COVID-19 and the ensuing economic shutdowns have changed the rules of the investing game. Amid this unprecendented market shakeup, investors must navigate unfamiliar territory, with the old saws not necessarily as reliable as they were before.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Bank of America, one of these investing playbook staples is the often-repeated phrase, “sell in May and go away.” Even though the S&P 500’s charge forward had reached somewhat of a standstill, this week has seen the index post a two-day winning streak, and the firm thinks there’s still plenty of room for a summer rally.

“…seasonality favors a summer rally as contrarian bullish Farrell Sentiment and futures positioning across large speculators, leveraged funds and asset managers suggest that the pain trade remains higher and equities continue to climb a perpetual wall of worry,” Bank of America strategists wrote. “The second best 3-month period of the year for the S&P 500 going back to 1928 is June – August, which has been up 64% of the time with an average return of 3.1%. Within this bullish three-month period, most of the fireworks occur in July, which has been up 59% of the time with an average return of 1.5%.” The firm’s conclusion? “Sell in July/August.”

Taking all of this into consideration, we used TipRanks’ database to find compelling penny stocks, or names trading for less than $5 per share. These tickers are notoriously risky, so we kept our eyes peeled for only the crème de la crème. The platform revealed three that met our criteria, each boasts a “Strong Buy” consensus rating from the analyst community as well as significant upside potential.

ConforMIS (CFMS)

Applying a new approach to orthopedics, ConforMIS combines advanced 3D imaging technology with the latest manufacturing capabilities to produce implants based on each patient’s unique size and shape. While COVID-19 has taken a toll on the company, several analysts think that at $0.79 per share, now is the time to get in on the action.

Canaccord analyst Kyle Rose is among the CFMS bulls, noting: “Our view continues to be that while elective procedure volumes will likely be significantly depressed through at least Q2, we will see quarter-over-quarter improvements with gains dramatically rising in the back half of the year (normalization likely in the Q4 or early 2021). We continue to view the LT opportunity of custom orthopedic implants favorably, particularly in a backdrop that includes growing expectations for the shift of procedures into the ASC/ outpatient setting – a setting which favors CFMS’s ‘implant-in-a-box’ product offering.”

Speaking to the company’s standing before the pandemic’s onset, Rose points out that “underlying execution was trending positively.” Originally, Q1 revenue was expected to reflect a 3% year-over-year decline, significantly better than the actual 20.2% drop. This slowdown persisted throughout April, with its peers outperforming the company as CFMS derives more of its revenue from primary elective procedures. However, management did see an uptick in order volumes during the last week of April and first week of May.

“The company expects procedures to continue trending higher in the back half of the year, with base case assumptions being that Q4 is flat to down ~10% and the U.S. returns to normalized volumes quicker than Europe. Management also believes the shift of orthopedic surgery toward the outpatient/ASC setting accelerates (something we’ve heard from other ortho companies and physicians we’ve surveyed), representing a tailwind for the company given its exposure there,” Rose noted.

With CFMS also expecting its development agreement with SYK’s Triathlon system to be commercially available mid-2021, the deal is sealed for Rose. In line with his optimistic take, the analyst reiterated a Buy rating and $2 price target. Should the target be met, a twelve-month gain of 152% could be in store. (To watch Rose’s track record, click here)

Do other analysts agree with Rose? As it turns out, most do. 3 Buy ratings and a single Hold add up to a Strong Buy analyst consensus. At $2.33, the average price target indicates 194% upside potential. (See ConforMIS stock analysis on TipRanks)

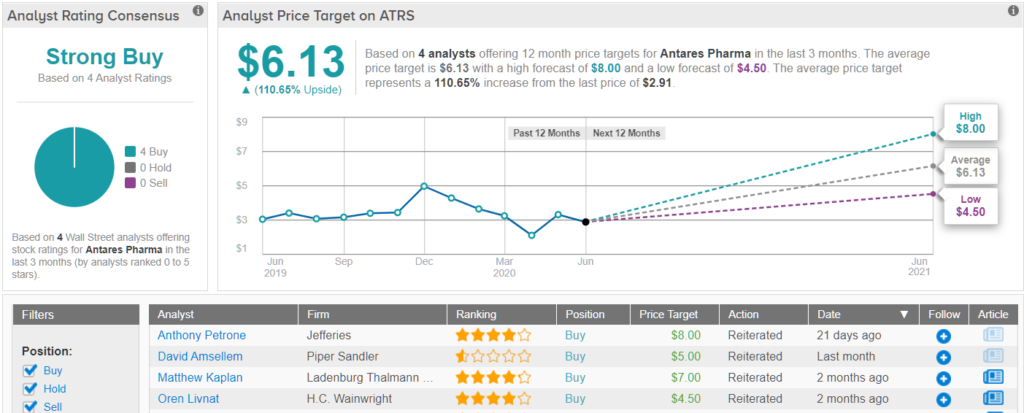

Antares Pharma (ATRS)

Combining drug development expertise with patented delivery technology, Antares Pharma wants to provide safe and effective therapies that improve dosing and reduce side effects. Following a strong showing in its first quarter, multiple members of the Street believe that its $2.91 share price reflects an attractive entry point.

Writing for Ladenburg, analyst Matthew Kaplan tells clients that the reported Q1 revenue of $33.1 million flew past his $30.6 million call. It should be noted that this revenue excludes propriety products including XYOSTED and OTREXUP, which generated revenue of $9 million and $3.6 million, respectively. Sales from its partnered products and from the auto-injector, multi-dose pen and needle-free products also weren’t included.

Looking specifically at XYOSTED’s January 2019 launch, Kaplan believes it “continues to be very encouraging, and we continue to believe it could become the primary driver of topline growth.”

The analyst added, “XYOSTED prescriptions continue to grow with over 100,000 prescriptions filled since launch by 5,300 unique prescribers, with greater than 19,000 patients prescribed XYOSTED. Growth was supported by an increased co-pay assistance program at the start of the year to bridge patients through reauthorizations. ATRS has achieved payer coverage of ~72% of commercial lives as of the end of Q1 2020.”

Although the uncertainty surrounding COVID-19’s impact caused ATRS to withdraw its 2020 revenue guidance, Kaplan maintained his estimates. “Despite the impact of near-term reimbursement authorizations and COVID-19, we see the rise of telemedicine and need to avoid intramuscular injections as positive developments for XYOTSTED uptake. With respect to the Makena SC auto-injector royalty and device revenues and the ADCOM outcome, we believe there is relatively little risk the FDA will remove the product from the market given otherwise unmet need in the space and FDA approved, non-compounded formulations,” he explained.

Adding to the good news, Kaplan sees multiple potential catalysts for ATRS in 2020 including continued XYOSTED and generic EpiPen prescription growth, potential FDA approval and launch of generic Forteo and additional visibility to pipeline products in development. It also doesn’t hurt that developmental activities are progressing, with COVID-19 having a relatively limited effect.

Everything that ATRS has going for it prompted Kaplan to stay with the bulls. Along with a Buy recommendation, he left his price target at $7. This target implies shares could climb 141% higher in the next year. (To watch Kaplan’s track record, click here)

Other analysts also take a bullish approach. Antares’ Strong Buy consensus rating breaks down into 4 Buys and zero Holds or Sells. Additionally, the $6.13 average price target puts the potential twelve-month gain at 111%. (See Antares stock analysis on TipRanks)

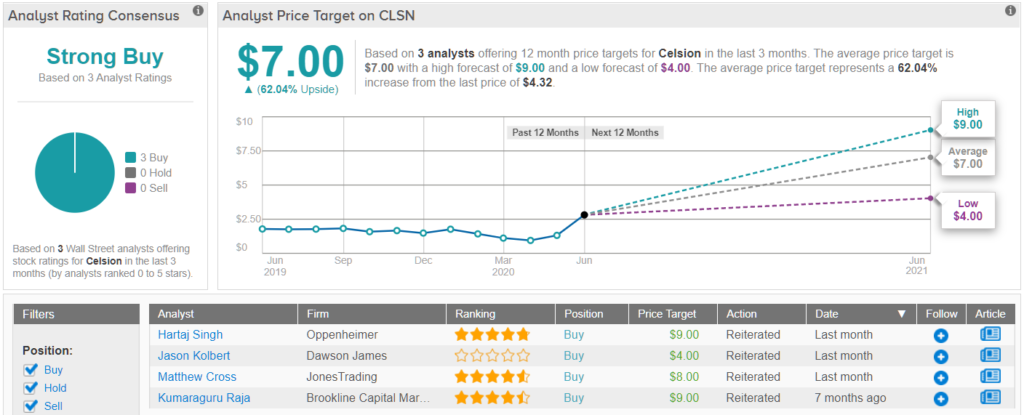

Celsion Corporation (CLSN)

Operating within the oncology space, Celsion uses its cutting-edge technologies and unique targeting strategies to develop therapies that could potentially improve survival rates or even cure cancers. Currently going for $4.44 apiece, some Wall Street pros warn investors not to miss out on an exciting opportunity.

Representing Oppenheimer, five-star analyst Hartaj Singh is optimistic prior to its readout of the second interim analysis of the Phase 3 OPTIMA trial evaluating ThermoDox in hepatocellular carcinoma (HCC) in Q3 2020. He doesn’t dispute the fact that the trial has a “complicated history”, with it having an unsuccessful first interim in Q4 2020.

Looking more closely at the trial, it was designed based on the Phase 3 failure of the HEAT trial in early 2013. “We note that recent reviews of historical data indicates a ~35% chance of Phase 3 success in oncology trials. However, we believe that CLSN’s HEAT trial served as a large Phase 2 proof of concept (PoC) trial, letting CLSN learn from mistakes and potentially position ThermoDox for success in this underserved population,” Singh explained.

As for why Singh is bullish this time around, and assigns a 50% chance of success compared to 33% for the first interim, he stated, “Given better statistical odds for the second interim, larger number of patient events and a longer patient follow-up, we believe OPTIMA tees up better for the second interim.”

Going forward, if the trial is successful, Singh argues investor focus will land squarely on the significant potential of ThermoDox in primary HCC. “Our physician checks have indicated that radio frequency ablation (RFA) is a low-risk procedure with a high risk of disease recurrence—two areas that a positive OPTIMA trial could address. We believe our modeling of ThermoDox’s potential in HCC could be conservative,” the analyst said.

Based on all of the above, it’s no wonder Singh reiterated his Outperform rating. With a $9 price target, shares could soar 109% in the next twelve months. (To watch Singh’s track record, click here)

Looking at the consensus breakdown, other analysts are on the same page. With 3 Buys and no Holds or Sells, the word on the Street is that CLSN is a Strong Buy. Given its $7 average price target, upside of 62% could be in store for investors. (See Celsion stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.