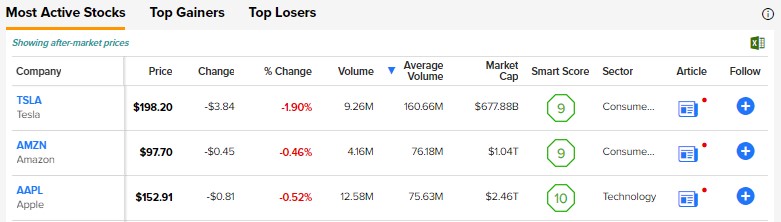

You may have finished celebrating Valentine’s Day, but gifting something unique, like a stock that will enhance the financial well-being of your partner, shouldn’t be limited to a day. If you plan to gift shares, we recommend stocks with the highest trading volume. Using TipRanks’ U.S. Stock Movers tool, we have selected Tesla (NASDAQ:TSLA), Amazon (NASDAQ:AMZN), and Apple (NASDAQ:AAPL).

Our data shows that Tesla has the highest average trading volume of 160.66M. It is followed by Amazon and Apple, with an average trading volume of 76.18M and 75.63M, respectively.

These three stocks have a good chance of making your loved ones wealthier by the next Valentine’s Day. Holding these stocks for longer can be even more rewarding. Let’s dig deeper.

What is Tesla’s Highest Price Target?

TSLA stock is riding high on solid demand and an expected improvement in production. It has gained about 64% year-to-date in 2023. Moreover, its highest price target of $300 from Piper Sandler analyst Alexander Potter shows a further upside of 48.49%.

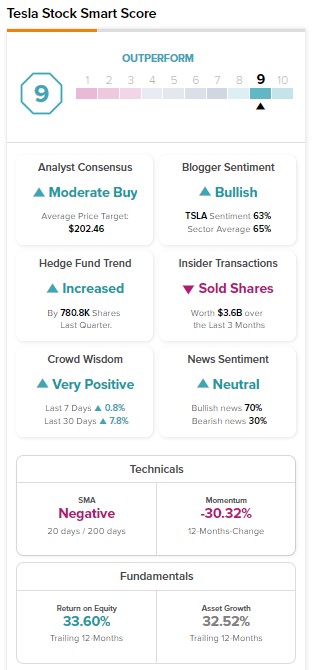

Among the 31 analysts providing recommendations on Tesla stock, 22 have rated it a Buy. Meanwhile, six analysts have a Hold, while three maintain Sell recommendations. In aggregate, TSLA stock sports a Moderate Buy consensus rating. As Tesla stock gained quite a lot in 2022, the analysts’ consensus 12-month price target of $202.46 is roughly in line with its closing price on February 16.

Nevertheless, TSLA stock has a positive signal from hedge fund managers, who bought 780.8K shares in the previous quarter. Meanwhile, TSLA has an Outperform Smart Score of nine.

What is the Future of Amazon Stock?

Amazon is a leader in the e-commerce and cloud spaces, implying the company has stellar growth prospects in the coming years. Its stock took a beating amid pressure on consumer spending due to macro headwinds, adverse currency movements, and increased cost pressure. However, these issues are transitory, and AMZN will likely deliver solid growth as the macro environment shows signs of improvement.

This is also reflected in analysts’ positive ratings on AMZN stock. Among the analysts covering AMZN stock, 36 rate it a Buy. Meanwhile, only three analysts recommend a Hold. Overall, Amazon sports a Strong Buy consensus rating on TipRanks. Amazon stock is up about 17% year-to-date. Further, analysts’ average 12-month price target of $137.05 implies 39.63% upside potential.

Besides for analysts, hedge funds are also optimistic about Amazon. They bought 17.3M shares of AMZN last quarter. With positive signals from analysts and hedge funds, Amazon carries an Outperform Smart Score of nine.

Is Apple Still a Good Long-Term investment?

The macro headwinds weighed on Apple’s sales in Q1. However, its long-term fundamentals remain intact, as AAPL is poised to benefit from strength in the Services segment, an increase in its installed base, and demand for its devices, including the iPhone.

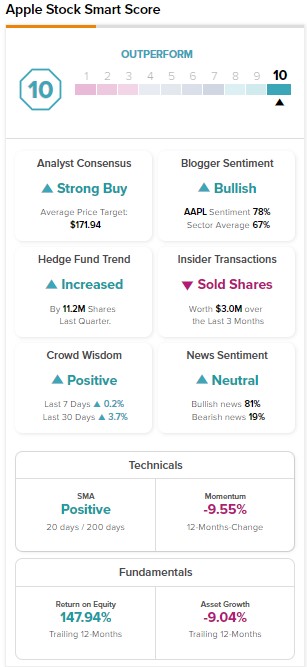

Analysts also maintain a favorable outlook on AAPL stock. Among the 29 analysts providing ratings on AAPL stock, 24 rated it a Buy, and five recommended Hold. Overall, it has a Strong Buy consensus rating.

AAPL stock also has a positive signal from hedge fund managers, who bought 11.2M shares last quarter. It’s worth highlighting that Warren Buffett has also increased his holding in AAPL stock. Meanwhile, BlackRock (NYSE:BLK) bought more AAPL stock in Q4. Apple stock has a maximum Smart Score of “Perfect 10.” Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Bottom Line

Valentine’s Day is over, but you can always gift something unique, like a stock, to your loved ones that will add to their financial freedom. TSLA, AMZN, and AAPL are U.S. stocks with solid long-term growth prospects. All these stocks carry an Outperform Smart Score on TipRanks, suggesting they are more likely to outperform the benchmark index.

Meanwhile, investors can leverage TipRanks’ Experts Center tool to identify top stocks that can outperform the broader market averages.