Software stocks have taken a beating recently as sentiment has turned bearish due to fear of inflation and expectations of interest rate hikes. These fears are not unfounded as interest rates are near historic lows, and even a modest increase can have a dramatic impact on stock pricing models.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

One of the hardest hit software stocks during the market correction was Alteryx, Inc. (AYX), an industry leader in data analytics. The stock plummeted from $140 to less than $90 in one month and is now sitting on long-term support that has been in place since mid-2019.

With the depressed share price, Alteryx now has a more reasonable valuation at least by tech standards, with a price/sales ratio of 12. This figure is significantly less than many software companies that still sport lofty valuations in spite of the recent sell-off. A good example is competitor Palantir Technologies Inc (PLTR), which has an elevated price/sales ratio of 45 after its recent direct listing.

Slowdown In Growth

Prior to the pandemic, Alteryx was considered to be a high-growth company, with a five-year revenue growth of 56% per annum. But unlike most other digital transformation enablers, Alteryx did not benefit from the pandemic-driven work-from-home environment, primarily due to lack of cloud presence and high-priced subscriptions.

In 2020, Alteryx achieved a much more modest revenue growth of 19%, reporting shorter contract durations and above normal churn in mid-sized enterprises. While the revenue growth was still impressive given the recession-like conditions, the company’s financial performance made it difficult to justify the lofty stock valuation that high-growth companies typically command.

Slowing revenue growth is one factor that contributed to the stock price decline, but there were others such as churn in senior management and weak guidance for 2021. This year is a year of transformation for Alteryx, implying that performance will be weak for an extended period of time, but these are not the words that investors like to hear.

Management Turnover

Alteryx has been busy over the last few months replacing top management, starting with the CEO back in October, who in turn brought in his own hand-picked senior management, including both a new Chief Product Officer (CPO) and Chief Revenue Officer (CRO), among others. Unfortunately, the new CRO, expected to lead the next phase of company growth, has since left due to an inappropriate post on social media, leaving the CRO position unfilled. The exodus of the new CRO certainly did not boost investor confidence in the company’s recent changes.

Weak Guidance For 2021

Not only was 2020 revenue growth subpar by company standards, but management also provided weak guidance for 2021 during the Q4 2020 earnings call, forecasting revenue of $555-565 million, which translates to an annual growth rate of 13%. This is significantly less than the company has achieved in previous years. The weak guidance is predicated on continued economic weakness, continuation of shorter contract durations, ramp up of the new management team, and the implementation of the new sales strategy which involves greater focus on larger organizations while allowing partners to address small customers.

Perhaps a better performance metric is the growth of annual recurring revenue (ARR). Alteryx expects to have approximately $625 million in ARR at the end of 2021, representing an annual growth rate of 25%. This is still below historical standards but better than the guidance for total revenue growth.

Wall Street’s Take

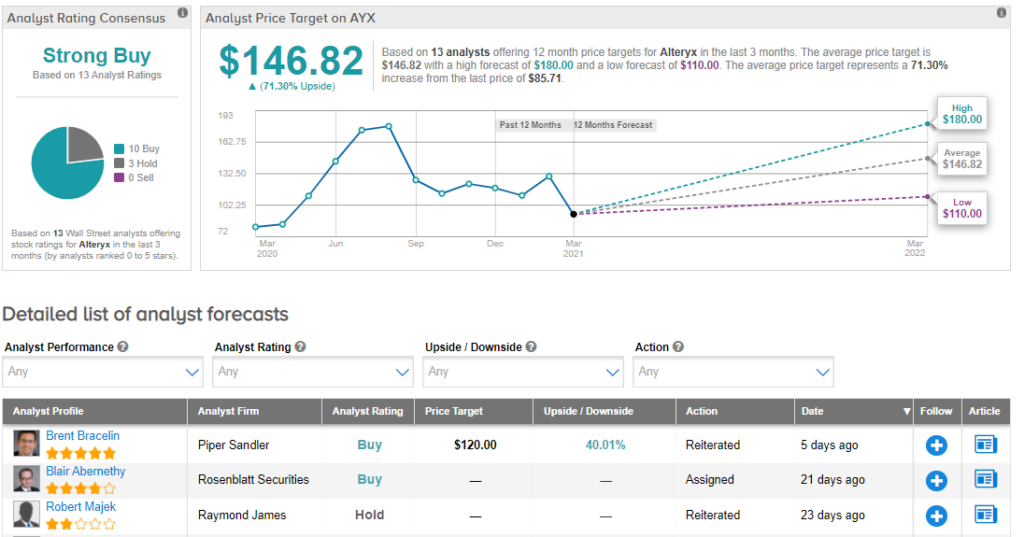

From Wall Street analysts, Alteryx earns a Strong Buy consensus rating, based on 10 Buys and 3 Holds. Additionally, the average analyst price target of $146.82 puts the upside potential at 71%. (See Alteryx stock analysis on TipRanks)

Summary And Conclusions

Alteryx is an industry leader in data analytics and has been considered a high-growth investment up until 2020 when COVID-19 sent the world into lockdown. While other digital transformation companies benefited from the work-from-home environment, Alteryx experienced soft revenue growth and is guiding for more of the same in 2021.

This is a year of transformation for Alteryx, as it shifts towards the cloud and sets its sights on large enterprise while expanding its partner network, which is expected to pick up the slack with smaller customers.

Assuming that the new management is able to successfully complete the company transformation, Alteryx should approach historical levels of revenue growth beyond 2021. With the currently depressed stock price, now might be a good time to invest.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.