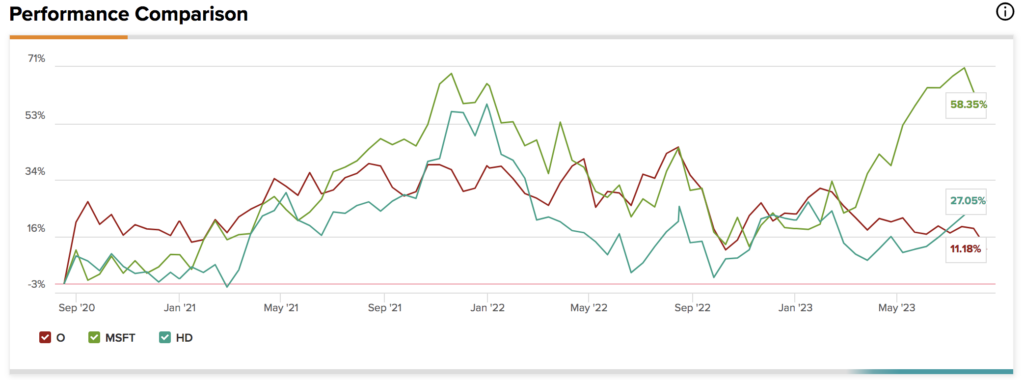

Although dividend growth investing does not guarantee high returns, it is widely considered a reliable return-seeking methodology. Therefore, after using TipRanks’ database, I discovered that Realty Income Corporation (NYSE:O), Microsoft (NASDAQ:MSFT), and Home Depot (NYSE:HD) are three “grade-A” dividend growth stocks that I am bullish on.

While capital gains typically outweigh income-based returns in a bull market, dividends contribute proportionately to long-term stock returns. Despite the feasibility of dividend investing, though, chasing high-yielding dividend stocks can be disadvantageous, as high dividend-payout ratios often translate into stagnating growth. Thus, it is critical to find the correct balance between price gains and dividend payouts if you are aiming to unlock optimal risk-adjusted returns.

Dividend-growth investing helps achieve an optimal mix regarding total returns. For this strategy, I seek stocks that possess a track record of dividend increases while maintaining high free cash flows, low debt ratios, and robust earnings-per-share metrics.

With this in mind, here’s my analysis of the aforementioned dividend growth stocks.

1. Realty Income Corp. (NYSE:O)

Realty Income Corporation, otherwise known as the “monthly dividend company,” is a North American real estate investment trust (REIT) that invests in free-standing single-tenant commercial real estate properties.

With a portfolio containing some of the highest-quality retail tenants in the world, such as Sainsbury’s (OTC:JSAIY), Walgreens (NASDAQ:WBA), and 7-Eleven, Realty Income benefits from non-cyclical leases that escalate on a continuous basis. For example, the REIT has achieved a cumulative total operational return of 110.1% from 2015 to 2022, accompanied by adjusted-funds-from-operations growth of 6.6% per year since 2012, according to the company.

Further, Realty Income Corporation recently beat second-quarter revenue forecasts by $80.38 million. Much of the REIT’s quarterly success can be attributed to smart asset dispositions and nimble acquisitions. In fact, Realty Income Corporation added to its pipeline in its second quarter by investing $2.6 billion in existing and developmental assets with an average capitalization rate of 6.8%.

Realty Income’s continuous value creation has resulted in a 4.4% compound annual dividend growth rate since 1994, which coalesces with its robust fixed-charge interest coverage ratio of 4.6 to formulate a dividend yield of 5.24%.

In a nutshell, although it possesses cyclical risks, Realty Income is a superb dividend growth stock due to its robust fundamentals coupled with lucrative shareholder returns

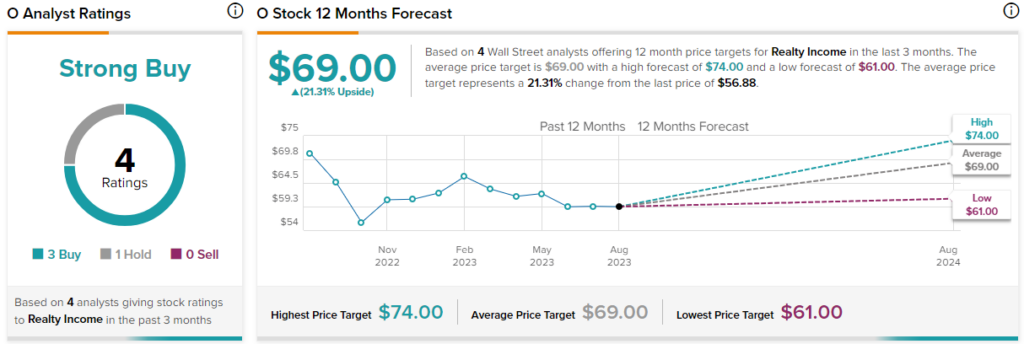

Is O Stock a Buy, According to Analysts?

Turning to Wall Street, Realty Income Corporation earns a Strong Buy consensus rating based on three Buys and one Hold assigned in the past three months. The average O stock price target of $69 implies 21.3% upside potential.

Microsoft (NASDAQ:MSFT)

Many might question Microsoft’s inclusion in this article, as its dividend yield is merely 0.83%. However, as mentioned in the introduction, dividend-growth investing is a long-term strategy that seeks an optimal total return mix. Therefore, Microsoft’s inclusion is due to its future income-based prospects instead of its retrospective distributions.

Microsoft is an exciting stock to own, as the company is exposed to new growth prospects like ChatGPT, cloud infrastructure, and LinkedIn. At the same time, Microsoft is a maturing enterprise that might decide to return value to its shareholders in due course.

Further, Microsoft is a secular growth firm with dominant market positions across its key segments. The firm’s secular stealth was proved once more in July, as the company strolled past its third-quarter estimates to achieve a revenue figure of $56.2 billion, with salient features of the firm’s quarterly results being 27% and 26% year-over-year increases in revenue from Azure and Dynamics 365, respectively.

Microsoft’s secular business growth might convert into secular dividend growth. The firm’s payout ratio of 27.73% remains on the lower end of the spectrum, thus, has the capacity to increase. Sure, Microsoft will likely enter a renewed capital expenditure cycle to facilitate its pivot into the “AI economy;” nevertheless, higher value pass-throughs look probable.

Is MSFT Stock a Buy, According to Analysts?

Turning to Wall Street, Microsoft earns a Strong Buy consensus rating based on 32 Buys, two Holds, and one Sell assigned in the past three months. The average MSFT stock price target of $391.52 implies 23.55% upside potential.

3. Home Depot (NYSE:HD)

Although it sells durable goods and related products, Home Depot’s beta of 0.95 suggests it is a low-volatility stock. Thus, the stock is suitable for dividend-growth investors that want to avoid being overzealous with their investment approach.

Home Depot’s second-quarter earnings report surfaced on Tuesday, revealing numerous exciting talking points. Firstly, the company beat its bottom-line estimates, as it achieved an earnings-per-share figure of $4.65 (vs. the estimate of $4.45). Moreover, Home Depot’s second-quarter revenue settled at $42.92 billion, beating estimates by $690 million.

Even though Home Depot’s second-quarter results beat estimates, the company suffered from heightened inflation and high variable interest expenses, as its operating and net profits fell by 8.6% and 9.9% year-over-year. However, global inflation is abating, and an interest rate pivot is looming. As such, Home Depot’s year-end results may impress the masses.

Further, Home Depot’s management recently approved a $15 billion share buyback program, illustrating the company’s confidence in its future financial performance. Accompanying the buyback program is a forward dividend yield of 2.52%, which is supported by a 10-year compound annual dividend growth rate of 19.36%.

To conclude, Home Depot’s stock presents compelling dividend-growth prospects. Although risks persist, most of the stock’s attributes are well-aligned.

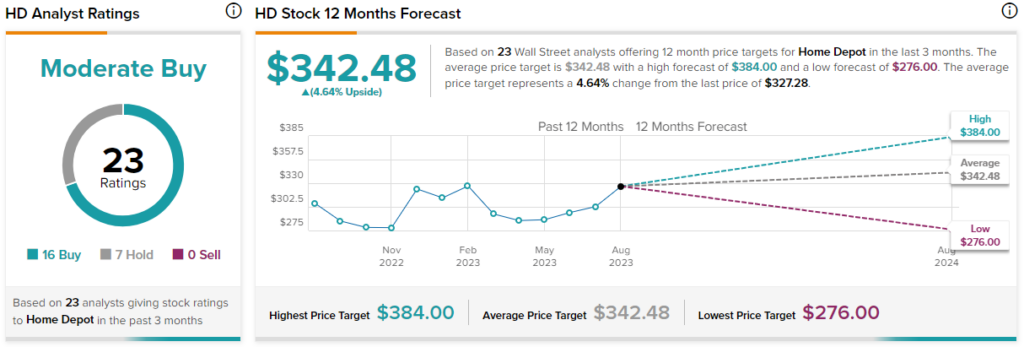

Is HD Stock a Buy, According to Analysts?

Turning to Wall Street, Home Depot earns a Moderate Buy consensus rating based on 16 Buys and seven Holds assigned in the past three months. The average HD stock price target of $342.48 implies 4.6% upside potential.

Concluding Thoughts

Dividend growth investing provides solid risk-adjusted return potential, and the likes of Realty Income Corporation, Microsoft, and Home Depot seem like best-in-class picks due to their robust fundamentals and generous shareholder returns.