After years in the investing wilderness, the energy sector came back from the dead to trounce the broader market in 2022. The Energy Select Sector SPDR ETF (NYSEARCA:XLE), which tracks the energy sector of the S&P 500 (SPX), posted a stunning 64.3% return in 2022, which was even more impressive given the S&P 500’s decline of 19.6% for the year.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Energy has cooled down a bit this year as oil prices have decreased. However, there is still a lot to like about the sector. For one thing, even after 2022’s monster performance, energy still makes up just a small weighting of the S&P 500 as a whole.

Second, energy stocks, in general, are still fairly cheap, with many trading at valuations below the average market multiple. Furthermore, many of the stocks return plenty of cash to shareholders via dividends and share buybacks. Lastly, as we saw last year, it doesn’t take much for oil prices to turn around quickly.

The sector is appealing. For generalist investors looking to invest in oil, there can be a lot of complexity — there are upstream and downstream oil companies, as well as integrated majors. There are global mega caps and small wildcatters. Different companies offer exposure to different types of energy and different geographies. This is why ETFs are a great way to begin investing in the energy space. Here are three top energy ETFs.

Energy Select Sector SPDR ETF

As discussed above, the Energy Select Sector SPDR ETF had a year for the ages in 2022 with a monster 64.3% gain. XLE is a large ETF with over $40 billion in assets under management, and in many ways, it has become a proxy for the energy space as a whole.

As State Street’s ETF that tracks the energy sector of the S&P 500, XLE’s top holdings are essentially a who’s who of the top energy stocks in the United States.

ExxonMobil (NYSE:XOM), the top holding, is the U.S.’s largest oil company by market cap, accounting for a whopping 24.2% of XLE’s holdings. Overall, XLE holds 25 positions, and its top 10 holdings make up 74.5% of the fund. After ExxonMobil, the second-largest holding, Chevron (NYSE:CVX), makes up 18.7% of holdings.

Additional top 10 holdings include integrated U.S. oil and natural gas companies like Occidental Petroleum (NYSE:OXY) and EOG Resources (NYSE:EOG).

Upstream plays like Pioneer Natural Resources (NYSE:PXD) are also represented, as are downstream and midstream companies like Marathon Petroleum (NYSE:MPC), Valero (NYSE:VLO), and Phillips 66 (NYSE:PSX). SLB (NYSE:SLB), (formerly known as Schlumberger), the world’s largest oilfield services company, is the third largest holding.

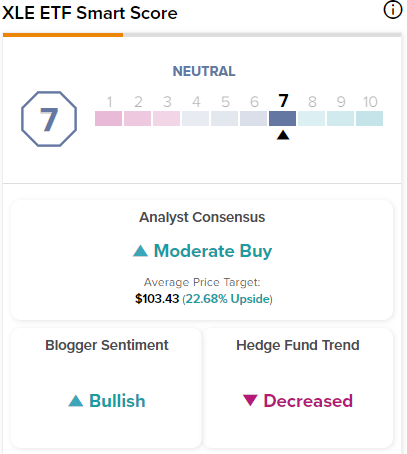

XLE has an ETF Smart Score of 7 out of 10, indicating a neutral rating, and blogger sentiment on the ETF is bullish. On the other hand, hedge fund activity is decreasing.

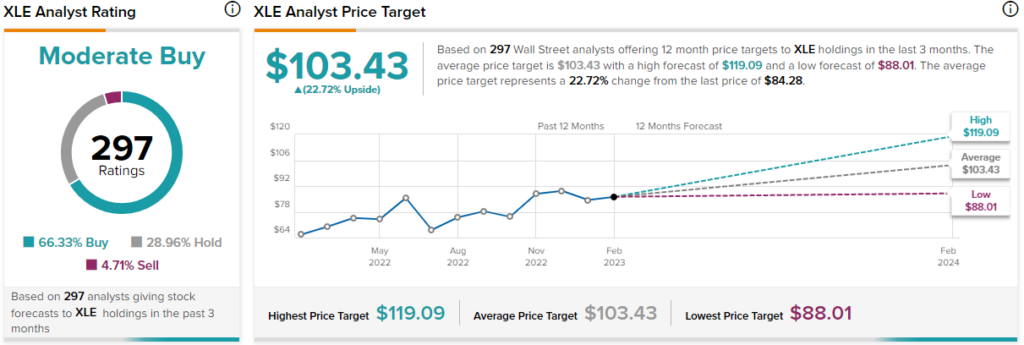

Analysts collectively view XLE as a Moderate Buy. 66.3% of the analysts covering XLE view it as a Buy, 29% call it a Hold, and just 4.7% see it as a sell. The average XLE stock price forecast of $103.43 indicates upside potential of 22.7% from current levels.

XLE has a low expense ratio of just 0.10% coupled with a dividend yield of 3.75%, which is well above the average yield of the S&P 500. XLE is a great choice for investors looking to get into the energy space thanks to its rock-bottom expense ratio and its standout dividend yield.

Vanguard Energy ETF

VDE is an energy-focused ETF from index fund giant Vanguard. VDE harbors a similar appeal to XLE in that it boasts an 0.10% expense ratio and a dividend yield of 3.7%.

Rather than tracking the energy sector of the S&P 500, the Vanguard ETF tracks the performance of the Spliced US IMI Energy 25/50 index. That being said, there is a significant overlap between the VDE’s top holdings and XLE’s. In fact, VDE holds the same ten stocks that XLE does in its top 10, with the only differences being the order and the position sizing.

The Vanguard Energy ETF is more diversified than XLE, with 114 total positions, and the fund’s top 10 positions make up 66.5% of assets. VDE is a smaller fund than XLE, with about $8.4 billion in assets under management.

VDE is also similar to XLE in that it has an ETF Smart Score of 7 out of 10 and a Moderate Buy consensus rating. The average VDE stock price target of $144.98 indicates 25.85% upside potential from current levels. 63.5% of the 644 analysts covering VDE call it a Buy, 31.4% have a Hold rating, and 5.1% have a Sell rating on the ETF.

VDE is down 1.0% year-to-date after a 62.9% gain last year. VDE’s wide array of energy holdings, its minuscule expense ratio, and its substantial dividend yield make it a great ETF for investors to consider.

SPDR S&P 500 Oil & Gas Exploration ETF

While XLE gives investors exposure to the entirety of the S&P 500’s energy sector, XOP is another offering from State Street that tracks the S&P Oil & Gas Exploration & Production Select Industry Index. The ETF’s name implies that it invests in upstream oil and gas exploration and production companies; however, it also invests in refiners and integrated companies.

XOP’s top 10 holdings include some of the same names as XLE and VDE, with positions in ExxonMobil, Valero, and Marathon. However, there are also many independent oil and gas companies like Matador Resources (NYSE:MTDR), Kosmos Energy (NYSE:KOS), and Callon Petroleum (NYSE:CPE). There are also refiners like PBF Energy (NYSE:PBF), Valero, and HF Sinclair (NYSE:DINO).

XOP is more diversified than its State Street counterpart, with 61 holdings. These top 10 holdings make up just 24.2% of the fund.

XOP also has an ETF Smart Score of 7 out of 10. Additionally, blogger sentiment is positive, while crowd wisdom is very negative. Analysts collectively view XOP as a Hold. Of the 404 analysts covering XOP, 60.2% have a Buy rating, 32.7% have a Hold rating, and 7.2% have a Sell rating. However, the average XOP stock price target of $175.92 represents upside potential of 36.9%.

XOP has a higher expense ratio than XLE or VDE, at 0.35%. It also has a lower dividend yield of 2.5%. XOP gained 44% in 2022 and is currently down 0.2% year-to-date.

The Takeaway

After a strong 2022, the energy sector continues to look appealing. XLE and VDE offer investors who are interested in this sector great ways to invest in the space as a whole. They feature significant dividend payouts and minimal expense fees, making them great choices for investors. I particularly like XLE because of its focus on blue-chip energy companies.

XOP is interesting as well, but I prefer XLE and VDE because of their higher dividend yields, lower expense ratios, and stronger performances last year.