You are an astute investor, you do your homework, and you identify a company whose product will be in demand. You are so confident about it that you take the money you are saving for a new set of golf clubs, and use it to buy the company’s stock. You are now eagerly awaiting the results.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company reports earnings and you are right – demand for its product is skyrocketing. However, unbelievably, the stock is down and you actually lost money. There is nothing more frustrating than being right and losing money. What happened?

In today’s market, there are many factors that can influence the price of a stock besides fundamental analysis. In times like these, an investor needs a more comprehensive way to analyze investment opportunities.

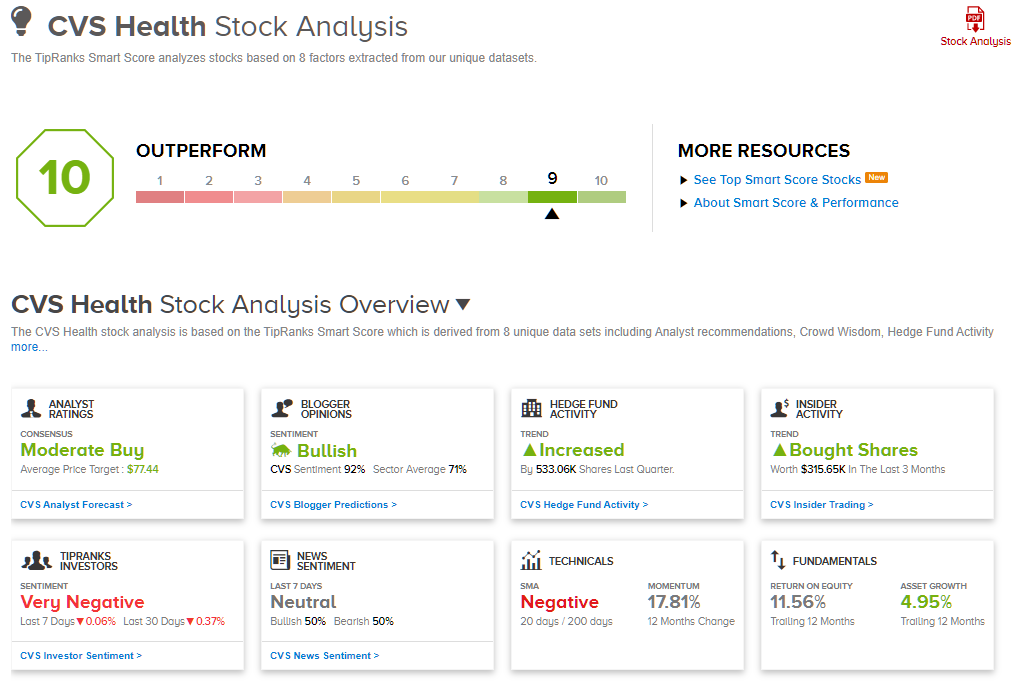

TipRanks has a tool that does exactly that. Building on eight important factors such as analyst ratings, hedge fund activity, news sentiment, as well as fundamentals and technicals, the Smart Score collates all of the data and assigns each stock a score ranging from 1 to 10, indicating the direction a stock could be heading in.

Bearing this in mind, we used TipRanks’ database to lock in on three stocks with a “perfect 10” Smart Score. Not to mention these Buy-rated tickers offer double-digit upside potential.

Rent-A-Center Inc. (RCII)

First on our list is Rent-A-Center, which operates approximately 2,100 rent-to-own stores, leasing products such as electronics, appliances, computers, and furniture.

Total revenues increased marginally by 0.8% to $701.9 million in the first quarter of 2020, compared to the same period in 2019. The gain was partially driven by a 1.7% rise in same store sales.

Weighing in on the company’s earnings, Stephens analyst Vincent Caintic commented, “This first quarter 2020 earnings season and in subsequent calls, most of our coverage still appeared to be adjusting to the post-COVID and calling for near-term pain…Rent-A-Center, in contrast, is the only company that is guiding to flat year over year EPS in second quarter 2020 and appears to have maneuvered to neutralize the impact of COVID-19.”

Caintic believes Rent-A-Center’s shares will rally going forward even though the stock is down 8% year-to-date. Caintic explained, “We have had the view that companies catering to the subprime consumer should fare better during our recession than our broader coverage. Moreover our takeaways from management calls today is that upside opportunities exist for second half 2020… We have adjusted as a result.”

If that is not enough, the analyst is enthusiastic about management’s ability. He noted, “…we have been impressed with the management team since CEO Mitch Fadel took the helm in January 2018. What we once thought was a company heading for bankruptcy…has emerged as one of the strongest and best operated in our coverage. …we consider the team to be one of the best in our consumer coverage.”

To this end, Caintic rates Rent-A-Center shares an Overweight (i.e. Buy), and places a $33 price target on the stock, which suggests 27% upside potential. (To watch Caintic’s track record, click here)

Wall Street mostly agrees with Caintic’s view. The analyst consensus on RCII is a Strong Buy, based on 4 Buys and 1 Hold. The average price target is $30.20, which indicates 16% upside potential. (See Rent-A-Center stock analysis on TipRanks)

Turtle Beach (HEAR)

Next up is Turtle Beach, which sells headsets for various gaming platforms as well as keyboards, mice, and other personal computer accessories under the ROCCAT brand.

The company experienced strong demand for its headsets in the first quarter of 2020, as people stayed home due to COVID-19. Besides gaming, Turtle Beach’s headsets are well-suited for working remotely and distance learning, which further boosted demand.

The positive trend continued. On June 16, management increased the sales outlook for the second quarter of 2020 by a hefty 70%, citing continued strong demand and significant increases in product supply.

Writing for Maxim, analyst Jack Vander Aarde weighed in on the announcement, “We raise our estimates across the board, as we expect demand for gaming headsets and accessories to remain at elevated levels. Based on NPD Group’s published industry data, broad-based gaming industry sales trends continue to grow at a robust pace.”

Adding to the good news, Turtle Beach was able to dominate the market. Expounding on this, Vander Aarde stated, “…as of April, all 7 top-selling headsets and 8 of the top-10 best-selling headsets were attributed to Turtle Beach.”

Looking to the future, the analyst believes Turtle Beach will continue to outperform. This is because of the upcoming launches of new consoles in the holiday season.

Based on all of the above, Vander Aarde reiterated his Buy rating on the stock and raised his price target to $20, which translates to potential upside of 21%. (To watch Vander Aarde’s track record, click here)

All in all, other analysts are on the same page. 4 Buys and 1 Hold add up to a Strong Buy consensus rating. Given the $19.20 average price target, shares could rise 23% over the next year. (See Turtle Beach stock analysis on TipRanks)

CVS Health Corporation (CVS)

Our third ‘Perfect 10’ stock is drugstore chain giant CVS Health, with $260 billion in revenue.

Despite the impact of COVID-19, first-quarter results were positive. Revenues increased 8.3% from the prior year, while EPS was $1.91, almost 18% higher than the year before.

The company is in the midst of transforming itself into an integrated healthcare company from a retail pharmacy. In regard to this, Deutsche Bank analyst George Hill noted, “CVS is in the early innings on delivering against its vision of a vertically integrated healthcare services company with outsized consumer engagement.”

Hill is very bullish on CVS, calling it “one of his favorite investment ideas.” The Deutsche Bank analyst added, “Our price target reflects 14x our 2021 EPS estimate of $7.82. The 14x multiple we use still positions CVS at a substantial discount to healthcare conglomerate bellwethers like UnitedHealth Group, given CVS’s larger relative exposure to the less-attractive retail segment.”

To this end, Hill has a $109 price target on CVS to support his Buy rating. His target indicates upside potential of 77% for the coming 12 months. (To watch Hill’s track record, click here)

In general, other analysts echo Hill’s positive sentiment. 8 Buys and 4 Holds mean that CVS gets a Moderate Buy consensus rating. At $77.44, the average price target indicates 26% upside potential. (See CVS Health stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.