September is behind us, fall is here, and we’re well into the swing of Q4. Later this month, we’ll get a better picture of market conditions when the Q3 earnings start coming out. In the meantime, however, there’s some cause for caution in the air.

David Kostin, chief US equity strategist for Goldman Sachs, lays out the reasons for that caution in a list of risks that are putting some headwinds into play. First, he sees the continuing supply chain bottlenecks; second are rising oil prices, a sign of inflation; third are labor costs, another inflationary factor; and finally, the slowdown in China’s economic growth.

Taken all together, these can spell trouble for US markets. Kostin is predicting an upcoming earnings season quite different from what we saw last quarter. While the watchword may still be growth, investors should not expect another quarter of 88% growth; they should, instead, look for growth about one-third that value, on the order of 27%.

So with that in mind, what should a retail investor do? One thought that may come to mind: shore up the defensive aspects of the portfolio. And that will naturally turn heads toward dividend stocks. These are the classic defensive equity moves, as they guarantee an income stream even when markets turn down.

We’ve used the TipRanks platform to look up a couple of high-yield dividend moves, Strong Buy stocks with dividend yields coming in at 8% or better. Here are the details.

Crestwood Equity Partners (CEQP)

We’ll start in the energy sector. Crestwood Equity Partners is a limited master partnership company that owns and operates midstream assets in three major US oil and gas production regions: the Delaware Basin and Barnett Shale of Texas, the Bakken Shale and Powder River Basin in the Rocky Mountain region, and the Marcellus Shale in Appalachian Pennsylvania. Crestwood’s assets operates in 19 states and include three working divisions, Gathering & Processing, Storage & Transport, and Marketing, Supply & Logistics.

By the numbers, Crestwood has some impressive capacity. The company boasts of 2.9 billion cubic feet per day of natural gas gathering capacity and 35 billion cubic feet of available storage. This is complemented by 10 million barrels worth of natural gas liquid storage and well over 1,100 rail units for NGL transport. In crude oil, the company can gather 150 million barrels per day for processing and storage.

Crestwood has seen its revenues recover well from the COVID crisis during the first half of this year. While Q2’s top line of $876.9 million was down 4.4% from Q1, it was still up over 160% year-over-year. The company’s net loss, but was still able to announce

Looking ahead, Crestwood used the Q2 report to update its full-year guidance for 2021, changing several key metrics in a positive direction. The company raised its net income forecast from a loss of $25 million to a profit of $5 million, and increased its distributable cash flow guidance – important for dividend investors, as distributable cash typically funds the dividends – from $345 million to $375 million.

CEQP pays out its dividend quarterly, and has a reputation for not missing payments. The most recent dividend, at 62.5 cents per common share, was paid out in August. This annualizes to $2.50, and gives a yield of 8.62%. This is robust by any standard.

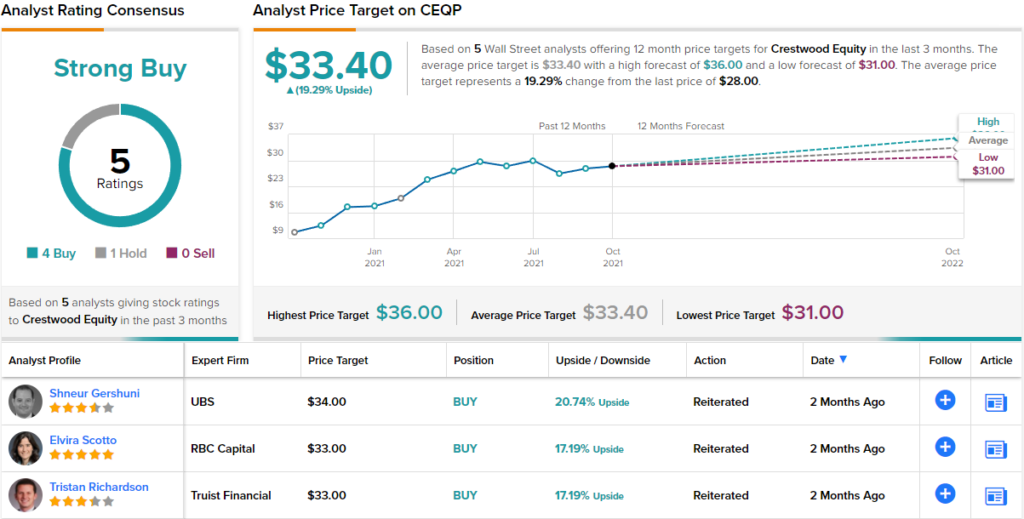

Analyst Tristan Richardson covers this stock for Truist, and writes: “An improved 2H outlook and higher budget are clear positives despite broader energy pressure on equities, creating an attractive entry in our view. A narrative of accelerated activity behind the core Arrow asset and clear signals around unit repurchase will drive outperformance over the near-term in our view. We are increasing our estimates for 2022 and 2023 on an encouraging exit rate this year.”

In line with these comments Richardson gives CEQP shares a Buy rating and his $33 price target suggests it has room for a 17% upside in the coming year. (To watch Richardson’s track record, click here)

Overall, Crestwood holds a Strong Buy rating from the analyst consensus, based on 5 recent reviews that break down 4 to 1 favoring Buy over Hold. The shares are priced at $28.16 and their $33.40 average price target indicates ~19% one-year upside potential. (See CEQP stock analysis on TipRanks)

Hercules Capital (HTGC)

The second stock we’ll look at is Hercules Capital, a business development company (BDC) that specializes in venture capital debt. Hercules makes available financing for emerging companies that are pre-IPO. Since its founding in 2003, Hercules has made $12 billion worth of capital commitments to more than 530 companies, with a focus on science-oriented firms.

Hercules Capital prides itself on bringing strong returns to its investors. The company boasts a return on average assets of 5.9%, and a return on average equity of 11.8%. The company’s stock has performed even better, appreciating more than 53% over the past 12 months. In September of this year, Hercules announced that it had made $1.5 billion in annual gross debt and equity commitments so far this year. This is a record level for the company, and it will only grow as the year is not over yet. The previous one-year record was $1.47 billion.

The most recent dividend that Hercules paid out was for Q2, paid out in August at 32 cents per common share – and boosted to 39 cents by a 7-cent supplemental payment. The company’s common stock dividend, not including the supplement, annualizes to $1.28, and gives a yield of 7.59%. This yield is more than 3x higher than the average dividend yield found among peer companies listed on Wall Street.

Compass Point analyst Casey Alexander notes that Hercules’ dividend is high, and likely to grow higher. He writes: “HTGC has a high-class problem, which is their spillover income now exceeds the regulatory limit of 1-years earnings. As result, even though the board has chosen to declare a $0.28 per share special distribution payable $0.07 per share in each quarter during this year, HTGC will almost certainly have to (a) increase the base dividend, or (b) declare additional special distributions , or (c) declare a meaningful capital gains distribution.”

Alexander reiterates his Buy rating on this stock, and his price target, at $19.50, implies it has room for one-year growth of 15%. (To watch Alexander’s track record, click here)

With 3 recent reviews on file, all positive, the Strong Buy for Hercules Capital is unanimous. HTGC shares are priced at $16.98 and their $18.83 average price target suggest ~12% upside in the next 12 months. (See HTGC stock analysis on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.