You may have finished celebrating Valentine’s Day, but gifting something unique, like a stock that will enhance the financial well-being of your partner, shouldn’t be limited to a day. If you plan to gift shares, we recommend stocks that are the most held by investors who maintain Smart Portfolios on TipRanks. Using TipRanks’ TipRanks Smart Portfolio tool, we have selected Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Tesla (NASDAQ:TSLA).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

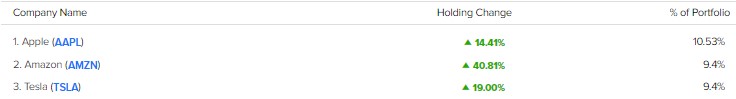

Our data shows that AAPL is the most-held stock, followed by AMZN and TSLA. Further, 10.53% of the total Smart Portfolios hold AAPL stock, up 14.41% on average since last week. Meanwhile, 9.4% of the portfolios have AMZN and TSLA stocks, reflecting average increases in the past week of 40.81% and 19%, respectively.

These three stocks have a good chance of making your loved ones wealthier by the next Valentine’s Day. Holding these stocks for longer can be even more rewarding. Let’s dig deeper.

What’s the Prediction for Apple Stock?

Macro and currency headwinds, COVID-led challenges in China, and supply-chain issues weighed on Apple’s financials, which reported a 5% decline in sales in Q1 of Fiscal 2023. Its earnings of $1.88 per share came in below the Street’s expectations.

Nevertheless, analysts see these short-term challenges to dissipate and highlight the strength in the Services segment and growing installed base of 2 billion active devices as a key growth driver.

Apple stock sports a Strong Buy consensus rating on TipRanks, reflecting 25 Buys and five Holds. Further, Wall Street’s average price target of $172.71 implies 11.19% upside potential.

Along with analysts, hedge funds are also bullish about AAPL stock. Our data shows that hedge funds bought 11.1M shares of AAPL last quarter. Further, Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) bought more of AAPL stock in the last quarter, while BlackRock (NYSE:BLK) also increased its holdings in AAPL.

Overall, Apple stock has a Neutral Smart Score of seven on TipRanks.

Is Amazon a Buy or Sell?

Currency headwinds, economic uncertainty, and higher inflation and interest rates continue to hurt Amazon’s financial performance and price. While challenges persist in the short term, Amazon is poised to gain from its leadership positions in e-commerce and cloud computing. Further, the strength of its advertising unit is positive.

Among 39 analysts, 36 have rated it a Buy. Meanwhile, three analysts recommend Hold. Further, analysts’ average price target of $137.05 on AMZN stock reflects 35.48% upside potential.

Besides for analysts, hedge funds are also bullish about AMZN stock. Hedge funds bought 17.3M shares of AMZN last quarter. Meanwhile, AMZN has a Neutral Smart Score of seven.

Is Tesla Stock Likely to Go Up?

The economic uncertainty and pressure on consumer spending will likely hurt the automotive industry and Tesla stock. However, Tesla CEO Elon Musk’s positive commentary about demand and production indicates that Tesla could outperform the broader market.

Tesla stock has already gained about 74% year-to-date in 2023. Thus, the consensus 12-month price target of $202.46 suggests a downside of 5.5% over the next 12 months. It has received 22 Buy, six Hold, and three Sell recommendations for a Moderate Buy consensus rating.

While analysts are cautiously optimistic, hedge funds sold 6.6M shares of TSLA in the last three months. TSLA stock has a Neutral Smart Score of nine.

Bottom Line

Valentine’s Day is over, but you can always gift something unique, like a stock, to your loved ones that will add to their financial freedom. AAPL, AMZN, and TSLA are solid long-term picks, making them attractive for gifting. However, due to the short-term headwinds, they carry a Neutral Smart Score on TipRanks.

Meanwhile, investors can leverage TipRanks’ Experts Center tool to identify top stocks that can outperform the broader market averages.