The rally we’re experiencing in the stock markets has become something of a sensation. While equities generally are down some 15% from their all-time high levels, reached back in February, the rebound has been substantial. The S&P 500 is almost 33% from its March 23 trough.

The big factor, of course, is the coronavirus crisis and the COVID-19 pandemic. The virus has – justifiably – taken the lion’s share of the news broadcasts. But that intense focus on one item has left investors with an incomplete picture.

BMO Chief Investment Strategist Brian Belski has issued a report to correct this, by broadening the picture to point out other factors that are impacting markets and investor sentiment.

“While the COVID-19 virus is obviously still the big concern out there in the market, several others have also been recently brought up in our client interactions, including high market cap concentration atop the S&P 500, a surge in negative dividend actions by companies, and several sector weights approaching lows […] While we do believe these data trends should certainly continue to be monitored in the coming months, our analysis suggests that they may not be the roadblocks to US stock market performance moving forward that many investors appear to be expecting,” Belski wrote.

Belski says that the dividend stocks on the S&P 500 are still strong, and have not yet deteriorated as far as they did in the 2009 financial crisis. With the real possibility that an economic recovery may start in 2H20 – several states, including powerhouses like Texas and Florida, are moving to reopen now – this makes dividend stocks a valuable insurance policy for investors.

With this in mind, we’ve used TipRanks database to pull up the details on three high-yield dividend stocks recommended by BMO analysts, in line with Belski’s report.

Citizens Financial Group (CFG)

We’ll start with Citizens Financial, one of the top retail banking companies in the US. Citizens offers an array of deposit, insurance, investment, and loan services in the commercial and retail segments.

The company’s earnings, which had been solid in the $0.95 to $1.00 range for much of 2018 and 2019, slipped to just 9 cents per share in Q1 2020, and have a similar outlook for Q2. Through all of this, CFG has kept up its dividend. In fact, the company has raised the payment 5 times in the past three years. The current payment, at 39 cents per share quarterly, annualizes to $1.56 and gives a 7.2% yield. This compares highly favorably to the 2.16% average yield found among peers in the financial sector.

The overall outlook is not perceived as grim – at least, not yet. The bank showed increased income from fees, clear gains in both mortgage and trust banking, and improvement in deposit balances. While low rates are bad for the loan business, CFG also showed an uptick in loan balances that bodes well. CFG has set up a small-business grant program, which is likely to both help the business sector most harmed by the COVID-19 epidemic and drum up longer-term business for the bank. In addition, the company has shored up its liquidity position through an issue of $1.5 billion in senior notes.

Looking at the whole picture, BMO’s 5-star analyst Lana Chan says, “We believe that its capital and liquidity position appears sufficient to weather the COVID-19 related economic downturn.” In a more detailed outlook, she writes, “NII +low-mid single digits as strong loan growth more than offsets sizeable decrease in NIM, noninterest income down low-mid SDs, noninterest expense up slightly, LLP will depend on depth of recession and pace of recovery, significant loan growth reflecting commercial line draws, government programs, and increased demand in education.”

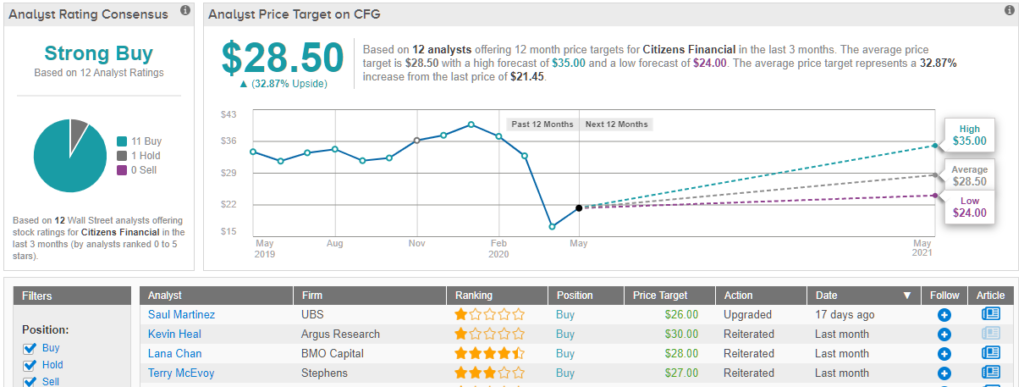

Chan puts a $28 price target on CFG, backing her Buy rating. This target implies an upside for the stock of 31% in the coming year. (To watch Chan’s track record, click here)

All in all, the analyst consensus view on Citizen’s Financial is a Strong Buy, based on 12 reviews that include 11 Buy and only a single Hold. Shares are deeply discounted and trading at $21.45, while the $28.50 average price target suggests an upside of 33%. (See Citizen Financial stock analysis at TipRanks)

Ares Capital Corporation (ARCC)

Next up is Ares Capital, an asset management company. Ares is well known for strong dividends, even in a business niche that usually pays out high yields. The company is currently paying out $1.60 annually, or 40 cents quarterly, making its dividend yield a robust 11.2%. Ares also has a history of adjusting its dividend payment to keep it in line with earnings, and sustainable.

The company’s earnings, which took a hard hit from the coronavirus-inspired shutdowns, had already been trending down for three quarters – but remained in positive territory in Q1. EPS came in at 41 cents, missing the forecast by 4.6%. However, investors were heartened by the company’s lower reported expenses and positive activity in its portfolio. Ares also had taken successful efforts to shore up its liquidity position and overall balance sheet. These were seen as outweighing the generally expected drop in earnings.

BMO’s Lana Chan was impressed by the company’s cash position. She noted, “ARCC currently has ~$460 million in cash and $2.1 billion in undrawn credit commitments. This gives it flexibility to support existing borrowers (with tighter loan documentation) and dry powder to take advantage of mis-priced opportunities (including select credit investments, large portfolios, or M&A). This extra liquidity and capital strength has the power to be a differentiating factor among BDCs…”

While keeping her Buy rating on this stock, Chan lowered her price target to $16 – but this still indicates confidence in an 12% upside potential. (To watch Chan’s track record, click here)

Ares Capital has a unanimous Strong Buy analyst consensus rating, based on no fewer than 14 Buy reviews. The stock’s price is trading at $14.36, and the average price target implies a modest upside of 6.4%. (See Ares Capital stock analysis at TipRanks)

WP Carey & Company (WPC)

You can’t talk about dividend stocks without at least mentioning one real estate investment trust. REITs are known high-performers among dividend plays, and WP Carey, with a market cap exceeding $10 billion, is one of the larger companies in the niche. The company specializes in commercial real estate, leasing properties long-term to clients in the US, and Northern and Western Europe.

While most companies saw a steep earnings hit in Q1, due to this year’s pandemic, WPC managed to avoid that. The long-term nature of the company’s leases provided insulation, and Q1 FFO (funds from operations) came in at $1.25, beating the forecast by 5%, and broadly in-line with the previous five quarters’ income reports.

WPC is currently paying out $1.04 per share in quarterly dividends, which annualizes to $4.16 and produces a strong yield of 7%. Like the stocks above, this dividend is sharp – and favorable – contrast to the average yields found among peer companies. WPC has a history of reliable payments, and has grown the dividend gradually over the past 6 years. The payout ratio is 83%, comparable to other REITs, and indicating that the payments are affordable at current income levels.

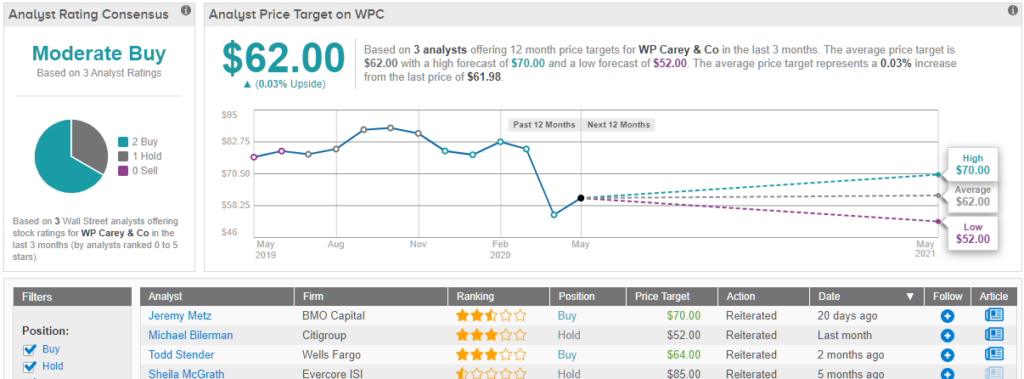

WPC impressed BMO’s Jeremy Metz, and the analyst set a $70 price target, suggesting a 13% upside, to back his Buy rating. (To watch Metz’s track record, click here)

In his comments, Metz wrote, “Our bull case on WPC in the current environment has been its revenue composition with limited relative exposure to retail, and at risk retail in particular (~2%)… the balance sheet/ liquidity remains in good shape.”

Wall Street is both bullish and cautious on this stock. The Moderate Buy consensus rating is based on 2 Buy and 1 Hold set in recent months, while the $62 average price target projects a minimal upside – less than 1%. The share price has been mostly range-bound since early April, suggesting that it has found resistance at the average price target level. (See WPC stock analysis at TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.