Economists are starting to toss around the dreaded ‘S’ word again – stagflation. The combination of stubbornly high, persistent inflation plus slowing GDP growth was the hallmark of the ‘malaise’ that defined the 1970s. We haven’t seen that sort of economic stutter in two generations – but market watchers today are worried that it’s returned.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Inflation reached an annualized rate of 8.5% in March, the highest level since 1981, while GDP growth, which registered a hot 7% in 4Q21, is expected to brake sharply and slow to just 1.7% for 1Q22. While not quite at recession level, yet, a slowdown of that magnitude is going to have an impact – especially when it hits in conjunction with generationally-high inflation.

While the current economic landscape has spurred fear among investors, Bank of America’s head of equity and quant strategy, Savita Subramanian, recommends investors to stay bullish on financial stocks. In Subramanian’s view, these stocks offer a suite of advantages that suit them to current condition.

“The conventional view that financials benefit from a steepening yield curve and are hurt by a flattening one appears to no longer apply. Financials outperformed 40% of the time during market sell-offs around yield curve inversions and 50% of the time during the full period of inversion,” Subramanian wrote.

With this in mind, we’ve used the TipRanks database to pull the details on three small-cap bank stocks that fit Subramanian’s bill. Let’s take a closer looks, and bring in commentary from the Wall Street analysts, as well.

Preferred Bank (PFBC)

First up, Preferred Bank, is an independent commercial bank in California. Boasting a market cap of $1.01 billion, the bank has 10 branch offices around the state, plus one more in Flushing, New York. The bank offers a full range of services to small- and mid-sized enterprises, real estate developers, professionals, and high-net-worth individuals.

Early this year, Preferred Bank reported its financial results for both the fourth quarter and full year 2021. At the bottom line, the bank had $1.80 in EPS, based on net income of $26.4 million. The EPS gained 28% year-over-year, rising from $1.40. The company’s full year growth was also impressive. 2021’s net income of $95.2 million translated to an EPS of $6.41, a 37% rise y/y.

Solid financial results backed up the bank’s dividend, which was declared in March, for an April 21 payment, of 43 cents per common share. Annualizing to $1.72, the dividend yields 2.4%. While the yield is relatively modest, the bank’s dividend is impressive for its reliability – it has been raised twice in the last two years, and Preferred Bank has an 8-year history of maintaining the payments.

Janney analyst Timothy Coffey believes that this small-cap bank is well-sited to bring strong ROI when as the Fed moves to end quantitative easing.

“We are adjusting our EPS estimates on expectations for better than previously expected earnings power from higher interest rates… PFBC’s balance sheet is highly asset sensitive with 85% of the loan portfolio adjustable rate-tied to the Prime rate and 84% those variable rate loans currently priced at floor rates. We believe the first 25bps increase in short-term rates could result in higher yields on $900 Million in loans and ~$800 Mil in liquid assets held at other institutions. We estimate that could result in more than 10bps improvement in margin,” Coffey opined.

Coffey’s upbeat outlook leads him to put a Buy rating on PFBC stock, and his price target, of $30, implies an upside of ~35% for the year ahead. (To watch Coffey’s track record, click here)

Wall Street appears to agree on the bullish future here, as all five recent analyst reviews of this stock are positive, supporting a Strong Buy consensus rating. The shares are priced at $70.6 and have an average price target of $91.80, giving the stock its 30% upside potential (See PFBC stock forecast on TipRanks)

Old Second Bancorp (OSBC)

Next up is Old Second Bancorp, an Illinois-based bank operating in the Chicagoland area. Old Second has a market cap of $633 million, and operates 29 branch locations in America’s third-most populous city, along with more than 70 ATM units. The bank offers the usual full range of services to both commercial and consumer customers, and benefits from its location in the Midwest’s largest financial, commercial, and transportation center.

In December of last year, Old Second completed a merger with West Suburban Bancorp, effectively folding the smaller firm’s branches and assets into Old Second’s network. The transaction, conducted in both cash and stock, was valued at $297 million.

In its last reported quarter, for 4Q21, Old Second showed net interest and dividend income of $28.6 million. This was up $6 million, or 26.7% sequentially, and $4.8 million, or 20%, year-over-year. The company approved a dividend of 5 cents per common share in January, and paid it out in February. The dividend is modest, yielding only 1.4%, but Old Second has kept it up reliably for the past 13 years.

Manuel Navas, in coverage for investment firm DA Davidson, writes of Old Second: “OSBC screens as the most asset sensitive bank in our Mids coverage with its 10K disclosure pointing to +19.5% benefit to NII from a +100bp increase in the Fed Funds rate… Our forecasted NIM expands rapidly when we layer in our new rate expectations for 8 Fed rate hikes across 2022-2023 (vs. 4prior) as well as 10yr yields reaching 2.50% at YE22, 2.75% at YE23, and 3.00% at YE24.”

“We believe YTD outperformance understates the extreme asset sensitivity in OSBC, but also discounts OSBC’s substantial progress in growing its lending team to drive above-peer loan growth. These factors combine to support an improved, above-peer return profile in our upwardly revised estimates that justify a higher valuation and should drive Consensus higher,” the analyst added.

To this end, Navas gives OSBC shares a Buy rating, and his price target of $22 implies an upside of ~54% over the coming 12 months.

This stock, like many small caps, hasn’t picked up many analyst reviews – but the analysts who have reviewed it, have liked it. OSBC has a unanimous Strong Buy consensus rating, based on 3 positive reviews. The stock’s $18.67 average price target indicates room for 31% upside from the trading price of $14.24. (See OSBC stock forecast on TipRanks)

Mercantile Bank Corporation (MBWM)

We’ll wrap up with a company based in Grand Rapids, Michigan. Mercantile Bank, with assets worth $5.2 billion, 44 banking offices, and a market cap of $534.2 million, serves business, consumer, and governmental customers in its region. Services include deposit and checking accounts, health savings accounts, personal and business loans, and mortgages.

In January, Mercantile reported results for 4Q21 and the full year 2021, describing the reports as ‘strong.’ The company’s quarterly EPS, of 74 cents per diluted share, was down 14% year-over-year – but the full year earnings, of $3.69 per share, grew 36% from the 2020 result. Total net income for the year was reported at $59 million, compared to $44.1 million in the prior year.

The full-year gains were driven by solid growth in the commercial loan and residential mortgage loan segments. The bank reported having $975 million in cash and liquid assets on hand as of December 31, 2021. This was up 55% y/y.

The cash assets and full-year earnings growth backed up the bank’s dividend, which was raised by 3% to 31 cents per common share. This gives an annualized payment of $1.24 to stakeholders, and a yield of 3.6%.

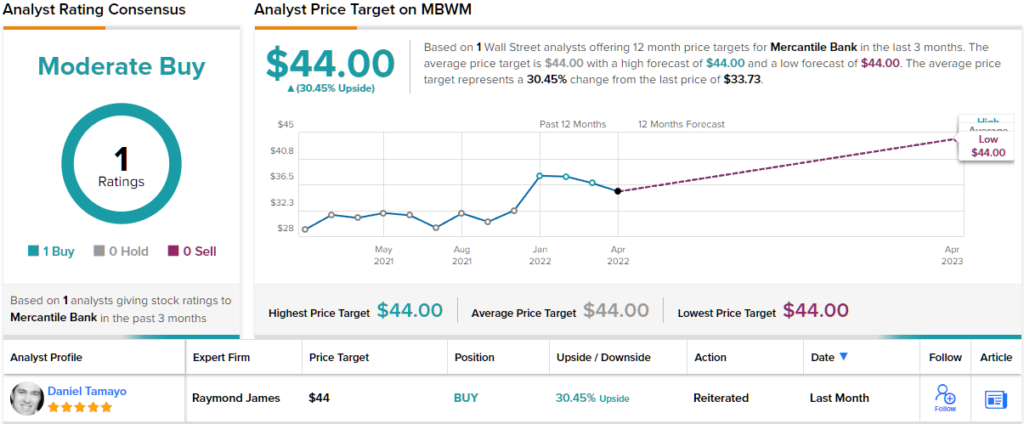

Covering the stock for Raymond James, 5-star analyst Daniel Tamayo believes MBWM presents a compelling risk reward. He writes, “[Given] our belief that the fundamental outlook for the bank is unchanged while the market continues to expect meaningful rate hikes in the next two years, we believe shares present a compelling opportunity to purchase and have significant upside opportunity at this price. We continue to like the company’s long-term prospects given its attractive footprint and desirable deposit base and believe strong organic loan growth and asset sensitivity will drive near-term outperformance.”

Expecting growth here, Tamayo rates these shares as a Strong Buy, and sets a $44 price target, implying a 30% upside on the stock. (To watch Tamayo’s track record, click here)

Tamayo’s is the only analyst review on record for this small-cap bank, which is currently trading for $33.71 per share. (See MBWM stock forecast on TipRanks)

To find good ideas for financial stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.