The Metaverse isn’t just a passing fad. It’s here to stay, and it’s not too late to hand-pick several top metaverse stocks that analysts love in 2023. Only a few of them will actually make the grade, but successful traders are choosy, and if you’re going to invest in the Metaverse, you might as well stick with the best and forget about the rest.

Maybe you haven’t personally experienced the Metaverse, where participants can interact through virtual characters, play immersive video games, and of course, make purchases along the way (that’s how revenue is generated, after all). It’s fine if you’re not directly involved with virtual and augmented reality, as you can still consider giving any or all of these metaverse stocks a try.

Moreover, you’ll at least have the added assurance that comes with picking stocks that are rated as Strong Buys on Wall Street (which is why, for example, I didn’t include chip champ Advanced Micro Devices (NASDAQ:AMD) on the list, since Wall Street currently only rates it a Moderate Buy). With those criteria in mind, let’s dive right into the three Strong-Buy rated metaverse stocks I am bullish on.

Meta Platforms (NASDAQ:META)

Formerly known as Facebook, Meta Platforms is so metaverse-focused that CEO Mark Zuckerberg purposely changed its name and stock ticker symbol to emphasize “META.” Speaking of the stock, it has zoomed higher since November of last year, but don’t assume the rally is running out of steam. After all, the skeptics can’t begrudge Meta Platforms’ impressive first-quarter 2023 earnings beat.

Still, some critics might contend that Zuckerberg and Meta Platforms have given up on the Metaverse in favor of more artificial-intelligence (AI) focused efforts. It is true that Meta Platforms has taken a financial hit during its initial foray into virtual and augmented reality experiences, but that’s to be expected in the initial stages of a major corporate re-branding. In any case, Zuckerberg has assured Meta Platforms’ stakeholders, “We’ve been focusing on both AI and the Metaverse for years now, and we will continue to focus on both.”

To reinforce this commitment, Meta Platforms recently released the Quest 3 mixed reality headset. Its starting price is $499 – which, as we’ll see in a moment, actually isn’t very expensive – and Meta Platforms touted the Quest 3 as “the first mainstream headset with high-res color mixed reality.” Thus, Meta Platforms is still pushing the boundaries of metaverse-capable hardware, so let’s now check in with Wall Street to see if they’re on board with Zuckerberg’s bold vision for the company.

What is the Price Target for META Stock?

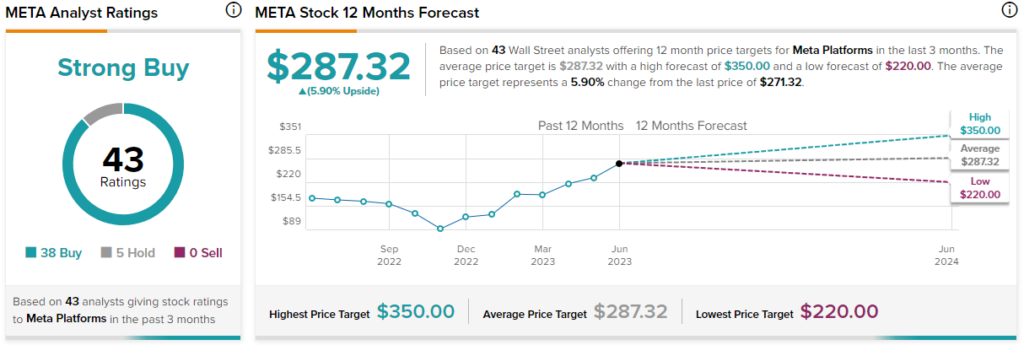

According to TipRanks’ analyst rating consensus, META is a Strong Buy based on 38 Buys, five Holds, and zero Sell ratings. The average Meta Platforms stock price target is $287.32, implying 5.9% upside potential.

Apple (NASDAQ:AAPL)

Apple stock isn’t a pure play on the Metaverse, as the company’s primary revenue generator is the iPhone. Yet, Apple is a darling of the market with a clear-cut metaverse connection since the company recently revealed its Apple Vision Pro “spatial computer.”

That’s really just a fancy way of saying the Vision Pro is a feature-rich mixed-reality headset, which is ideal for handling high-resolution metaverse experiences. However, whether the public is willing to pay $3,499 for the Vision Pro — which is set to be released to the public early next year — remains to be seen.

I’m actually fairly optimistic that this “spatial computer” will be a decent revenue generator for Apple. Bear in mind that new iPhone versions are sold on quality and brand-name prestige, not on price. Apple has disrupted tech-gadget niche markets before, so why couldn’t the company change the game (literally) in metaverse-compatible gear? For his part, Wedbush analyst Daniel Ives anticipates that more consumers will come on board, especially since Apple will probably eventually reduce the price of the Vision Pro.

What is the Price Target for AAPL Stock?

Turning to Wall Street, AAPL is a Strong Buy based on 22 Buys, seven Holds, and not a single Sell rating. The average Apple stock price target is $189.17, implying 3.2% upside potential.

Sea Limited (NYSE:SE)

My third metaverse stock pick is one that you may not be as familiar with. Sea Limited is based in Singapore, and the company has e-commerce and fintech divisions, but it’s Sea Limited’s gaming business, Garena, that provides interactive virtual experiences and, therefore, a metaverse angle.

Unlike META stock and AAPL stock, SE stock dropped recently, thereby providing an opportunity for dip-buyers. On the financial side of the equation, Sea Limited’s total revenue, gross profit, and balance of cash, cash equivalents, and short-term investments have remained fairly steady from one quarter to the next.

As Sea Limited continues to generate revenue from immersive game titles like Star Wars Jedi: Survivor, the company has picked up a notable investor — Saudi Arabia’s sovereign wealth fund, known as the Public Investment Fund or PIF. In this year’s first quarter, the PIF increased its stake in Sea Limited by a jaw-dropping 248%. Now, that’s what I would call a confident position. So, let’s swing by Wall Street now to see if they’re equally confident in Sea Limited.

What is the Price Target for SE Stock?

On Wall Street, SE stock comes in as a Strong Buy based on 10 Buys and three Holds, with no Sell ratings whatsoever. The average Sea Limited stock price target is $100.26, implying 52.6% upside potential.

Conclusion: Should You Consider Metaverse Stocks?

Clearly, publicly-listed technology companies don’t address the ever-growing metaverse in the same way. It’s different strokes for different folks, but the good thing is that you get to pick and choose your favorite metaverse stocks for your portfolio.

No matter how you strategize your metaverse stock allocations, I definitely feel it’s worthwhile to conduct your due diligence and have some metaverse market exposure (this is not professional financial advice, of course). Otherwise, you might miss out on an emerging tech segment where the objects may be virtual, but the revenue is 100% real.