Year-to-date, we’re looking at an impressive 24% gain on the S&P 500, and a 20% gain on the NASDAQ. While there have been some short-term pullbacks during the year, the overall trend has been bullish. It’s clearly a market environment to please a growth stock investor.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Wall Street’s analysts would sure seem to think so, too, as they’ve been pointing out stocks that are clear winners in this year’s market conditions. The analysts aren’t shying away from predicting outperformance, and they’re picking out stocks that have histories of triple-digit gains – and have potential for further gains in the months ahead.

We’ve used the TipRanks platform to look up three such stocks. A look at their details, along with commentary from the analysts, should tell why they are such compelling buys.

Silicon Motion Technology (SIMO)

We’ll start with a chip company, Silicon Motion. This is one of the smaller firms in the semiconductor chip space, with a $3.09 billion market cap and revenues of $540.5 million last year. Silicon Motion specializes in solid-state storage memory; the company’s chief products include NAND flash memory, flash cards, and USB drives, making Silicon Motion a major name in the memory storage universe. Investors are impressed, too, and the stock has gained an impressive 104% over the past 12 months.

Silicon Motion’s numbers showed robust growth in Q3. Revenue rose 101% year-over-year to $254.2 million, while at the bottom line, EPS soared 123% to $1.70. So far this year, the company has reported revenues of $658.8 million, easily surpassing last year’s total.

This strong performance has prompted management to step up its returns to investors. The company announced this week that it is initiating a new $200 million share repurchase program. This announcement comes just over a month after the company bumped up its regular stock dividend payment by 43%, to 50 cents per common share. At $2 annualized, the dividend yields 2.2%. Together, the dividend and share repurchase promise a solid return of profits to investors.

In coverage for B. Riley, 5-star analyst Craig Ellis sees Silicon Motion’s profit returns as a key factor to fuel investor interest. He writes, “SIMO PR’d a new $200M six-month share repurchase authorization on the heels of October’s +43% dividend increase, with implications for C22’s revenue and EPS estimate upside significant and positive, in our view. Shares are up… but, in our view, fall well short of discounting incremental positives, and we [believe] SIMO retains attractive absolute and very compelling relative SOX valuation.”

To this end, Ellis rates SIMO a Buy along with a $125 price target. At current valuation, he sees a 41% one-year upside for the shares. (To watch Ellis’ track record, click here)

It’s not just Ellis who’s bullish; the Street has given SIMO a unanimous Strong Buy consensus rating. The stock is currently trading for $88.44, and its $110 average price target implies an upside of 24% for the next 12 months. (See SIMO stock analysis)

Oasis Petroleum (OAS)

Switching gears, we’ll take a look at a mid-cap hydrocarbon exploration and production company. While the US oil industry is facing serious political headwinds, in the form of a hostile Administration in Washington, the industry is also finding lift in a major tailwind: the price of oil is up. WTI, the US benchmark, is at $70.5 per barrel, down 15% from its November peak – but up 55% from one year ago.

Oasis Petroleum, which operates in the rich Williston Basin of Montana and the even richer Delaware Basin of Texas’ Permian formation, is perfectly positioned to gain from that price increase. And it’s clear that investors agree, as the stock is up, up, up this year; currently, OAS is showing a 252% year-to-date gain.

The rise in oil prices has allowed Oasis to see rising revenues in the first three quarters of this year, despite a fall-off in production. The company reported $402 million in revenue for Q3, even though the total production of 51.8 million barrels of oil equivalent per day was down 20% yoy. The company’s cash flow was strong, too; Oasis saw $294 million in net cash from operations during the quarter, with a free cash flow of $65 million, and it has no debt on the balance sheet. Growing revenues and a rising stock price support the company’s dividend, which is yielding 4.8%.

Truist analyst Neal Dingmann sees the cash flow and dividend as key attractors for investor here, as they hold the promise of solid returns based on a growing share value. He writes, “Oasis continues to run a consistent/moderate program that we forecast will result in notable FCF largely paid to shareholders given the little to no total debt on the balance sheet. We anticipate a program going forward that could be a combination of dividends and potential stock buybacks.”

It should be unsurprising, then, that Dingmann rates OAS a Buy. Not to mention the $168 price target puts the upside potential at ~37%. (To watch Dingmann’s track record, click here)

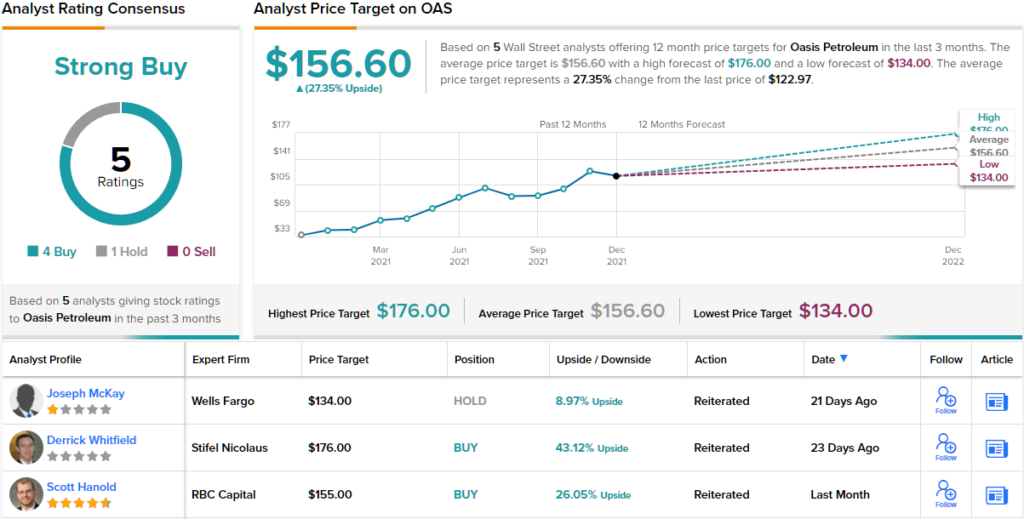

Overall, there are 5 ratings on Oasis Petroleum, and they include 4 Buys and 1 Hold, for a Strong Buy consensus from the analysts. OAS shares are priced at $122.97 and the average price target of $156.60 implies ~27% upside going into next year. (See OAS stock analysis)

Kezar Life Sciences (KZR)

For the last stock, we’ll turn to the bioscience field, where Kezar Life Sciences, a clinical-stage biotech researcher, is focused on the development of new treatments for cancer patients and sufferers of chronic autoimmune diseases. The company’s stock is up 183% so far this year, and the lion’s share of the gains have come since mid-November, in an event that sheds much light on the nature of biotech stocks.

On November 15, Kezar reported interim results from its MISSION study, a Phase 2 clinical trial of its leading drug candidate, KZR-616. This compound is a novel treatment for patients with Lupus Nephritis, a chronic, painful condition that severely impacts quality of life. The study monitored patients with active disease symptoms; 5 of them reached week 25, and 4 of that group showed ‘partial or complete renal response.’ Of the 10 patients who reached week 13 in the study, half showed clinically meaningful reductions in disease biomarkers. There were no drug-induced adverse events during the six-month study.

Also of interest for investors, Kezar reported that in October, it dosed the first patient in a Phase 1 study of KZR-216, a potential treatment for advanced solid malignant tumors. This trial will be conducted in two parts, safety and tolerability, and dose escalation, with the goal of evaluating the drug for a follow-on Phase 2 study.

Based on the above, Wells Fargo’s Derek Archila counts himself as a fan. The analyst gives KZR shares an Overweight (i.e. Buy) rating, and his $19 price target suggests the stock has a 37% one-year upside. (To watch Archila’s track record, click here)

“We believe the interim data from KZR-616’s Phase 1b/2 study in lupus nephritis provides us with confidence that the top line results should be positive as they have shown meaningful and rapid activity on key biomarkers, which correlate well with the registrational endpoint. Further, we believe pre-clinical data for KZR-616 and its mechanism of action are supportive of its potential efficacy in dermatomyositis/polymyositis patients, where few good treatments exist. While we concede these trials are small, we think they are well-designed and offer meaningful de-risking ahead of subsequent studies,” Archila opined.

All in all, with 3 Buy ratings and no Holds or Sells assigned in the last three months, the word on the Street is that KZR is a Strong Buy. This stock is trading for $13.87 and its $19.50 average price target implies an upside of ~41% for the year ahead. (See KZR stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.