After the coronavirus fears subside and the U.S. counts the economic toll, the legalization of cannabis is a potential beneficiary. Most states have huge budget deficits with an eye on legalization of especially recreational cannabis as a major source of new tax revenues.

One state pushing forward with recreational cannabis approval is New York. Governor Andrew Cuomo is one of the few governors pushing aggressively for approval and the state would probably be very close to legalization, if not for the ongoing setback from COVID-19.

The flip side of this setback is the need for cannabis tax revenues is further enhanced by the near full shutdown of the New York economy for 4 months now. State lawmakers are now pushing to get marijuana legalized due an estimated $300 million in tax revenues for the state that now has a budget deficit of up to $61 billion.

The state currently has a medical cannabis program with 10 licensed organizations approved for 4 dispensaries each. A big remaining question is whether these existing license holders and dispensaries will obtain an immediate conversion into recreational cannabis sales similar to Illinois.

Illinois is an estimated $2 billion to $4 billion annual cannabis sales opportunity while New York has a population about 50% larger. The best opportunity to expedite immediate sales and tax collection is following the Illinois plan.

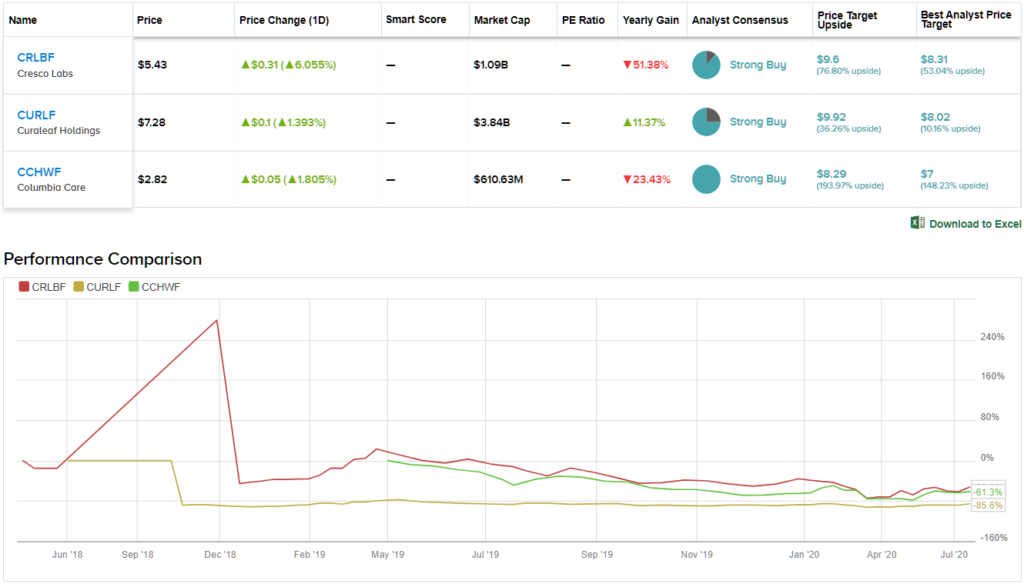

With this in mind, we’ve delved into 3 multi-state operator (MSO) stocks to consider as the state of New York looks to quickly approve recreational cannabis to fill a major budget deficit. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to get the lowdown on what the near-term holds for these MSO players.

Cresco Labs (CRLBF)

Cresco Labs is one of the leading MSOs and positioned to lead in important states such as Illinois, Pennsylvania and New York. The company obtained four NY dispensaries and the right to operate one cultivation facility via the acquisition of Valley Agriceuticals, LLC. The dispensaries have recently been re-branded to the Sunnyside retail brand.

Unlike most of the MSOs, Cresco Labs is more focused on the wholesale market. The company gets over 50% of revenues from the wholesales business, but the key retail stores located in large states like New York will provide substantial revenue upside.

Illinois is on pace to be 3.5x to 4x larger in 2020 than 2019 sales levels following the legalization of recreational cannabis on January 1. The MSO had a similar position in that state with some equally strong competitors, but the limited licenses to start was a huge benefit to the existing license holders.

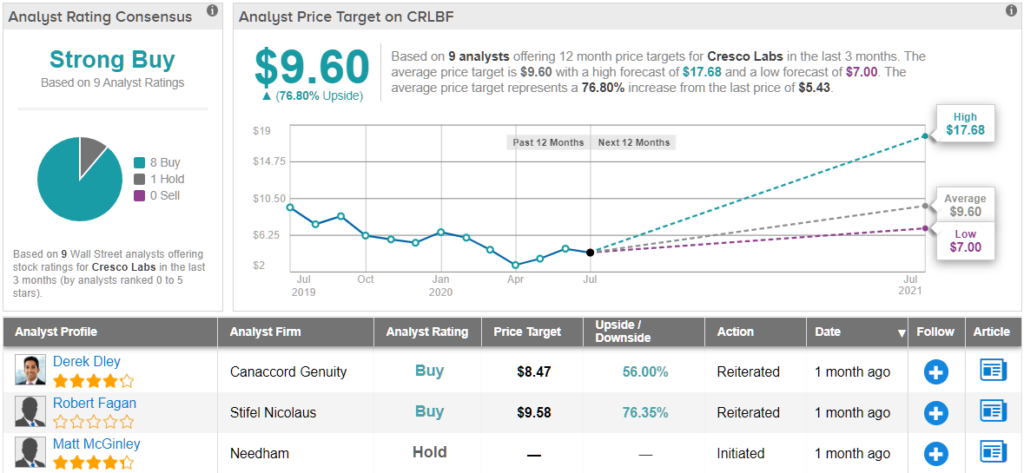

Overall, Cresco remains a Wall Street darling, as TipRanks analytics showcasing the MSO as a Strong Buy. With an average price target of $9.60, analysts are predicting massive upside potential of 77% for the stock. In total, the stock has received 8 ‘buy’ ratings vs. just 1 ‘hold’ in the last three months. (See Cresco stock analysis on TipRanks)

Curaleaf (CURLF)

Curaleaf is the biggest MSO and will benefit from the approval of recreational cannabis in New York. The company has the same four store locations as the other smaller MSOs so the big upside potential is probably in the other MSOs, but the large MSO having licenses amongst only 10 other companies is a huge plus to Curaleaf becoming a dominant MSO.

The cannabis company forecast Q2 revenues of $165 million despite some major impacts from store closures in Nevada and Massachusetts. Even $10 or $20 million in additional quarterly revenue wouldn’t move the needle substantially for Curaleaf, but the revenues would build the case for the company being the global leader in cannabis by a wide margin. Curaleaf is already approaching $200 million in quarterly revenue while some Canadian players are still struggling to hit the $100 million level.

Depending on how New York approves the market dynamics for recreational cannabis, Curaleaf could definitely utilize market size to roll out new recreational products quicker and even build out additional new retail stores faster. The approval of recreational cannabis in New York would make the MSO as one the dominant players in two of the new big cannabis markets in the U.S.

Columbia Care (CCHWF)

Columbia Care remains one of the few MSOs not well known by the market. The company isn’t generating quarterly sales in the $50 million or $100 million range of other major MSOs involved in New York, but the company is just getting started in major states outside of New York including operations in Florida, Illinois, Massachusetts and Ohio.

Analysts have Columbia Care generating 2020 revenues of $210 million while the market cap is only $620 million. The MSO is positioned to see the biggest upside from four retail locations in New York being able to sell recreational cannabis due to the smaller size of the company. Columbia Care has key store locations in Brooklyn and Manhattan.

Analysts forecast the MSO doubling revenues in 2021 to over $400 million before even seeing upside from a New York and even Florida approval of recreational cannabis. The company has limited stores in Illinois, Massachusetts, Ohio, Pennsylvania and New Jersey just now opening or ramping up.

Columbia Care is still generating large EBITDA losses as the company still launches operations in additional states such as New Jersey and Virginia while ramping up operations in these other states.

Like the other stocks in this article, Columbia Care has a Strong Buy consensus – and it is based on 3 ‘buy’ ratings given in recent months. The shares have an average price target of $8.29, suggesting a 194% upside from the $2.82 current trading price.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclosure: No position.