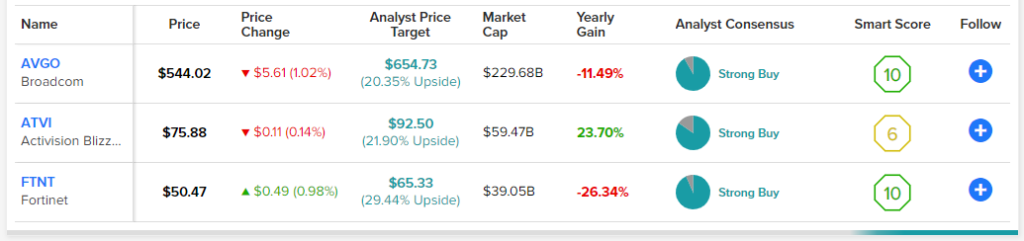

It’s been a turbulent year for tech, but many Wall Street analysts aren’t ready to downgrade their recommendations on select high-quality names. As the Federal Reserve continues raising interest rates, more of the same (tech-led volatility) is a likely possibility for most of 2023.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Though tech stocks are up against it yet again, some of the higher-rated tech stocks seem more than able to keep innovating. As long as innovation keeps moving forward, share prices will likely follow over the long run.

Let’s check out three hard-hit tech stocks and see where they stand going into the new year.

Broadcom (NASDAQ:AVGO)

Broadcom is a behemoth ($227 billion market cap) of semiconductor stock that offers one of the most bountiful dividend yields in the space. With a 3.35% yield, AVGO stock is one of the few places where one can get growth and passive income.

Since bottoming out in October 2022, AVGO stock has been on a tear, rising by over 40% from trough to peak. Shares recently pulled by last week, opening up a compelling entry point for those who missed the latest run off lows.

Broadcom is still a chip heavyweight, but its software business is growing quite quickly. Thanks to timely investments (Broadcom’s recent VMWare purchase came at a very reasonable multiple), the company has the means to grow sales while improving operating margins.

With a few quarterly beats in the books and an appetite for deal-making, AVGO stock remains an intriguing long-term hold. Recently, UBS touted Broadcom’s “strong competitive positioning,” also praising the firm as one of the better stories in the semiconductor industry. I couldn’t agree more.

At writing, the stock trades at a reasonable 21.0 times trailing earnings and 13.6 times cash flow. A fair value for such a proven juggernaut.

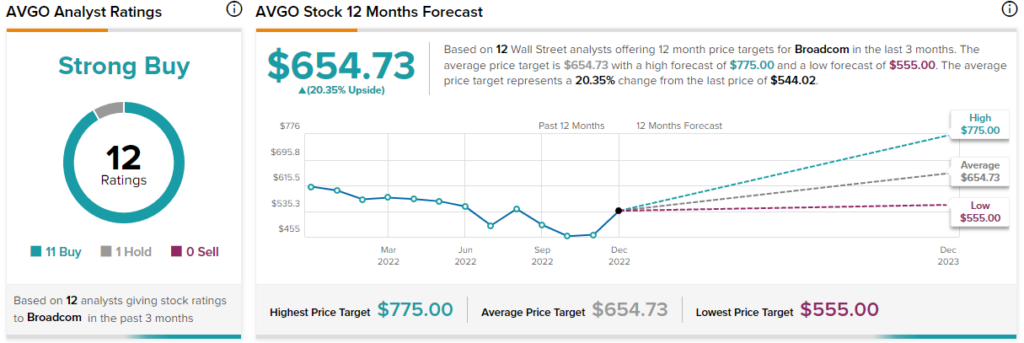

What is the Price Target for AVGO Stock?

Wall Street is sticking with AVGO stock as we move into 2023. The average AVGO stock price target of $654.73 implies 20.35% upside from current levels. As shares continue to add to their gains, I expect price target hikes to come flowing from top Wall Street analysts.

Activision Blizzard (NASDAQ:ATVI)

Activision Blizzard is a video game maker behind such names as Call of Duty. Call of Duty: Modern Warfare 2, the latest title in the series, has been a smash hit that’s held many first-person shooter rivals at bay. As the company continues releasing solid AAA titles from its full pipeline, it’s hard to argue that ATVI stock is the best publicly-traded gaming company right now.

With the Microsoft (NASDAQ:MSFT) takeover facing pressure from regulators, it’s a mystery whether the deal will be allowed to happen. Recent price action in ATVI stock suggests a deal is less likely than when Microsoft announced its intent to buy the firm at $95 per share.

At writing, the stock is trading just below $76 per share. If Microsoft is allowed to buy the company, a juicy 25% return stands to be made from investors willing to play the game of merger arbitrage.

Undoubtedly, Warren Buffett‘s vote of confidence doesn’t suggest a deal is a sure thing. The FTC has a lawsuit against the Microsoft-Activision deal, making a timely green light less of a sure thing to those who bought the stock after Microsoft expressed its interest.

In any case, a deal fall-through already seems to be partially baked in here. Activision Blizzard is a strong company with some of the best brands in gaming. Even if a deal is blocked by the FTC, you’re getting a great company for a modest price.

What is the Price Target for ATVI Stock?

Wall Street still likes Activision Blizzard. The average ATVI price target of $92.50 implies 21.9% upside potential based on 11 Buys and two Hold ratings.

Fortinet (NASDAQ:FTNT)

Fortinet is a cybersecurity and networking software company that’s felt the pressure of the tech wreck. Shares are down more than 30% from their highs and are flirting with yearly lows. Despite the plunge, the stock remains expensive at 9.6 times sales and 54.9 times trailing earnings.

Any rise in hawkish tone from the Fed will likely lead to amplified down days for FTNT stock. The 1.12 beta implies Fortinet makes for a slightly choppier ride than the S&P 500 (SPX).

Undoubtedly, the cybersecurity side of the business makes Fortinet more of a defensive growth stock than other pricy peers in the enterprise software space. The cybersecurity space is becoming quite crowded, though. If Fortinet is to continue to thrive, a considerable amount of spending will be needed, all while rates rise.

What is the Price Target for FTNT Stock?

Wall Street loves Fortinet at around $50 per share. The average FTNT stock price target of $65.33 implies 29.4% upside potential from here.

The Takeaway

AVGO, ATVI, and FTNT are strong software stocks that Wall Street analysts continue to favor. With a “Strong Buy” consensus recommendation on each name, investors may wish to put in the extra homework ahead of a potentially prosperous 2023.