Products and services offered by the Packaging & Containers industry are indispensable for multiple other industries. Moreover, the industry has been resilient in handling the ongoing market volatilities and offers solid growth potential for the years ahead.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Interestingly, growth in the Retail industry, propelled by a surge in e-commerce businesses and improving lifestyles in emerging nations, is favoring the Packaging & Containers industry.

The Food and Beverages, Consumer Goods, Cosmetics, and Pharmaceuticals industries too are heavily dependent on proper and attractive packaging, which makes transportation and marketing easy. Overall, the demand side for the Packaging & Containers industry seems solid.

On the supply side, the packaging & containers companies have to constantly upgrade and innovate products to address the needs of their customers, which, in turn, are influenced by the changing behavior of consumers. Of late, the demand for flexible packaging products, especially those made of plastic, is very high in the United States.

According to the Packaging Industry in United States – Growth, Trends, COVID-19 Impact, and Forecasts (2021 – 2026) report, the industry is anticipated to grow by 3.5% CAGR between 2021 and 2026.

Per TipRanks data, the Basic Materials sector (which houses the Packaging & Containers industry) has 379 companies with consensus ratings, of which 81% are either Strong Buy or Moderate Buy. Let us discuss three prominent names in the Packaging & Containers industry.

Ball Corporation (NYSE: BLL)

Based in Westminster, CO, Ball is among the leading providers of aluminum-based packaging materials in the United States, Canada, and other countries. Prime end-markets served include household products, beverages, and personal care.

Over the past year, shares of this $29-billion company have increased 4.3%. In the last reported quarter, its earnings and revenues increased 19.8% and 18.4% year-over-year, respectively.

In January, the company’s Executive Vice-President and CFO, Scott C. Morrison, said, “The company is well-positioned for long-term growth, cost/price recovery and increasing return of value to shareholders.”

For 2022, Morrison anticipates Ball to gain from “long-term contracts with global strategic partners” and “newly commissioned investments.” Shareholders will also be rewarded well with dividends and share buybacks in the year.

Recently, Adam Josephson from KeyBanc reiterated a Hold rating on Ball. Meanwhile, the rating on Ball was upped to Buy from Hold by George Staphos, an analyst at BofA, a few days ago. The price target on Ball was increased to $108 (20% upside potential) from $103.

Overall, Ball has a Moderate Buy consensus rating based on five Buys and eight Holds. Ball’s average price target of $104.50 suggests 16.11% upside potential from current levels.

Crown Holdings, Inc. (NYSE: CCK)

The company manufactures and sells packaging solutions for use in Food and Beverage, Corrugated, Industrial, and other industries. The $15.5-billion company is headquartered in Yardley, PA. Over the past year, shares of Crown Holdings have soared 24.6%.

In the last reported quarter, Crown Holdings’ adjusted earnings grew 10.7% from the year-ago quarter while revenues expanded 24.1%. Solid product lines, growing demand, and expanded production capacity are likely to add new vigor to the company’s growth trajectory in the years ahead.

In February, Crown Holdings’ President and CEO, Timothy J. Donahue, commented that the company was poised to deliver earnings growth in 2022 as well as work on increasing its beverage can manufacturing capacity and reward shareholders handsomely.

For 2022, Crown Holdings anticipates adjusted earnings to be within the $8.00-$8.20 per share range, up from $7.66 per share in 2021.

Recently, BMO Capital analyst, Mark Wilde, reiterated a Buy rating on Crown Holdings with a price target of $140 (11.92% upside potential).

Overall, Crown Holdings has a Strong Buy consensus rating based on 11 Buys and one Hold. Also, Crown Holdings’ average price target of $140.27 mirrors 12.14% upside potential from current levels.

Silgan Holdings Inc. (NASDAQ: SLGN)

The company is a specialist in manufacturing rigid packaging solutions for Healthcare, Food and Beverage, and other industries. The company is located in Stamford, CT. Over the past year, shares of the $5.1-billion company have increased 10.1%.

Silgan Holdings’ adjusted earnings expanded 32% year-over-year in the last reported quarter, while its revenues grew 17.3%. In the years ahead, the company is well-placed to benefit from its manufacturing capabilities, acquired assets, solid cash position, and healthy demand.

In January, the company’s President and CEO, Adam Greenlee, said, “…we estimate adjusted earnings per share in 2022 in the range of $3.80 to $4.00, which represents a 15 percent increase at the midpoint over record 2021 levels.”

Post the earnings release in January, George Staphos, an analyst at BofA Securities, reiterated a Buy rating on Silgan Holdings while increasing the price target to $54 (16.81% upside potential) from $53.

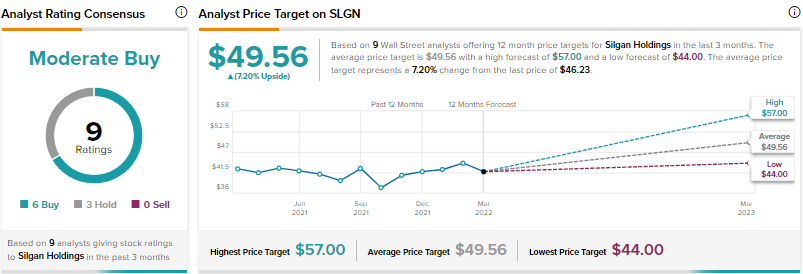

Overall, Silgan Holdings has a Moderate Buy consensus rating based on six Buys and three Holds. Silgan Holdings’ average price target of $49.56 suggests 7.20% upside potential from current levels.

Conclusion

Like most companies, the above-mentioned companies are braving the headwinds caused by supply chain disruptions and cost inflation. However, their solid fundamentals and favorable industry trends make them solid picks for long-term investing.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure