Volatility is the name of the game right now. Last week, markets had their worst close since March, despite a Friday rally. The S&P 500 lost 6% on Thursday, the index’s worst trading day in three months, and finished the week down 4.8%.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Worries about a new spike in coronavirus cases, along with racially charged urban rioting, have put investors in a selling mood. But remember the old cliché, that the Chinese word for crisis is composed of the symbols for ‘danger’ and ‘opportunity?’ The market’s gyrations these last few trading sessions have given income-minded investors an opportunity, if they are willing to shoulder some risk.

The question for investors, of course, is where will the market head next? Are the gains returning, or is this just the next hill of the roller coaster? Uncertainty is the only certainty, making defensive moves, toward dividend stocks, a smart play for investors.

Using the TipRanks database, we’ve pulled up three Strong Buy stocks that show a combination of dividend yields from 7% to 11% and considerable upside potential. While buying into stocks during a downturn is inherently risky, the upside on these three – and their high-yielding dividends – makes the risk worthwhile.

Brookfield Property Partners (BPY)

We’ll start in the real estate business, where Brookfield holds one of the world’s largest portfolios in office, retail, multifamily dwellings, industrial parks, hospitality, student housing – there is hardly a sector that Brookfield does not have a finger in. The company owns high-end office space in New York and Los Angeles, as well as London, Sydney, and Toronto. The student housing portfolio includes 5,700 beds in the UK university system. The retail segment includes Saks Fifth Avenue in downtown Manhattan.

So, Brookfield is not an ordinary real estate company. Its highly diversified portfolio provided some insulation from the COVID-19 pandemic, and the company reported $309 million in total Funds From Operations (FFO) in Q1 – in line with the year-ago results. General depreciation in the real estate market pushed the net income into negative territory, and BPY showed a loss of 49 cents per share for the quarter.

At the same time, Brookfield has maintained its dividend payment. Even facing a severe net loss, management remains committed, for the time being, to its shareholder return policy. The current dividend, at 33.25 cents per share quarterly, gives an annualized payment of $1.33 and an impressive yield of 11.9%. Compare this to the 2.2% average yield among financial sector peer companies, or the 2% average yield found on the S&P 500, and the attraction is clear.

CIBC analyst Dean Wilkinson acknowledges Brookfield’s tough business landscape during the pandemic – but points out that “April rent collections in the office and multifamily portfolios averaged above 90%. While retail collections were about 20%, it is important to note that lease obligations are contractual agreements; retailers cannot simply walk away from rental payments, and we expect that a material portion of the 80% of uncollected rent to date will, in time, be honoured through payment plans that are currently in negotiation.”

Wilkinson’s $18 price target on BPY stock implies a one-year upside potential of 62%, and fully supports his Buy rating on the stock. (To watch Wilkinson’s track record, click here)

Overall, Wall Street appears to agree with Wilkinson here. BPY shares have 5 recent analyst reviews, and of those 4 are Buy and only 1 a Hold – making the analyst consensus view a Strong Buy. Shares are priced at $11.13, and the average price target of $15.05 suggests the stock has room for 35% upside growth in the coming year. (See Brookfield stock analysis on TipRanks)

Brigham Minerals (MNRL)

The next stock on our list, Brigham Minerals, is mineral rights acquisition company focused on the oil and gas sector in the US. Brigham’s portfolio includes large acreage in the Bakken Shale of North Dakota, as well as the Delaware and Midland basins of Texas. These are the formations that put North American hydrocarbons on the map in the last decade, and their output has transformed the US into a major energy exporter.

MNRL saw earnings dip in Q1, mainly due to the coronavirus-inspired shutdowns, but EPS remained positive at 14 cents per share. Quarterly production rose by 8% sequentially, to 10,400 barrels of oil equivalent (BOE) per day. The company saw royalty revenue of $28.4 million, with nearly two-thirds of that total coming from Permian holdings.

Brigham has been adjusting its dividend over the past year, with the current quarterly payment set at 37 cents per share. This annualizes to $1.48, and gives the stock a dividend yield of 11.5%. Peer companies in the energy sector average a yield of just 1.9%, while Treasury bonds, the traditional ‘safe’ investment, are yielding below 1% up to 10-year terms. MNRL’s return simply blows away the alternatives.

SunTrust analyst Welles Fitzpatrick sees MNRL as a clear choice for investors. He writes, “MNRL turned in a 1Q beat on higher than expected lease bonuses, and in contrast to the rest of the industry paid out all its discretionary cashflow. The company’s timely offering in 4Q allows the unlevered balance sheet to shine. While MNRL will see declines in rigs and production this year the company should be able to maintain a high percent of CF distributed.”

Fitzpatrick’s Buy rating on the stock is supported by his $16 price target, suggesting a solid 24% upside potential. (To watch Fitzpatrick’s track record, click here.)

The analyst consensus here, at Strong Buy rating, is based on 6 Buy and 2 Hold reviews set in recent weeks. MNRL shares are trading for $12.85; the average price target, at $14.57, indicates a 20% upside for the stock. (See Brigham Minerals stock analysis on TipRanks)

Umpqua Holdings (UMPQ)

Last on our list for today is Umpqua, a holding company based in Portland, Oregon. Umpqua’s main subsidiary is Oregon’s Umpqua Bank. The bank provides asset management, mortgage banking, and general financial services in commercial and retail banking for corporate, institutional, and individual customers. The bank has locations across Oregon, as well as Washington State, Idaho, Nevada, and California.

The first quarter – the coronavirus quarter – was hard on Umpqua. The company reported a net loss of $28.3 million, or 13 cents per share. Management laid the loss – the company’s worst report after a two-year run of profitable quarters – squarely on the COVID-19 pandemic and crisis. The company has been able to switch many non-customer-facing employees to remote work, while keeping over 95% bank branches open. Looking ahead, UMPQ is expected to show a 17-cent EPS profit in Q2.

Through the coronavirus crisis, UMPQ has kept up its dividend. The company has a 7-year history of reliable dividend growth, and announced its most recent dividend payment back in March. They payment, made in April, was 21 cents per share. At 84 cents annualized, this gives UMPQ shares a dividend yield of 7.15%. This is more than 3.5x the average found among S&P listed companies, and also significantly higher than most peer companies’ payments.

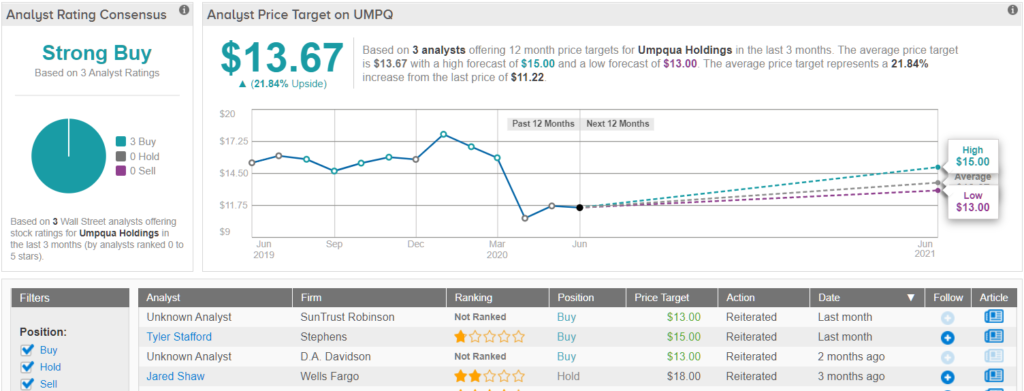

Reviewing the stock for SunTrust Robinson was analyst Michael Young. He backed his Buy rating on the stock with a $13 price target, showing confidence in a 11% upside potential. (To watch Young’s track record, click here)

Backing his stance, Young looked closely at the bank’s loan portfolio, writing, “Very granular portfolio, average loan size is under $1 million. The loan portfolio consists of very low leverage clients relative to competitors according to management… We do note that UMPQ has a larger multifamily loan concentration, but this is also likely one of the best performing CRE asset classes through a recession.”

Overall, Wall Street analysts are thoroughly impressed with UMPQ. It boasts 100% Street support, or 3 Buy ratings in the last three months, making the consensus a Strong Buy. Meanwhile, the $13.67 average price target implies that shares could surge nearly 22% in the next twelve months. (See Umpqua stock-price forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.