Naturally, investors intrigued with the opportunities inherent in chat AI may want to target MSFT. With the company commanding a Strong Buy rating on Wall Street, it easily ranks among the stocks to buy. However, by specifically targeting smaller enterprises, prospective investors may enjoy far greater rewards (albeit at higher risk profiles). For the brave contrarian, read on to learn about three smaller stocks to buy on the rise of chat AI.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Long the exclusive domain of science fiction, artificial intelligence (AI) platforms have become integrated across a range of applications. In particular, the role of conversational AI – or digital platforms that facilitate interactions with human end users through normal language – expanded considerably. And while it’s instinctive to target the largest enterprises for profiting off this sector, certain smaller stocks to buy may offer a bigger bang for the buck.

As TipRanks reporter Marty Shtrubel mentioned, AI commands incredible, wide-ranging relevancies. “From image recognition to healthcare, e-commerce to advertising to credit scoring and many other industries – all are making use of AI’s human-like capabilities. And with computing power continuously improving, it is set to get more prevalent over time.”

Specifically, Shtrubel highlights ChatGPT – an AI chatbot developed by OpenAI and supported by software giant Microsoft (NASDAQ:MSFT). “The tool has quickly caught the public’s imagination with its ability to perform different tasks such as write articles, songs, and even write code and its success has only highlighted how AI will keep on impacting our lives.”

SoundHound (NASDAQ:SOUN)

First on the list stands SoundHound, one of the direct players in the conversational AI arena. According to Shtrubel, the voice assisting specialist enables consumers to interact with products. Most notably, the company commands a massive total addressable market of $160 billion. By 2024, AI industry experts forecast that manufacturers will produce 8 billion voice assistants. Moreover, they will integrate with 75 billion connected devices operating globally by 2025.

Adding to SoundHound’s street cred, the company leverages an enviable client roster, including Mercedes-Benz Group (OTCMKTS:MBGAF), Hyundai, Kia, Snap (NYSE:SNAP), and Vizio (NYSE:VZIO). Interestingly, SoundHound represents a recent public offering, entering the capital market via a merger with a special purpose acquisition company back in April last year.

To be 100% clear, SOUN represents an aspirational stock. Financially, the company could use plenty of work, particularly with its balance sheet. Not surprisingly, for a limited-revenue firm, SoundHound’s profit margins rank deep in negative territory. As well, by most key measures – whether against sales, book value, or free cash flow – SOUN pings as overvalued relative to its peers.

Still, Cantor’s Brett Knoblauch believes SoundHound’s Dynamic Interaction platform – which utilizes conversational AI to service customers – could be a game-changer. Therefore, SOUN stands among the speculative stocks to buy.

Is SOUN Stock a Buy, According to Analysts?

Turning to Wall Street, SOUN stock has a Moderate consensus rating based on two Buys, zero Holds, and zero Sell ratings. The average SOUN stock price target is $3.05, implying 16.7% downside potential.

Lemonade (NYSE:LMND)

Combining two enterprises into one, insurance technology firm Lemonade offers an enticing narrative. Part financial technology (fintech) specialist and part insurance provider, Lemonade speaks the language of millennials and Generation Z, and increasingly, that language doesn’t really involve human interactions.

Instead, many of Lemonade’s frontline interactions utilize chatbots. Levering advanced conversational AI protocols, the company can effectively have computers address basic member inquiries and concerns. Fundamentally, the deployment of AI carries the advantage of 24/7/365 service. Frankly, in some cases, AI bots operate in a superior fashion to their human counterparts. They don’t require downtime, nor do they complain about the numerous frustrations real workers encounter.

As well, the utilization of AI frees up Lemonade’s core employees to conduct essential services, such as underwriting, customer care, and claims processing. Therefore, the business found a happy medium between digitalization and traditional “analog” operations.

Similar to SoundHound, though, Lemonade requires some shoring up of its financials. Eventually, investors will want to see margins move into positive territory, and for now, LMND rates as overvalued against trailing-year sales compared to its peers.

However, insurance represents a fundamentally relevant industry. Therefore, Lemonade’s inelastic demand profile makes it one of the AI-related stocks to consider buying.

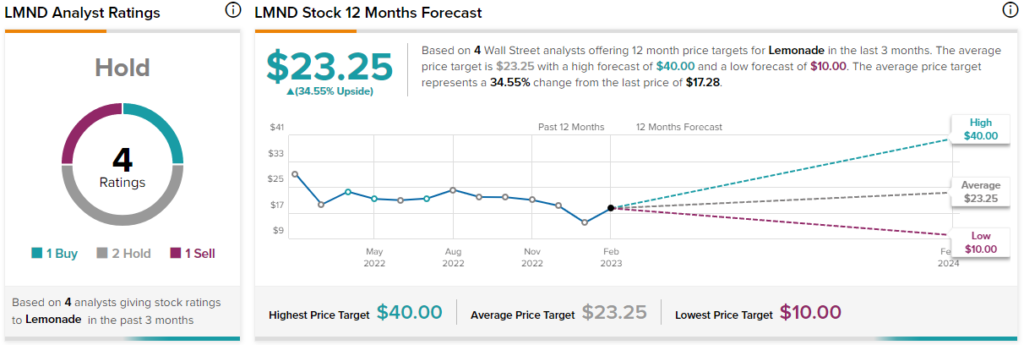

Is LMND Stock a Buy, According to Analysts?

Turning to Wall Street, LMND stock has a Hold consensus rating based on one Buy, two Holds, and one Sell rating. The average LMND stock price target is $23.25, implying 34.55% upside potential.

Denny’s (NASDAQ:DENN)

Typically, whenever the topic of Denny’s comes up, it’s usually because of hunger and the fact that no other eatery is open. However, as an example of AI-related stocks to buy, DENN would probably rank near the bottom of the relevancy scale. Still, the reality is that such a quick dismissal of “America’s Diner” would be a mistake.

In 2017, Denny’s rolled out a 24/7 online and mobile ordering platform for pickup and delivery called Denny’s on Demand. According to Marketing Dive, “The platform was created with the help of digital ordering provider Olo and includes a total revamp of Denny’s mobile app that makes it easier for users to find a restaurant location, place orders, and pay for takeout or delivery where available.”

Further, the diner announced the launch of a branded chatbot integrated into social media, thus enhancing the customer experience. Again, the underlying implication is that robots can handle much of the mundane frontline requests, sparing core employees for more critical work – such as food preparation.

Notably, in 2022, Denny’s replaced its on-premise contact center solution with 3CLogic’s service management protocol to manage employee incidents and human resource-related requests.

Financially, Denny’s enjoys a leg up on the competition because of its value proposition. Currently, the market prices DENN at a forward multiple of 17.9. This ranks better than 60% of sector peers, making it an attractive stock to consider buying.

Is DENN Stock a Buy, According to Analysts?

Turning to Wall Street, DENN stock has a Moderate Buy consensus rating based on three Buys and two Hold ratings assigned in the past three months. The average DENN stock price target is $13.25, implying 13.8% upside potential.