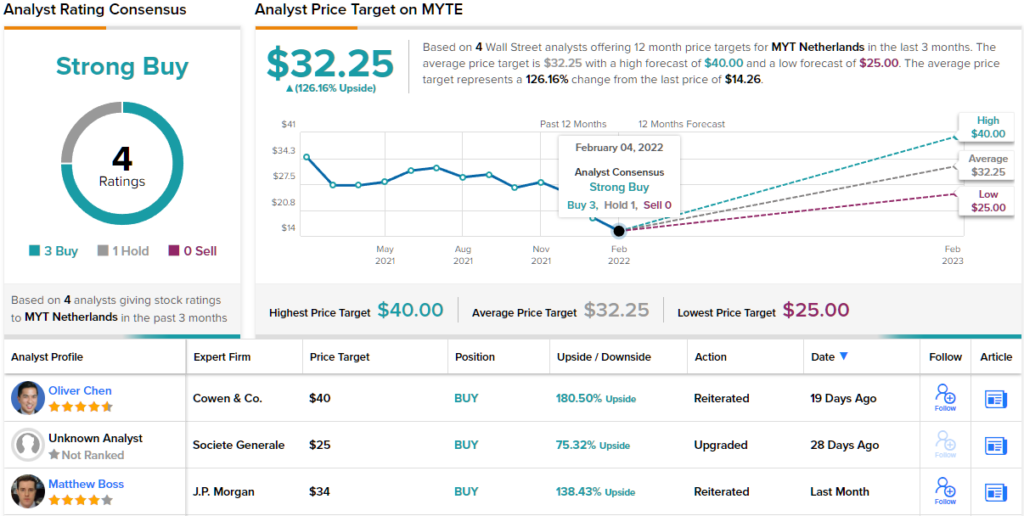

Wall Street generally is upbeat here, as the Strong Buy consensus rating, based on a 3 to 1 advantage of Buys over Holds, shows. The stock is selling for $14.26 and its $32.25 average target implies a 12-month upside of 126%. (See MYTE stock forecast on TipRanks)

Black Knight (BKI)

Next up is a tech company, Black Knight. This company provides data and analytics solutions and software for the real estate and mortgage financing industries. Black Knight is headquartered in Jacksonville, Florida, a fast-growing city in one of the country’s faster growing states. The company’s software and data solutions automate the processes of the mortgage life cycle, including loan origination, ongoing servicing, and default if needed. Black Knight gives its clients the ability to efficiently manage risk and improve financial performance.

Rising home prices have been good for business. Black Knight recently reported the magnitude of the increase, noting that the increase in real estate values over the course of 2021 gave homeowners a 35% increase in ‘tappable equity,’ the amount available for use as liquid assets. This translates to a $2.6 trillion increase in aggregate real estate values, a jump driven by home sales.

A look at Black Knight’s own revenues over the past two years bears out the impact of rising home values on mortgage servicers and facilitators. The company has seen six quarters in a row of sequential top-line gains, and the most recent reported, 3Q21, showed $378 million at the top line, up 21% year-over-year. EPS came in at 60 cents, for a 15% yoy gain.

Despite these gains, BKI shares are down 20% since hitting a peak this past December. Oppenheimer analyst Dominick Gabriele sees the stock’s increased volatility as symptomatic of an upcoming slowdown in real estate market, but doesn’t necessarily see it as a reason to abandon the stock.

“We think BKI’s relative stock selloff vs. the NASDAQ represents likely more than the headwind to current Fannie, Freddie and MBA originations forecasts… BKI’s ability to sell new platforms, cross sell, harness/maintain their dominant market share of accounts on file while making targeting M&A provides for a more stable and unique way for investors to play the mortgage industry through less cyclical technology revenue subscriptions. Given accelerating revenue growth, LT margin accretion and market positioning combined with a valuation discount vs. historical norms, we think today represents a unique buying opportunity for investors,” Gabriele explained.

To this end, Gabriele gives BKI an Outperform (i.e. Buy) rating, and his price target of $93 implies ~40% one-year upside potential. (To watch Gabriele’s track record, click here)

Overall, this stock has received 4 recent share reviews and they include 3 Buys to 1 Hold, for a Strong Buy consensus rating. The average price target of $82 indicates room for 23% growth from the current trading price of $66.60. (See BKI stock forecast on TipRanks)

Cue Biopharma (CUE)

Last but not least is Cue Biopharma, a clinical-stage company working on new treatments in the field of immunotherapy, specifically a new class of injectable biologic medications that will directly engage and modulate selected T-cells. This approach has applications in multiple fields, including cancer treatment, infectious diseases, and autoimmune disorders. Cue is using two proprietary biologics platforms, Immuno-STAT and Neo-STAT to develop its pipeline drug candidates. CUE shares peaked in November, and since then the stock has fallen by 65%.

Even though the stock has fallen, the company has shown progress on its research program. Most of the company’s pipeline is still in pre-clinical stages of development, but the cancer treatment research track features two drug candidates that are ready to break out. One, CUE-101, is undergoing a Phase 1 clinical trial for the treatment of Head and neck squamous cell carcinomas ; the other, CUE-102, has recently met important development milestones.

In an announcement on January 5, Cue stated that CUE-102 has shown potential in preclinical studies in activity against Wilms’ Tumor 1 (WT1)-specific cytotoxic CD8+ T cells. This makes it a strong candidate for clinical trials in the treatment of WT1-expressing cancers. Cue is developing this candidate in partnership with LG Chem Life Sciences, and will now receive a $3 million milestone payment, under the terms of its agreement with LG Chem. An Investigational New Drug filing is scheduled for 1Q22.

On the company’s human clinical trial, of CUE-101, Cue announced at the end of January that the drug, in combination with Keytruda, had demonstrated progress with four patients in dose escalation. Two showed partial objective responses, while two showed manifest reductions in the target lesions.

Cue is covered by Craig-Hallum analyst Robin Garner, who is impressed by CUE-101’s early clinical results and potential. He writes: “We believe CUE is undervalued at the current price based on CUE-101’s monotherapy and doubling of the SOC efficacy in difficult to treat HNSCC… There is evidence of tumor reduction in the target lesions in all four patients treated first line in the dose escalation of the combination study… CUE-101 represents an emerging solution to enhancing the therapeutic benefit of and expanding patient access to checkpoint inhibitors.”

In line with these comments, Garner gives CUE stock a Buy rating and a $28 price target, indicating confidence in a one-year upside of 345%. (To watch Garner’s track record, click here)

All in all, this stock has a unanimous Strong Buy consensus from the Street, based on 6 positive share reviews. The stock is currently selling for $6.29 and its $27.67 average target suggests it has a decidedly robust 340% upside in the wings for 2022. (See CUE stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.