Finding the perfect stock shouldn’t be a chore. After all, the information you need is out there, just waiting for you. The trick is knowing how to parse it, how to connect it, and how to interpret it.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

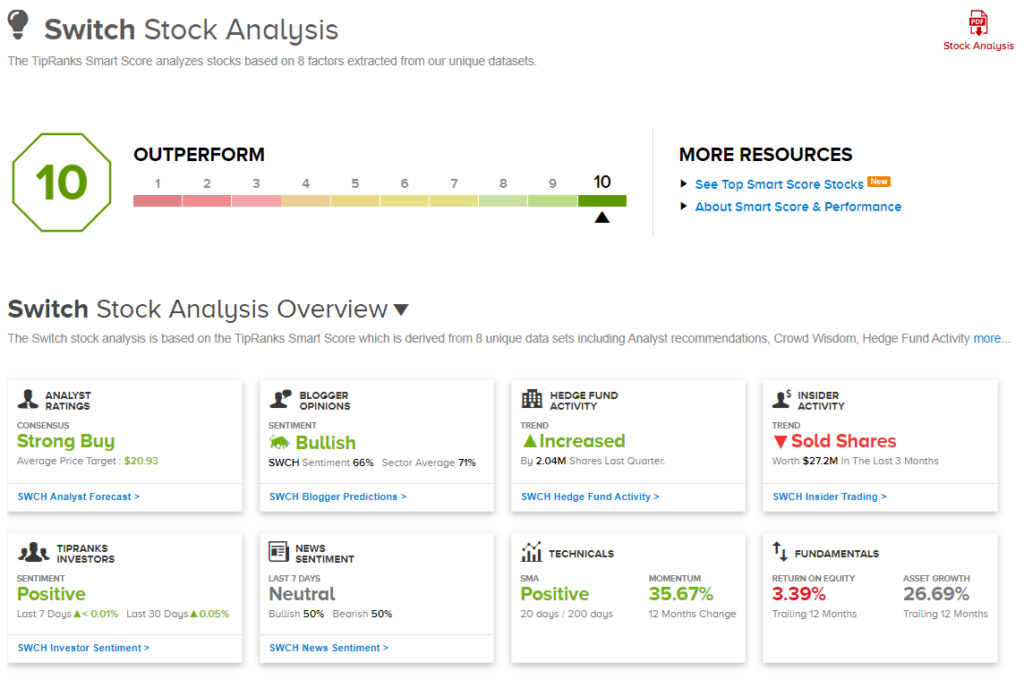

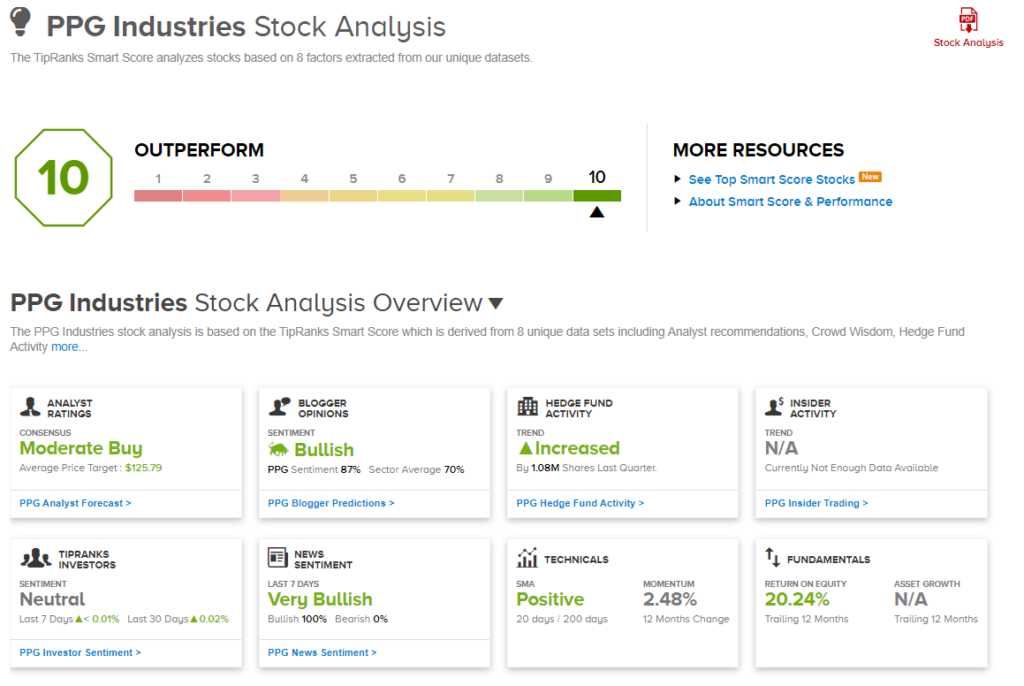

TipRanks offers a Smart Score that collects and collates datapoints on every stock from across the TipRanks database, bringing together 8 separate factors that are commonly used to assess the strength of an investment. Some of these are well known, such as the simple moving average or the return on equity, others are bit more esoteric, like the hedge fund activity or the insider sentiment, and still others, like the blogger sentiment and news coverage, are only measured by TipRanks. Taken together, these disparate datapoints add up to an invaluable trove of information.

The Smart Score is the distillation of this data, a single-digit score that tells you briefly whether a stock is likely to rise or fall in the coming months. The scale is simple, with 1 at the bottom and 10 at the top.

We’ve pulled three ‘Perfect 10’ stocks out of the TipRanks database, investments that present a compelling case for market traders. Let’s look behind the curtains, to find out what makes them stand out.

Cowen Group (COWN)

First on this list is Cowen Group, a name that deserves a higher profile than it has. Cowen is an investment bank, based in New York and operating primarily in the US and UK. The bank’s financial services are offered through two divisions, broker-dealer and investment management, and include a full range of investment services.

Despite the corona crisis, Cowen reported record-beating earnings in Q2, with EPS of $5.50. This was more than 11 times higher than the year-ago number, and beat the forecasts by a significant margin. Revenues were up 26% year-over-year, to $369.6 million.

Cowen’s share price has risen steadily during the market recovery since late March, and COWN is now trading within its February pre-crash level. This puts the stock’s performance in line with the S&P 500.

Sumeet Mody, 4-star analyst with Piper Sandler, takes a simple, upbeat, stance on COWN shares. He rates the stock a Buy and writes, “We remain positive on COWN following the record results of 2Q20 earnings. We believe COWN will continue to perform well in its core brokerage and banking businesses as activity levels remain robust and expect the company will hit its comp expense targets for the year (56 – 57% range). We are increasing our 2020 and 2021 operating EPS estimates from $4.69 and $3.01 to $4.91 and $3.28, respectively, to reflect the beat in the quarter as well as higher brokerage and banking revenues and the current mark-to-market of the Nikola stake.”

Mody’s price target, at $20, indicates the extent of his confidence with a 30% upside potential for the next 12 months. (To watch Mody’s track record, click here)

With 4 Buy ratings from Wall Street’s analysts, Cowen has a unanimous Strong Buy consensus rating. The stock’s $20.75 average price target suggests it has room for 22% upside growth from the current share price of $16.81. (See Cowen stock analysis on TipRanks)

Switch, Inc. (SWCH)

Next up is Switch, a major player in the data center industry. The company’s services include cloud computing, collocation, and connectivity. Switch designs, builds, and operates advanced data centers. The company is based in Las Vegas, Nevada, and includes major data hubs in Reno, Atlanta, and Grand Rapids. Switch boasts a market cap over $4.4 billion, and annual revenues over $460 million.

Switch’s results in the first half of 2020 have been remarkably stable, given the health and economic crises which have rocked the world. In the first quarter, SWCH reported 40 cents EPS against a forecast of 50 cents, the same results as Q4, and looking ahead, the company is expected to report the same for Q2. The share price recovered from the February/March market collapse within one month, and is now trading above its February peak.

Credit Suisse analyst Sami Badri writes of SWCH, “It has shown strong signings recently, with over $10M of incremental annualized recurring revenue in 1Q20; its Connectivity bundling can save customers between 30% and 50% of connectivity costs, which can be a meaningful driver in winning business; and SWCH’s new national sales team, an experienced group of industry experts which should help drive top line growth outside of its Las Vegas Campus.”

Badri gives SWCH stock a Buy rating, and his price target of $23 is bullish, implying a 24% one-year upside potential. (To watch Badri’s track record, click here)

At $20.93, the average price target on SWCH shares implies an upside of 13% for the next 12 months. The analyst consensus rating is a Strong Buy, based on 6 Buys versus only 1 Hold, and the stock is selling for $18.50. (See Switch’s stock analysis on TipRanks)

PPG Industries (PPG)

Last on our ‘Perfect 10’ list is PPG Industries, a major industrial player on the international scene. Pittsburgh-based PPG is the world’s largest supplier of paints, coatings, and other specialty finishing materials. PPG saw some $15 billion in net sales last year, but has seen a drop-off in revenues in 1H20 due to the economic downturn. Along with slipping sales and earnings, PPG shares have underperformed in the current cycle.

All of this, however, does not change the fundamental strengths that PPG features. The company’s net sales, even in the current environment, are nearly 50% higher than its largest competitor.

Covering the stock for Deutsche Bank, analyst David Begleiter writes of PPG, “We believe investor concerns are misplaced… while PPG does not expect DIY paint demand to be as strong in Q3 as it was in Q2, it should still be a strong Q3 and PPG is more than holding its own in this market. We would also note that the larger-than-expected temporary cost savings highlight the higher level of variable costs in PPG’s cost structure (a good thing) versus the last recession.”

To this end, Begleiter rates PPG a Buy along with a $126 price target. This figure indicates a 13% growth potential from current levels. (To watch Begleiter’s track record, click here)

All in all, PPG’s Moderate Buy consensus rating is based on 14 reviews, including 9 Buys and 5 Holds. The shares are selling for $111.66, and the average target price of $125.79 is in line with Begleiter’s, suggesting a one-year upside of 13%. (See PPG stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.