The last few days’ trading have been enough to make our heads spin. Markets have shifted up and down, showing both volatility and a short-term upward trend, a pattern that has investors wondering if this is the start of a sustained run of gains, or just a bear-market rally.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Stiffel Chief Equity Strategist Barry Bannister believes that there’s less reason for fear and lays out a strong case for upside.

“We forecast the S&P 500 up to 4,200 in 3Q22E and recommend Cyclical Growth groups… for a relief rally. We see a decline for oil, inflation and rate futures as well as avoidance of significant 2H22 S&P 500 EPS concerns supporting a P/E ratio-led rally in advance of our view that the Federal Reserve slows rate hikes and pauses rates by late-2022. Recession fear is over-done, and we see no U.S. recession in 6-9 months,” Bannister opined.

Whether Bannister is right or wrong, one thing is certain: investors have a chance to get in at discount prices. Plenty of sound stocks are trading at prices too cheap to ignore.

We’ve used TipRanks’ platform to pull up the latest scoop on two such stocks; both are ‘Strong Buy’ stocks with recent positive reviews from the Street and plenty of upside potential. Here’s a closer look, alongside the analyst commentary.

Offerpad Solutions (OPAD)

We’ll start in the real estate sector, where Offerpad offers buyers and sellers an online real estate sales platform. The company makes it easy for property owners to connect directly with prospective buyers, and also makes it easy for sellers to list their homes and buyers to find the perfect purchase. The platform can host photos, a virtual walkthrough tour of the house, and facilitate offers and closing transactions.

The economic slowdown this year has been broad-based, however, and has affected the real estate sector, too. One result: Offerpad’s shares are down 64% so far this year even as the company has swung into profitability and expanded its footprint in the US home sales market.

Just in June of this year, Offerpad expanded its service footprint in the states of Colorado and Florida. The latter is especially important, as Florida is the third largest state by population and the fourth largest by size of the economy – and one of the fastest growing states.

Also in June, Offerpad posted its 1Q22 financial results, described as the best quarter in the company’s history. The top line hit $1.37 billion, up 384% year-over-year, and earnings turned positive, to $410 million, or 16 cents per share. It was a remarkable showing, in just the third reported quarter since the company went public through a SPAC transaction in September of last year.

All of this caught the attention of Wedbush 5-star analyst Jay McCanless, who says of Offerpad: “Since coming public last year, the backdrop for Offerpad has shifted from the lowest mortgage rates in decades and an accommodative Federal Reserve to the highest mortgage rates in over a decade and a tightening Fed. The shift in the Fed and in mortgage rates may be a near term hindrance, but we anticipate OPAD can continue producing full year GAAP profitability despite those risks…”

“In spite of the slowing pace of resale activity, OPAD’s market share has been increasing… For the 8 new markets OPAD is entering in 2022, we estimate pro forma transaction values YTD through June 2022 rose to $235 million versus $220 million for the same period in 2021,” McCanless added.

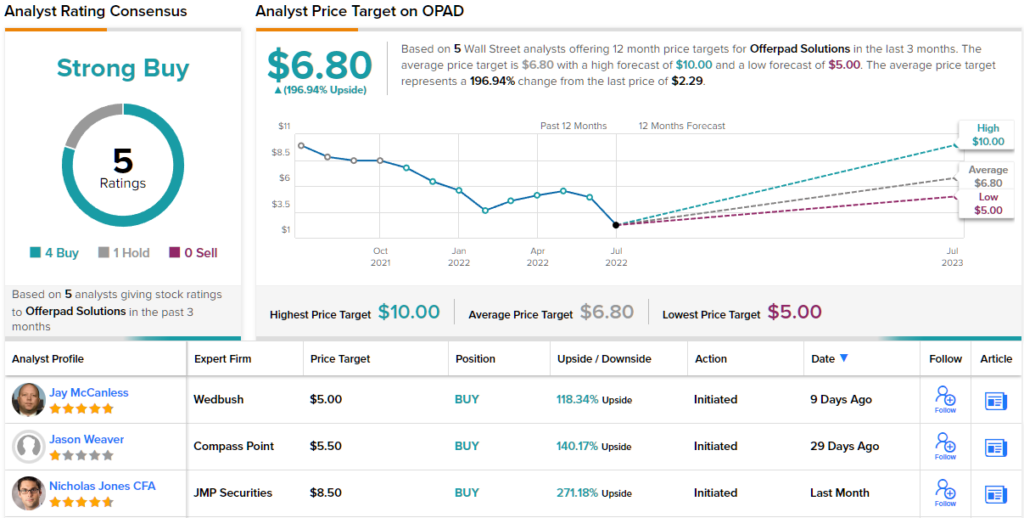

McCanless shows the extent of his optimism on OPAD with his opening rating of Outperform (i.e. Buy), and his $5 price target implies a 118% upside for the next 12 months. (To watch McCanless’s track record, click here.)

This new stock has picked up 5 analyst reviews during its first 10 months on the public markets, with break down 4 to 1 in favor of Buys over Holds, for a Strong Buy consensus rating. The stock is a ‘penny,’ priced low at just $2.29 per share, and the average target of $6.80 indicates potential for some impressive growth of ~197% in the next 12 months. (See Offerpad stock forecast on TipRanks)

Universal Electronics (UEIC)

Let’s stick with homes for now, and look at a stock in the ‘smart home’ tech segment. Universal Electronics produces remote controls, voice-activated smart home hubs, smart thermostats, and home sensors, along with software and cloud services needed for device interoperability. The company’s products offer solutions for smart home systems, home security, climate control, entertainment systems – even household wireless connectivity. Universal boasts that it ships or supports more than 100 million products annually.

Universal maintains its reputation in the sector by the regular launch of new products. In the last few months, the company has announced the launch of new TV remotes, a smart thermostat, and voice remotes. The company was also selected by DNA, a leading telecom provider in Finland, to provide an award-winning Android TV remote.

Despite these launches, Universal has had trouble gaining traction in earnings and revenues, and has seen a slow decline in top-line results over the past few years. In the recent 1Q22, the company reported $132.4 million at the top line, down 12% year-over-year. In earnings, adjust non-GAAP EPS fell y/y from 89 cents to 47 cents.

The company’s gradual drop-off in results has not gone unnoticed by investors, and the shares are down 44% over the past 12 months.

At the same time, Rosenblatt analyst Steve Frankel sees opportunity here for investors willing to shoulder the risk.

“Over the last three years, UEIC has rationalized its cost structure, moved a portion of its manufacturing from China to Mexico to lower costs and reduce cycle times and introduced multiple new products. The missing element has been revenue growth with the company reporting a year-over-year decline in revenue in eight of the last nine quarters. However, with a growing number of design wins and some improvement in the supply chain, it looks like the company is on the cusp of returning to a steady pace of revenue growth beginning in Q3,” Frankel opined.

“Between the potential inflection point in revenue growth, a current valuation of just 8.6x our CY22 EPS, just above the stock’s five-year low of 7.7x, and management’s steady repurchases of its stock, we see limited downside from current levels,” Frankel summed up.

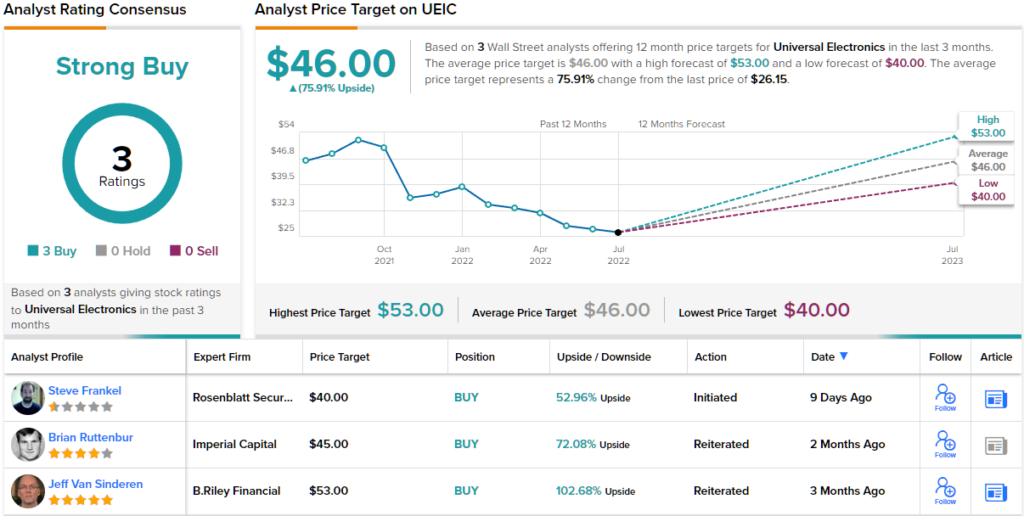

Proceeding from this stance, Frankel rates UEIC shares a Buy, and sets a $40 price target to imply a one-year upside potential of 53%. (To watch Frankel’s track record, click here)

Overall, this stock has managed to slide under the radar; it only has 3 recent analyst reviews. These are all positive, however, giving the stock its unanimous Strong Buy analyst consensus rating. The average price target of $46 suggests a 12-month upside of 76% from the trading price of $26.15. (See UEIC stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.