Mutual Fund investing is one of the safest ways to safeguard your capital and ensure steady returns. Investors can analyze and pick the mutual fund that best suits their risk-reward appetite and allocate funds accordingly. TipRanks recently added mutual fund pages to its website, thus expanding your research capabilities.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Today, we will look at three large-cap mutual funds that boast a Strong Buy consensus rating, offer a potential upside of over 20% in the next twelve months, and have a Smart Score of eight.

Fidelity Fund (MUTF:FFIDX)

The Fidelity Fund primarily invests in large-cap stocks seeking long-term capital growth while also investing a portion in fixed-income securities. As of date, FFIDX has 99 holdings with total assets of $6.38 billion. A major focus of FFIDX remains in the technology sector, followed by healthcare. FFIDX pays a semi-annual dividend amounting to $0.61 per share, with a current yield of 0.51%.

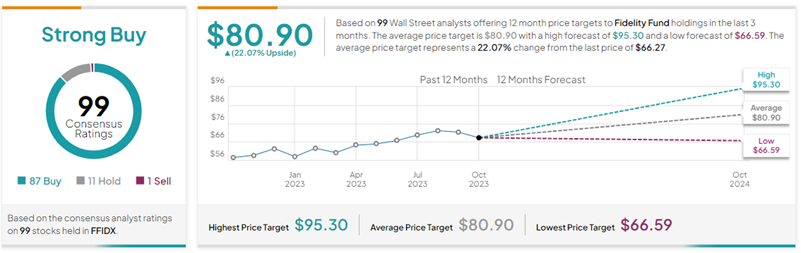

On TipRanks, FFIDX has a Strong Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Hence, of the 99 stocks held by FFIDX, 87 have Buys, 11 have Holds, and only one stock has a Sell rating. The average Fidelity Fund price target of $80.90 implies 22.1% upside potential from the current levels.

Year to date, FFIDX has gained 14.5%. Its top five major holdings include Microsoft (MSFT), Apple (AAPL), Alphabet Class A (GOOGL), Nvidia (NVDA), and UnitedHealth (UNH). The top 10 holdings account for 45.86% of the portfolio.

Brown Advisory Sustainable Growth Fund Institutional Shares (MUFT:BAFWX)

BAFWX invests primarily in mid- and large-capitalization stocks that adopt sustainable business strategies to grow earnings. BAFWX has 34 holdings with total assets of $7.65 billion. A major focus of FFIDX remains in the technology sector, followed by healthcare. Its top 10 holdings account for 43.35% of the portfolio.

On TipRanks, BAFWX has a Strong Buy consensus rating. This is based on 33 stocks with a Buy rating and one with a Hold rating. The average Brown Advisory Sustainable Growth Fd Inst Shs price target of $50.76 implies 26.4% upside potential from the current levels. Year to date, BAFWX has gained 16.4%. Its top five major holdings include Nvidia, Microsoft, Amazon.com (AMZN), Visa (V), and UnitedHealth.

Eaton Vance Atlanta Capital Focused Growth Fund Class A (MUFT:EAALX)

EAALX invests in large-capitalization stocks with sustainable earnings growth potential. The mutual fund has only 24 holdings, focused mainly on the financial and technology sectors. The fund has $1.04 billion in assets, with the top ten holdings accounting for 56.1% of the portfolio.

On TipRanks, EAALX has a Strong Buy consensus rating. This is based on 23 stocks with a Buy rating and only one with a Hold rating. The average Eaton Vance Atlanta Capital Focused Growth Fund Class A price target of $20.27 implies 21.3% upside potential from the current levels.

EAALX has gained 6.5% so far this year. Its top five major holdings include Visa, Alphabet Class B (GOOG), Microsoft, Danaher (DHR), and Thermo Fisher (TMO). The fund pays an annual dividend of $0.04 per share.

Ending Thoughts

Mutual Funds come in different shapes and sizes, just like every investor has a different level of risk tolerance and return expectations. The above three MFs can help generate lucrative returns for your portfolio. If you have not tried investing in mutual funds yet, start your journey today with the help of TipRanks mutual fund tools that will help you make the right choices.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue