In the current AI-fueled bull market, Amazon (NASDAQ:AMZN) has been one of the biggest winners, gaining strong momentum and reinforcing my bullish stance on the company’s stocks. Anyone looking at Amazon stock in early 2023, when it traded at $84 per share after a more than 50% drawdown, probably couldn’t have imagined a rebound of over 130% to its recent all-time highs.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Here are 3 reasons to be bullish on Amazon:

Amazon’s Shift To Higher Margins

Although at the peak of its market value, the company’s shift to higher margins under CEO Andy Jassy, combined with scaling AI across Amazon Web Services (AWS) and trading at potentially justifiable valuations, highlight the bullish thesis.

Amazon recently hit all-time highs, reaching a $2 trillion market cap. This surge can largely be attributed to its AI potential. Besides the huge potential in AI with AWS, the company’s margin climb has been impressive.

Under CEO Andy Jassy, Amazon has shifted focus to higher-margin services, like advertising, and away from first-party retail sales. Since taking over, Jassy has been dedicated to cutting costs, eliminating tens of thousands of jobs, and reshaping Amazon’s fulfillment network. Over the last year, these segments have become significantly more profitable.

Comparing Q1 2023 to Q1 2024, Amazon’s operating margins have greatly improved. In North America, the margin jumped from 1.20% to 5.8%. The International segment went from -4% to 2.8%. AWS had an impressive increase, going from 24% to 37%, although this was partly due to changing the estimated useful life of their servers.

AWS’s Open Source Models Opportunity

At present, Microsoft’s (NASDAQ:MSFT) Azure and Alphabet’s (NASADAQ:GOOGL) Google Cloud are often seen as leaders in the AI race, thanks to their proprietary models (BERT and LaMDA) and strategic partnerships (like OpenAI’s GPT).

Amazon’s AWS has lagged a bit behind in this race. Even though it isn’t exactly an open-source, AWS has a long history of supporting open-source projects and tools. AWS stands out for its flexibility, strong support for open-source models, scalable infrastructure, and wide range of AI services.

Moreover, a significant potential shift is happening, with enterprises leaning more towards open-source models, which could benefit AWS more greatly than its competitors. Even though closed-source models often perform better in some tests and are more affordable, open-source models are usually preferred because they can be easily adapted to meet specific enterprise demands.

This shift could help AWS defend its leading market share in cloud computing against Azure and Google Cloud. If companies increase their use of open-source models for their AI applications, AWS customers might feel less need to migrate to other peers.

AWS’s leadership position also gives it the largest enterprise data repository, which is very convenient given the growing demand for open-source models. As CEO Andy Jassy points out, customers prefer to bring their models to their data, not the other way around, unlike the approach taken by Azure and Google Cloud.

Amazon’s Valuation Amid Growth Trends

When we look at Amazon’s valuation, the stock trades at a forward P/E ratio of almost 43x, higher than its cloud rivals Microsoft and Alphabet, trading at 38x and 24x, respectively.

Despite appearing more expensive on a forward P/E basis, this valuation overlooks the future earnings growth rates of these companies. Amazon’s forward EPS long-term growth rate of 23.4% over the next three to five years significantly outpaces Microsoft’s 13.7% and Alphabet’s 17.6%.

Using this more accurate comparison method that incorporates growth rates, Amazon’s forward PEG ratio of 1.87 looks notably more attractive than Microsoft’s 2.78, though less so than Alphabet’s 1.39.

Is Amazon Stock a Buy, According to Wall Street?

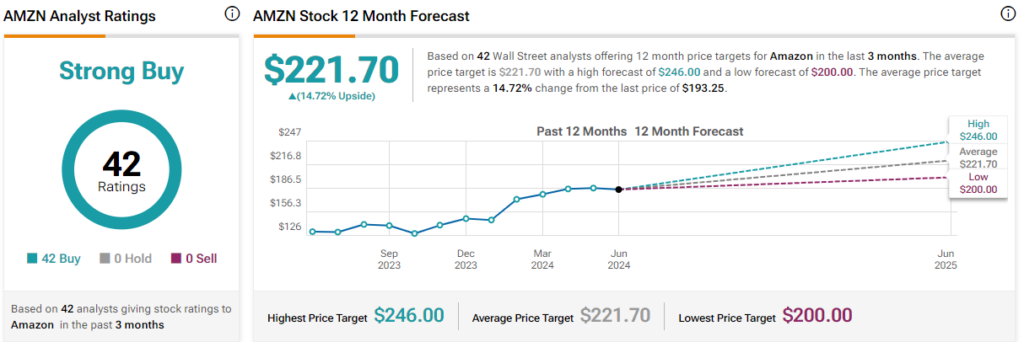

As a fourth bonus reason to be bullish on Amazon, there isn’t a single analyst on Wall Street with a recommendation other than “Buy.” The average price target among the 42 bullish analysts on AMZN stock is $221.70 per share, suggesting an upside potential of 14.72%.

One of the highlights is Moffett Nathanson’s Michael Morton, the most bullish analyst, with a price target of $246 on AMZN. He notes that last year marked a significant transition in Amazon’s investments, with retail CapEx being a smaller portion than AWS for the first time in the company’s history. Morton views this change positively, indicating the company acknowledges demand trends, which should result in top- and-bottom-line growth.

Conclusion

Even with Amazon’s stock reaching all-time highs mainly thanks to its AI potential, its growth outlook remains robust, making it a likely long-term winner.

Amazon is shifting towards higher-margin services and dialing back on direct retail sales, which sets the stage for future profitability. Meanwhile, AWS is just beginning to harness the power of AI, marking the early stages of what could be significant linear growth.

Considering its current valuation in relation to its growth potential, Amazon looks fairly valued. This suggests there’s still potential for further gains, like finding a good deal in a bustling market.