Stock markets are in bull-market mode right now, with recession fears seemingly falling by the quarter. Goldman Sachs (NYSE:GS) now sees a 20% chance (down from 25%) of the economy falling into a recession over the next 12 months. Undoubtedly, a recession now seems less likely than just a year ago, even though we’re supposedly closer to it. However, just because economists are reducing the odds of recession doesn’t mean you should ditch recession-resilient consumer stocks just yet.

Therefore, let’s check in with TipRanks’ Comparison Tool to check in with three consumer stocks that appear well-positioned to deliver, regardless of how the economy fares in the year ahead.

McDonald’s (NYSE:MCD)

McDonald’s is a fast-food company that tends to be a solid performer in all seasons. Thanks to its impressive value menu, the company has what it takes to keep sales going strong when consumer budgets take a hit to the chin.

The stock has crept steadily higher over the past year, thanks in part to a handful of earnings beats (Q1 2023 saw EPS of $2.63 vs. the $2.33 consensus) and a good amount of valuation multiple expansion. Undoubtedly, if you forecast imminent economic softness, there are few better blue chips to hide in than McDonald’s, which may view a recession as less of a headwind and more of a tailwind. Even as recession odds fall, I’m staying bullish on MCD, as it doesn’t need help from the economy to grow.

At writing, shares of MCD trade at a historical premium of 31.5 times trailing price-to-earnings (or 27.3 times forward). That’s well above the five-year historical average 28.6 times but still below the 33.3 times restaurant industry average. If we find ourselves in a recession a year from now, today’s premium may not be enough.

Looking ahead, I expect McDonald’s will continue to stay relevant with young consumers as it continues to find ways of going viral on social media. The Grimace milkshake is just the latest offering to grab the attention of TikTokers. McDonald’s chief marketing and customer experience officer Tariq Hassan has done a magnificent job of making the burger chain cool again with the likes of its nostalgic “cultural icons.”

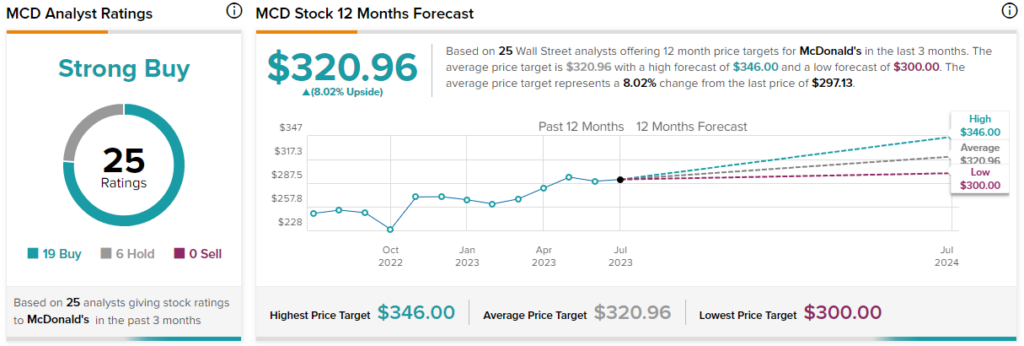

What is the Price Target for MCD Stock?

McDonald’s is a Strong Buy, with 19 Buys and six Holds from analysts. The average MCD stock price target of $320.96 implies 8% upside.

Hostess Brands (NASDAQ:TWNK)

Hostess Brands, the maker of Twinkies and other baked confectionaries, is a sweet option if you’re still not convinced we’re out of the woods yet regarding a potential recession. Over the past three quarters, the company managed to beat on earnings by the slightest of margins (beating on EPS by just a penny in the last two quarters). Still, investors seemed to love the high degree of predictability amid a highly-uncertain macro environment.

Should the economy tumble into recession, Hostess is a name that stands to hold its ground. I’m staying bullish on the stock because, at the end of the day, Twinkies aren’t all that expensive, given the joy they provide.

Looking ahead, Hostess expects revenue growth in the 4% to 6% range, with adjusted EPS in the $1.08 to $1.13 range. Given how spot-on analysts have been with Hostess, I expect coming quarters will also be in-line, whether or not macro headwinds begin to mount.

At writing, shares of TWNK trade at 20.2 times trailing price-to-earnings, just below the packaged foods industry average of 22.8 times. Unlike most other consumer-packaged goods plays, there is no dividend, but fret not, as shares have delivered over the years, with 73.8% in gains over the past five years.

What is the Price Target for TWNK Stock?

Hostess is a Moderate Buy on Wall Street, with four Buys and two Holds assigned in the past three months. The average TWNK stock price target sits at $29.17, suggesting 17.5% upside potential from here.

Mondelez (NASDAQ:MDLZ)

Mondelez is another confectionary play that’s enjoyed bigger quarterly earnings beats over the past year. The company’s specialty is biscuits (think Oreos), chocolates (Cadbury), and other sweets (gum and baked goods).

Though packaged goods aren’t known for growth, Mondelez has been more than willing to invest to keep the top-line sales growth target in the 3%-5% range. With strong brands, a proven management team, and a potential recession that may still be brewing, I’m staying bullish on MDLZ stock.

Amid inflation, Mondelez has demonstrated impressive pricing power, and if a recession does hit, I expect more resilience from the all-weather play. At writing, the stock trades at 25.5 times trailing price-to-earnings, quite a bit higher than Hostess. With a well-covered 2.1%-yielding dividend and a broad range of recession-resilient brands, though, I do think the premium to the peer group is justified.

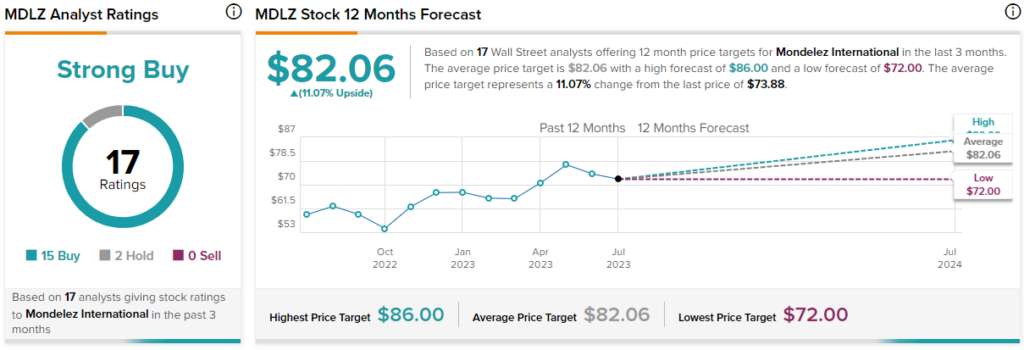

What is the Price Target for MDLZ Stock?

Mondelez is a Strong Buy, with 15 Buys and two Holds. The average MDLZ stock price target of $82.06 implies 11.1% upside potential.

Conclusion

Indeed, it’s the risks that lie outside of our radar that may be what drives recession worries higher again. In that regard, it makes sense to still be prepared for an economic hailstorm, even if Goldman economists see a one-in-five chance of recession instead of a one-in-four. Of the three consumer stocks in this piece, analysts expect the most from Hostess (17.5% upside).